Monthly Investment Newsletter - April 2025

SLF Investments (SLF) is a private equity investment company with 20+ assets under management that generated over $24.9 million ($99.8 million annualized) in revenues during Q4 2024. The majority of assets within our real estate investment portfolio are Independent Living (IL), Assisted Living (AL) and Memory Care (MC) communities that were developed and constructed by our sponsor partners utilizing SLF equity.

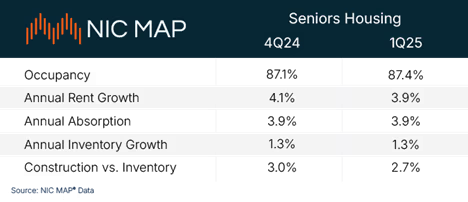

Q1 2025 Senior Housing Industry Performance

In the first quarter of 2025, the U.S. senior housing industry demonstrated robust performance, marked by notable occupancy gains and heightened investor interest.

Occupancy Rates and Demand

The average occupancy rate for senior housing rose to 87.4%, up from 87.1% in the previous quarter. This increase reflects a record-setting demand, with approximately 621,000 units occupied—a rise from 617,000 units in Q4 2024. This also marks the 15th consecutive quarter in which senior housing industry occupancy rates have increased.

Investor Sentiment

Investor confidence in the sector strengthened, with 78% of surveyed investors planning to increase their exposure to senior housing in 2025, a significant uptick from 54% in 2024. Assisted living facilities emerged as the most sought-after investment, with 50% of investors identifying them as the primary opportunity.

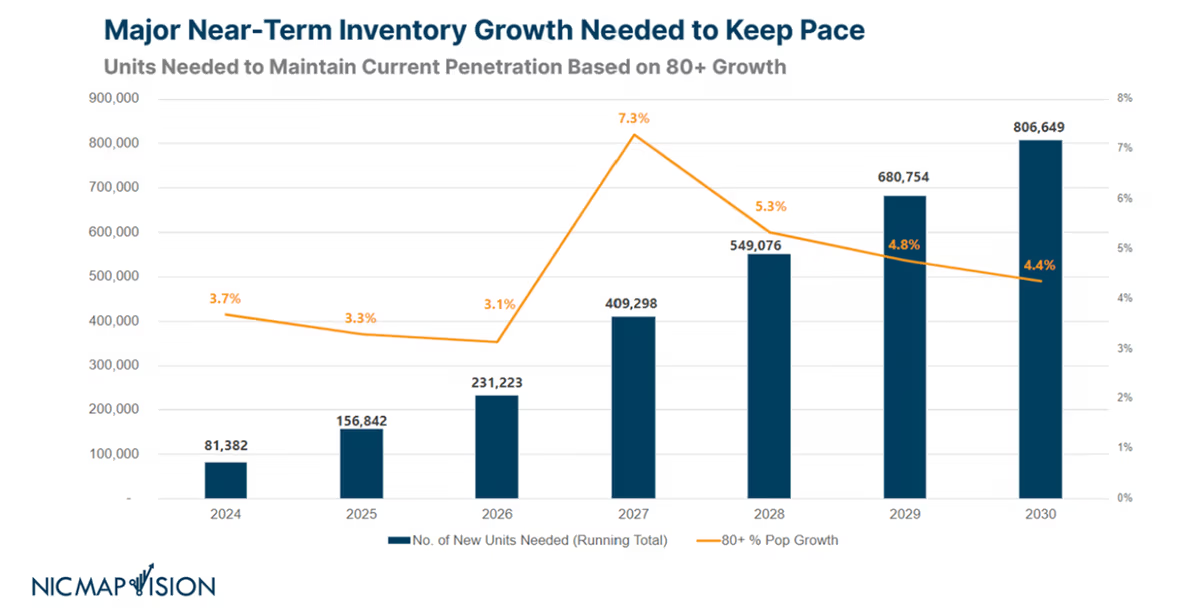

Supply Constraints

Despite rising demand, new construction activity remained subdued. The first quarter saw the lowest number of senior housing units under construction since 2013, totaling approximately 19,500 units. This supply-demand imbalance is expected to further elevate occupancy rates in subsequent quarters.

Tariffs & Their Impact on the Senior Housing Industry

The recent implementation of U.S. tariffs on imports from Canada, Mexico, and China is poised to hold changes for the senior housing industry, affecting both private investments and broader operational dynamics. While recent tariff policies have introduced challenges, they also unveil avenues for strategic growth and innovation. The temporary 90-day pause on certain tariffs offers a window for stakeholders to reassess and adapt, ensuring the sector’s continued vitality.

Escalating Construction and Development Costs

Tariffs on essential building materials, notably steel and lumber, are expected to increase construction expenses. For instance, tariffs on Canadian lumber could substantially raise the cost per unit for new developments, potentially leading to higher market rates and exacerbating affordability challenges within the sector.

Operational Expenditures Under Pressure

The tariffs extend to a range of goods integral to daily operations in senior living facilities, including medical supplies and pharmaceuticals. With the U.S. heavily reliant on imports for these products, the imposed tariffs may lead to increased costs for items such as prescription drugs and medical equipment. This escalation could strain operating budgets and potentially impact the affordability of care for residents

Investor Sentiment and Financial Implications

The financial markets have reacted negatively to the tariff announcements, with notable declines in stock indices. This downturn has adversely affected retirement accounts and investment portfolios, leading to decreased 401(k) and IRA balances. Such financial pressures may influence investment decisions in the senior housing market, potentially leading to a more cautious approach from investors. However, history has shown that the robust demand demographics coupled with large supply constraints make this a favorable long-term option.

Tariff Pause Provides Strategic Breathing Room

President Trump’s 90-day suspension of tariffs on many imports, including essential construction materials like Canadian lumber, offers immediate relief. This pause allows developers to advance projects without the looming pressure of escalating material costs, fostering a more stable investment environment.

Looking Into the Future

- Leverage the Tariff Pause: Utilize this period to secure materials and finalize projects, mitigating potential future cost escalations.

- Enhance Supply Chain Resilience: Diversify sourcing to reduce dependency on tariff-affected imports, ensuring consistent operational efficiency.

- Focus on Value-Driven Developments: Prioritize projects that offer both affordability and quality, meeting the evolving needs of the senior demographic.

In conclusion, while tariff uncertainties present challenges, they also catalyze innovation and strategic realignment. By embracing adaptability and forward-thinking approaches, the senior housing industry is well-positioned to thrive in this evolving landscape. If you are evaluating getting involved in the senior housing investment space, the time has never been better. However, be sure you are aligned with competent individuals who understand the various nuances of the industry.

Investment Community Spotlight – Fountain Valley, California

Our investment community in Fountain Valley, California is a one hundred fifty (150) unit assisted living and memory care community operated by Sunshine Retirement Living. Sunshine worked diligently in the latter half of 2023 through current to solidify the onsite leadership team, reduce turnover and strengthen the overall culture of this community.

Through the end of February 2025 average occupied units totaled 127.36 compared to 94.31 at the end of February 2024. The 33.05 net increase in occupied units drove total revenue 37.5% higher, subsequently raising net operating income (NOI) by $66,000 on average per month. Average cost per resident day dropped 27.7% during this same comparison period and employee turnover fell to 5.30% after nearly reaching 10% in February 2024.

Sunshine Retirement’s Mission & Vision

Our corporate mission and vision boils down to the singular goal of enriching the lives of those we serve and employ. All of our different communities have one thing in common — a genuine caring and kindness that you can feel as soon as you walk in the door. The staff and residents are a family and we’re always happy to welcome more into our close-knit group.

Want To Learn More About Investing in the Senior Housing Space?

Contact Us Today!

How to Participate.

Senior Living Fund has five (5) investment offerings for accredited investors:

SLF Value-Add Fund 1 - (SLF VAF 1)

- Anticipated 4.5-5 Year Term

- Annual Accrual + Profit Participation

- 12.00% to 21.00% Projected Fund IRR

SLF Value-Add Fund 2 - (SLF VAF 2)

- Anticipated 4.5-5 year term

- Monthly Distributions + Profit Participation

- 10.50% to 20.00% Projected Fund IRR

F4 Fixed Note Offering

- Anticipated 3 Year Term

- Monthly Distributions

- Fixed Interest Rate Equal to 15% Per Annum

F5 Fixed Note Offering

- Anticipated 3 Year Term

- Monthly Distributions

- Fixed Interest Rate Equal to 15% Per Annum

F6 Fixed Note Offering

- Anticipated 3 year term

- Monthly Distributions

- Fixed Interest Rate Equal to 15% Per Annum