Assisting Accredited Investors Across the Globe

(913) 283-7804

Mon - Fri: 9:00 a.m. - 5:00 p.m. CST

Team@seniorlivingfund.com

For Investment Inquiry

Mon - Fri: 9:00 a.m. - 5:00 p.m. CST

For Investment Inquiry

The senior housing sector is currently experiencing a rare alignment: occupancy momentum, limited new supply, and improving capital markets - all while demographics continue to build in the background. Early 2026 has shown signs of cap rate compression returning, and this Read More

Tennessee has quietly reshaped its position in the national retirement and housing conversation. As population trends shift and financial priorities change, senior housing investment in Tennessee has gained serious attention from investors focused on stability and long-term demand. Retirees continue Read More

New Mexico stands at the intersection of demographic change and shifting family dynamics. As residents live longer, the demand for structured senior care rises faster than traditional housing can adapt. Senior housing investment in New Mexico draws attention due to Read More

The Kansas senior housing market is attracting attention as the aging population grows and demand for specialized living arrangements rises. Investors seeking stable, long-term opportunities are examining assisted living communities, independent living residences, and continuing care retirement communities (CCRCs). Strong Read More

Senior housing investment enters 2026 with a rare alignment of fundamentals: improving occupancy, constrained new supply, and strong NCREIF performance. In this month’s investment brief, we explore the “90% threshold” — the point where incremental move-ins can translate into outsized Read More

Nevada stands at a turning point as demographic pressure, land policy, and housing shortages intersect. Senior housing investment in Nevada now draws attention from groups that invest in senior housing for long-term stability rather than short-term cycles. Senior housing investments Read More

Demand within the senior housing sector no longer rests on theory. Population data, occupancy recovery, and capital flows show clear momentum. Investors who want to understand how to assess the value of senior living investments must look beyond surface pricing. Read More

The global population is aging at an unprecedented pace, driving profound changes in senior living. Rising life expectancy, healthier lifestyles, and a more diverse elderly population are shifting expectations from basic care to lifestyle-oriented communities. Seniors now demand wellness programs, Read More

Senior housing no longer relies only on human judgment and manual processes. Data now guides daily decisions across care, staffing, safety, and operations. Artificial intelligence sits at the center of this shift. For investors, operators, and families, AI changes how Read More

Michigan stands at the center of a demographic shift that continues to reshape real estate demand. As Baby Boomers age into their late seventies and eighties, housing needs move beyond traditional multifamily models. Senior housing investment in Michigan now reflects Read More

The senior living industry 2026 is shaping up to present both opportunities and challenges for investors. As more Americans age into retirement, the demand for well-managed senior housing communities continues to grow. Understanding the key factors influencing this market can Read More

The 80 20 rule retirement structure is a major factor in how senior housing communities operate. If you are researching retirement living or exploring investment opportunities in this sector, understanding this rule helps you make more informed decisions. Senior Living Read More

Investing in senior living can feel complex, especially when you are evaluating potential returns. One concept that often comes up is the 2% rule. If you are asking, “what is the 2% rule for investment property?”, this article is for Read More

Investing in senior housing in Detroit presents a unique opportunity for you to participate in a growing market. As the population of older adults continues to expand, demand for high-quality senior living communities rises. Senior housing investment in Detroit combines Read More

Investing in senior housing is becoming an increasingly attractive opportunity, especially in growing communities like Madison, TN. For investors like you, understanding local trends, population growth, and operational factors is key to making informed decisions. Senior Living Fund specializes in Read More

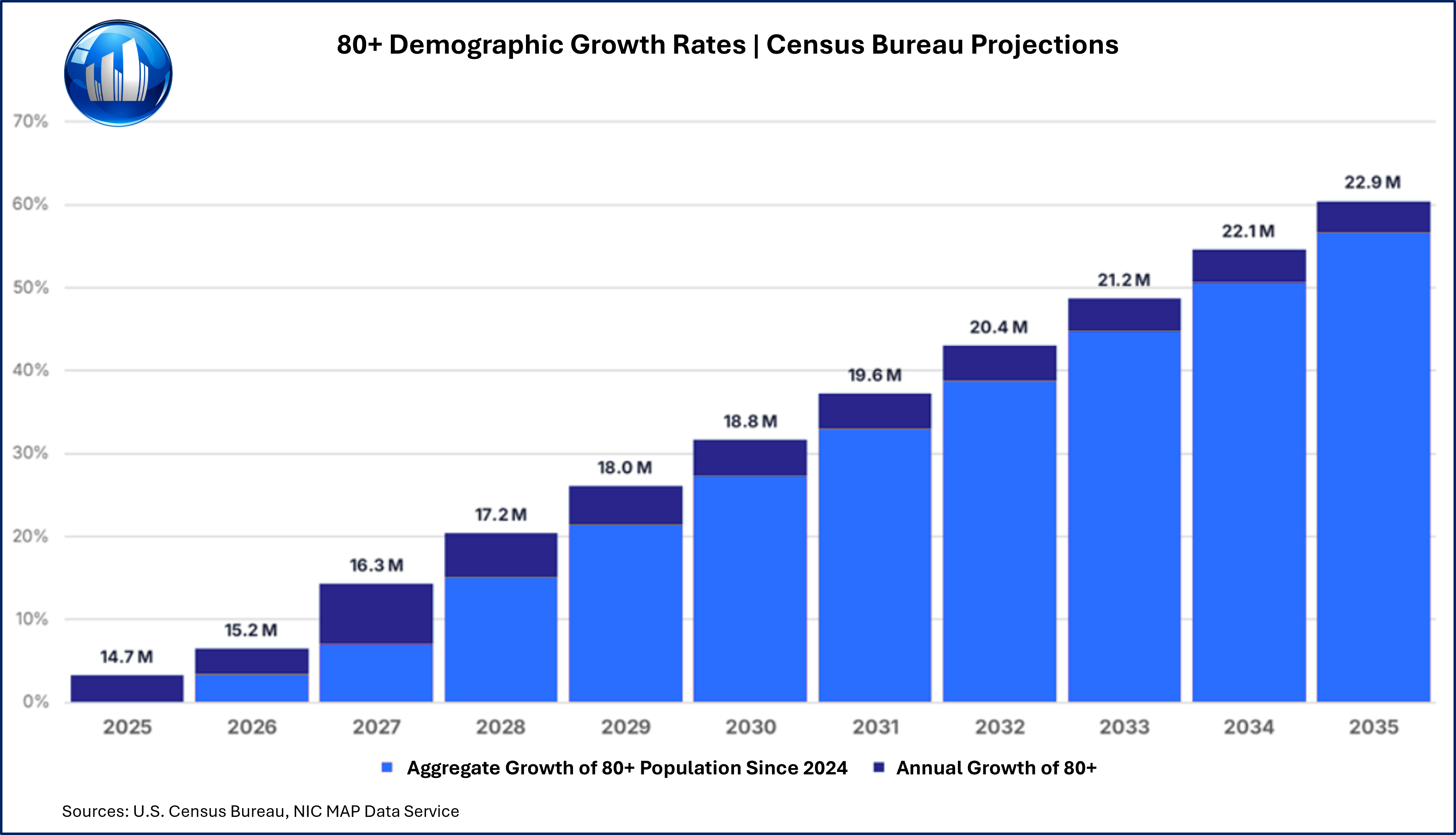

Senior housing investments are increasingly supported by strong demographic tailwinds, rising care needs, and a growing supply-demand imbalance. With the 80+ population expanding rapidly and new development at multi-year lows, assisted living, memory care, and skilled nursing are positioned for Read More

Senior housing investment in Las Vegas is becoming increasingly appealing as the city experiences growth in its older population and demand for quality care rises. If you are considering the option, understanding market dynamics, regulatory factors, and projected financial performance Read More

The senior housing shortage is becoming a growing concern for families and investors alike. With more Americans living longer, the need for safe, supportive communities is rising faster than the available supply. If you are looking at senior living as Read More

Investing in senior living offers unique opportunities, and respite care investments are gaining attention for both social impact and financial potential. As someone considering investment offerings in the senior housing sector, understanding the dynamics of respite care can help you Read More

Investing in senior housing can be a highly rewarding opportunity, but selecting the right partner is vital to achieving strong results. Knowing the right questions to ask a senior living investment partner can help you understand their experience, strategy, and Read More

Investing in senior housing can feel complex, especially when private equity nursing homes make headlines. You may have heard concerns about quality of care, profit motives, or the financial structure of these facilities. Understanding the reality behind these stories is Read More

Investing in memory care communities is a growing opportunity for those interested in senior housing. Memory care investments offer potential for steady returns while addressing an important need in the aging population. If you are considering entering this sector, understanding Read More

When evaluating senior living investment offerings, you may come across the metric known as senior housing price per unit. On the surface, it seems like a simple and quick way to compare different properties. You take the total purchase price Read More

The memory care market is becoming an important focus within senior housing as demand continues to grow rapidly. If you are considering investment opportunities, understanding this sector can help you make informed, strategic decisions. Memory care communities serve seniors with Read More

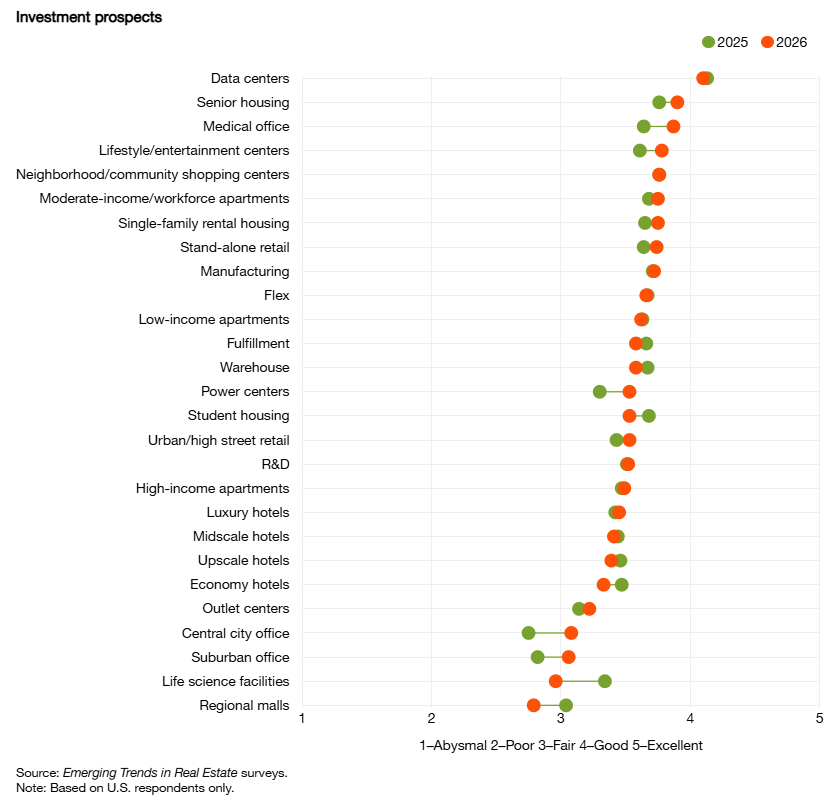

Senior housing continues to distinguish itself as one of the strongest performers in commercial real estate investment. The combination of elevated going-in yields, tightening occupancy, strong rent growth, and severely limited new supply positions senior housing as one of the Read More

Senior housing private investments are becoming increasingly important in the development and growth of modern senior living communities. As you explore ways to diversify your portfolio, you may find that this sector offers a balance of purpose and potential financial Read More

The senior living industry challenges in 2026 are shaping the decisions of investors, operators, and families alike. As demand for quality senior housing grows, you need to understand the factors that could affect both operations and returns. From rising labor Read More

Technology plays an increasingly important role in improving both operational efficiency and resident experience in the senior living market. Investment in technology solutions is both a trend and a necessity for staying competitive in the senior housing industry. As senior Read More

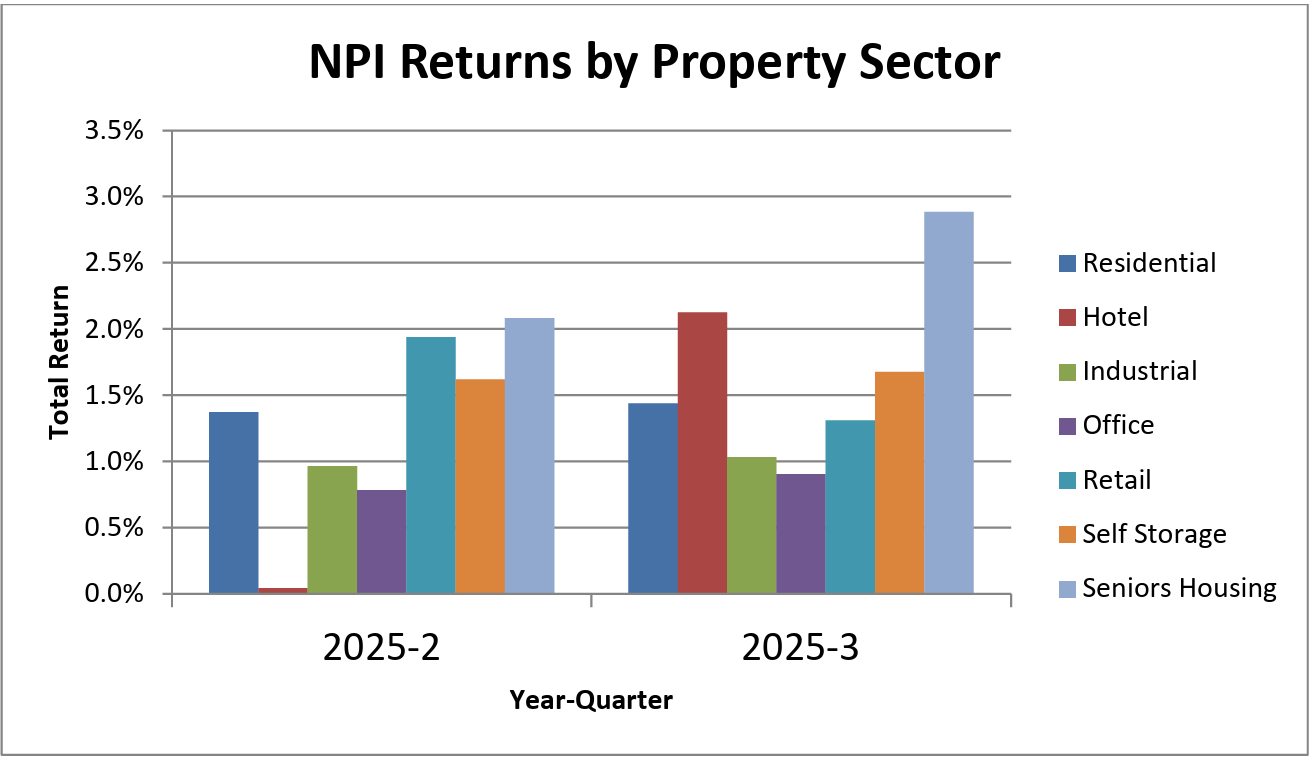

According to the National Council of Real Estate Investment Fiduciaries (NCREIF), senior housing investment delivered the highest total return of any property sector for the third straight quarter, reinforcing its reputation as one of the most resilient and income-driven real Read More

The senior housing market is entering a phase of significant adjustment as senior living rent increases are projected to range from 3% to 7% over the next year. These changes are influenced by higher operational costs, rising demand for quality Read More