Monthly Investment Newsletter – November 2025

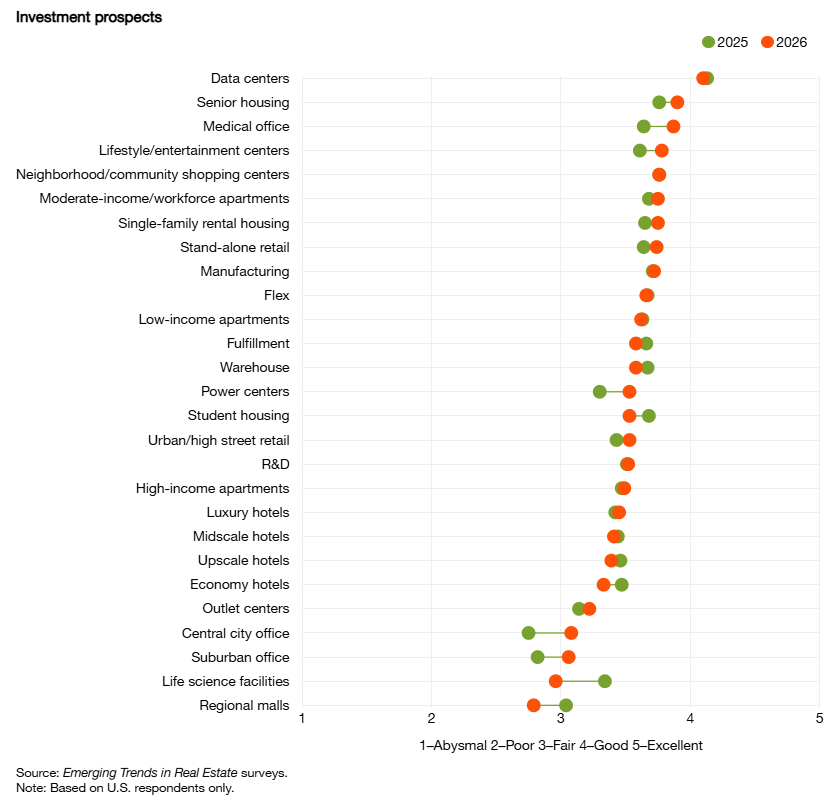

Senior housing continues to distinguish itself as one of the strongest performers in commercial real estate investment. The combination of elevated going-in yields, tightening occupancy, strong rent growth, and severely limited new supply positions senior housing as one of the most attractive risk-adjusted return opportunities in today’s environment.

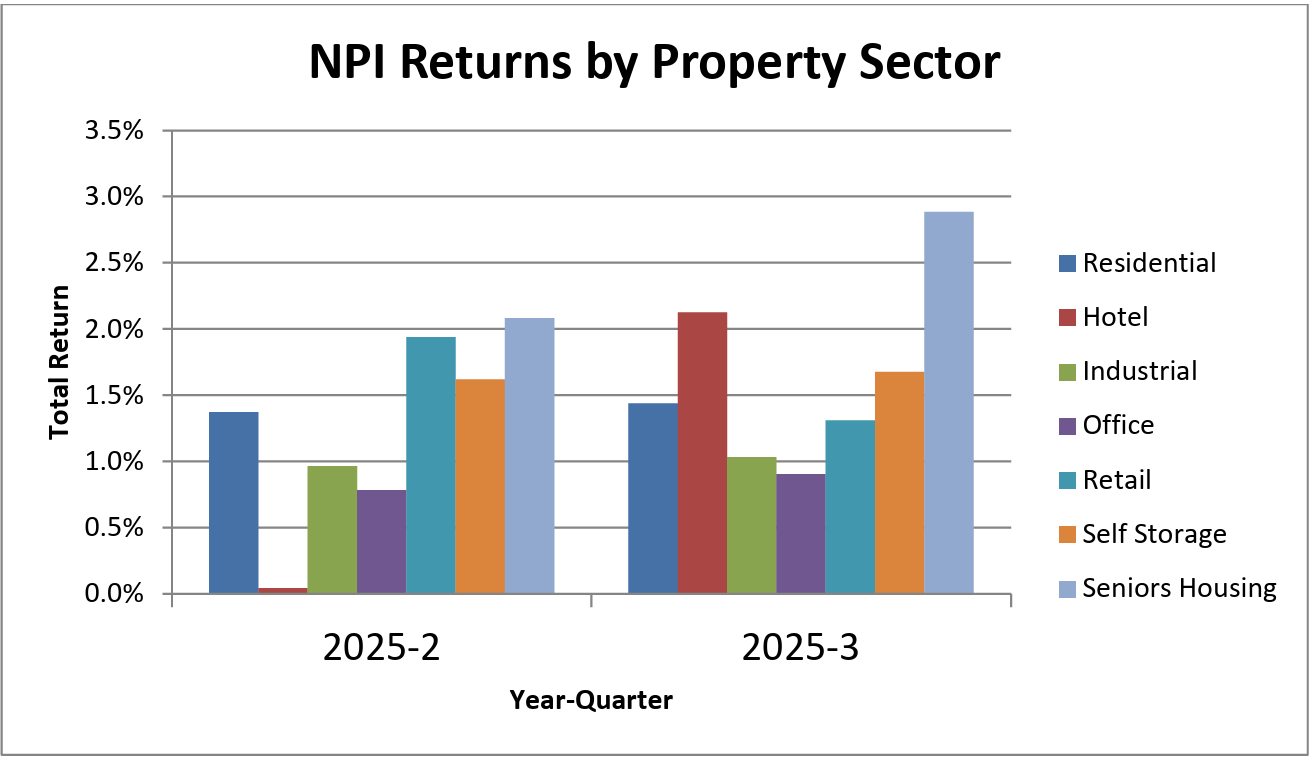

Senior Housing Leads the NPI – Third Consecutive Quarter

According to the National Council of Real Estate Investment Fiduciaries (NCREIF), senior housing investment delivered the highest total return of any property sector for the third straight quarter, reinforcing its reputation as one of the most resilient and income-driven real estate asset classes.

Senior Living Rent Increases By 3% To 7% In The Coming Year

The senior housing market is entering a phase of significant adjustment as senior living rent increases are projected to range from 3% to 7% over the next year. These changes are influenced by higher operational costs, rising demand for quality senior housing, and limited new development across many regions. Understanding these trends is important for […]