Monthly Investment Newsletter – May 2025

Explore how SLF Investments, a private equity investment company, is capitalizing on the future of senior housing with strong Q1 revenues, rising occupancy, and strategic innovations in technology, ESG, and lifestyle-focused design. Learn why purpose-built communities are outperforming in today’s competitive real estate landscape.

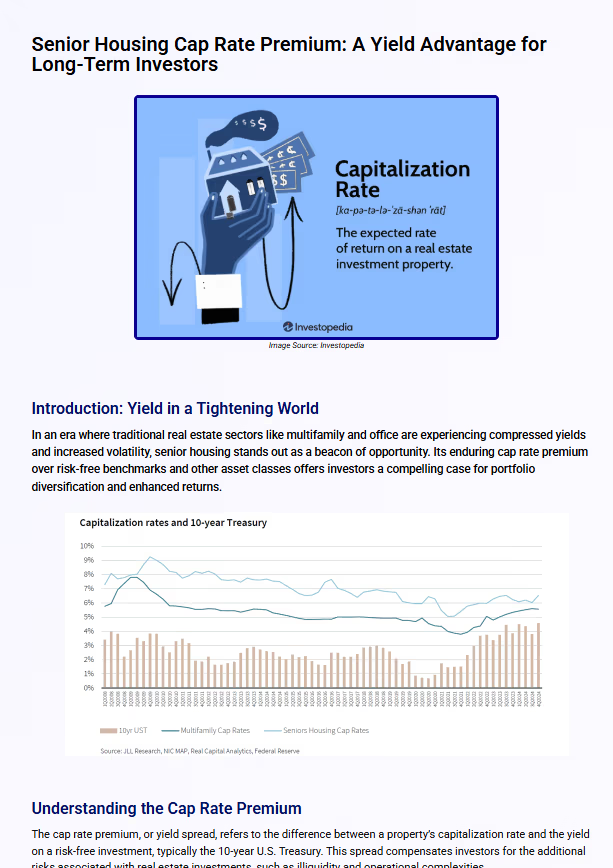

Senior Housing Cap Rate Premium: A Yield Advantage for Long-Term Investors

Discover why senior housing offers a lasting cap rate premium, outperforming multifamily with strong yields, demographic demand, and limited new supply.

Senior Living Investment in 2025: A Resilient Market Poised for Growth

Discover why 2025 is shaping up to be a strong year for senior housing investment. Explore key trends in rent growth, investor sentiment, and demographic tailwinds driving the sector forward.