Fixed Income Vs. Variable Income: Key Differences Explained

When it comes to making financial decisions, one of the key factors to understand is the difference between fixed income vs. variable income. Both types of income are commonly found in investment strategies, yet they operate in very different ways. Whether you are new to investing or have been managing your finances for a while, […]

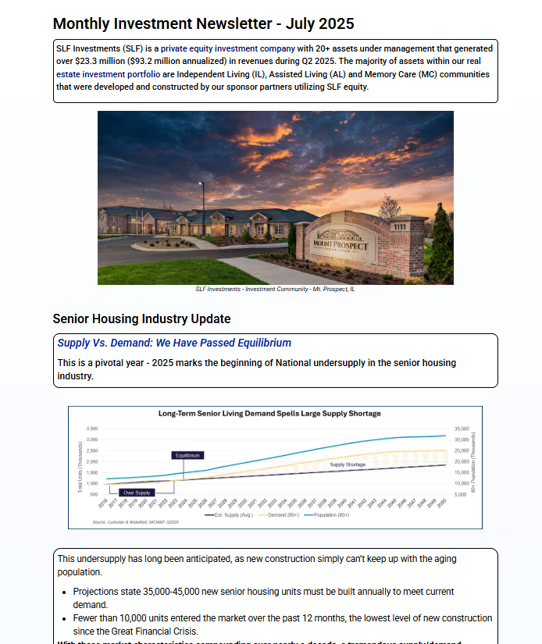

Monthly Investment Newsletter – July 2025

Explore July’s senior housing market update, occupancy trends, operator strategies, and investor insights from SLF Investments. See how we’re navigating 2025.

Understanding 7 Fixed Income Examples For Better Investing

Building a strong investment portfolio requires diversification across various asset classes. Among the safest and most reliable options are fixed income investments. These investments offer steady returns with lower risk compared to stocks. But what are fixed income examples, and how do they fit into your financial strategy? Let’s look into seven common types of […]