Assisting Accredited Investors Across the Globe

(913) 283-7804

Mon - Fri: 9:00 a.m. - 5:00 p.m. CST

Team@seniorlivingfund.com

For Investment Inquiry

Mon - Fri: 9:00 a.m. - 5:00 p.m. CST

For Investment Inquiry

Recessions are a natural part of the economic cycle, yet they still take many investors by surprise. While the exact timing of the next downturn is unknown, economic indicators suggest that market volatility could be ahead. That raises an important question: Is your investment portfolio strong enough to weather another recession?

No one can predict the exact timing of the next recession. Yet history has shown that downturns are inevitable, and those who prepare have a better chance of maintaining financial stability.

During the Great Recession (2007–2009), the S&P 500 lost half its value. Also, the average retirement account dropped by 25%. Many Americans—especially those close to retirement—saw their savings shrink dramatically. This raises questions:

The truth is, many investors aren’t prepared for a major market shift. After years of economic growth, it’s easy to grow complacent. But with a downturn always on the horizon, now is the time to strengthen your portfolio with recession-resistant investments that generate steady returns in any market.

Not all investments react the same way to economic downturns. While traditional assets like stocks and bonds can fluctuate with market cycles, some real estate investment opportunities have historically demonstrated strong performance during recessions.

Recession-resistant investments tend to share three key characteristics:

Incorporating these types of assets into your investment portfolio can help you reduce volatility and create a more stable foundation for long-term growth.

There are many things people can scrap during a recession – but caring for family members isn’t one of them. Need-based investments are often the most reliable, and there is no greater need right now – or for the foreseeable future – than senior housing.

From 2020 to 2060, the 85+ population will more than triple. Studies show that some 2 million senior housing units will need to be constructed to meet the demand anticipated by 2040 (ASHA).

Senior housing has performed strongly over the past decade with a 10-year annualized total return of 9.33%. This surpasses the NCREIF Property Index (NPI) overall return of 8.34% during the same period.

Economic challenges have prompted many families to seek smaller, more affordable housing options in recent years. Between 2019 and 2023, the number of owner-occupied housing units in the U.S. increased by 8.4%, rising from 76.4 million to 82.9 million. Meanwhile, rental households grew by approximately 1.3 million during the same period.

Looking ahead, projections from the Harvard Joint Center for Housing Studies indicate that household growth in the U.S. is expected to slow. This comes with an increase of 8.6 million households between 2025 and 2035, averaging about 860,000 annually. This marks a decline from previous decades, where growth ranged from 10.1 million to 13.5 million households per decade.

Despite a surge in new rental housing supply leading to a temporary cooling of the market, rental affordability remains a significant concern. As of early 2025, the national median monthly rent is $1,370, reflecting a modest decrease from the previous year. However, more than half of renter households spend over 30% of their income on housing costs, underscoring the persistent affordability challenges.

During the 2008 financial crisis, self-storage demonstrated remarkable resilience, with self-storage REITs posting a gain of 5% in 2008, while other commercial real estate segments experienced net annual losses between 25% to 67%. This resilience is partly due to the industry’s low overhead costs. These low expenses allow facilities to break even at occupancy rates as low as 40% to 45%, compared to over 60% for apartments.

As families downsize into more affordable multi-family units during economic downturns, the demand for self-storage increases to accommodate excess belongings. This trend and the industry’s low operating costs make self-storage attractive for investment portfolios, even for less experienced investors.

Diversification remains necessary while no single investment can render a portfolio entirely recession-proof. Incorporating assets like self-storage and senior housing into your investment strategy—private equity funds, REITs, or direct investments—can enhance resilience during economic downturns.

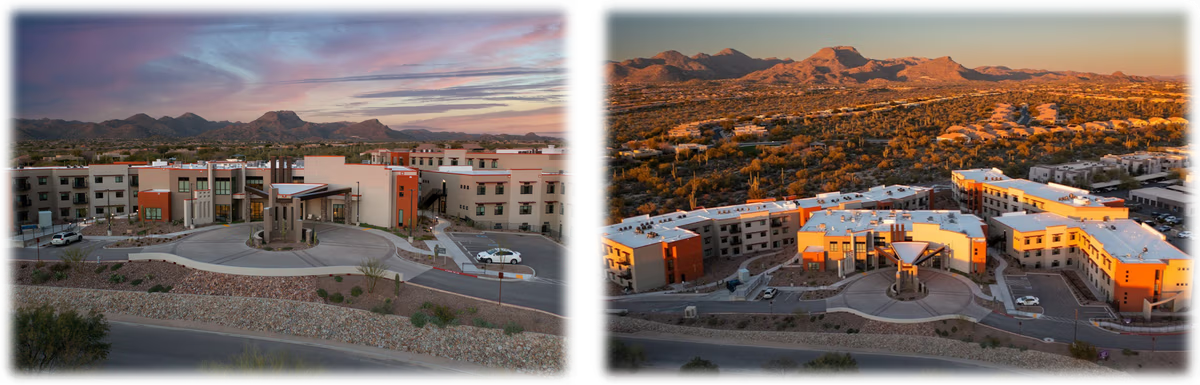

At Senior Living Fund, we specialize in helping accredited investors build strong, recession-resistant investment portfolios through carefully selected real estate funds. Our real estate investment opportunities focus on high-demand sectors that generate steady income and long-term growth.

Feel free to reach our Investor Relations team via email: Team@seniorlivingfund.com or call 913.283.7804

Feel free to reach our Investor Relations team via email: Team@seniorlivingfund.com or call 913.283.7804

Dan has 30+ years of business experience, including 25+ years as an executive and principal in real estate, capital placement, business development and management. Dan has 10+ years of experience in a business consulting and management role for Accenture. Dan also has 10+ years of experience in the senior housing sector.

Mark brings strong operations management skills to the SLF team through his 30+ years of experience in business consulting, real estate investment and development, financial analysis and management. Mark currently serves as Chief Operations Officer for Senior Living Fund, LLC and its affiliated entities.

Rick brings over 30 years of financial management experience, mostly focused on financial services industry. Rick oversees all of the accounting operations including financial reporting, cash planning, and managing external audit relationships and the Funds tax reporting.