A Guide To Understanding Fixed Income Funds

Investing can feel daunting with so many options to choose from. If you’re seeking a dependable way to grow your wealth with less risk, fixed income funds could be the right fit. These funds are designed to generate consistent income, offering a predictable cash flow while helping to safeguard your financial future. If you are […]

6 Fixed Income Alternatives For Senior Living Investments

Fixed income alternatives have become a popular choice for investors who want to diversify their portfolios beyond traditional bonds and stocks. In senior living investments, these alternatives can provide stable income streams, competitive returns, and reduced exposure to market volatility. They also give investors a way to pursue financial stability while supporting the growth of […]

Monthly Investment Newsletter – August 2025

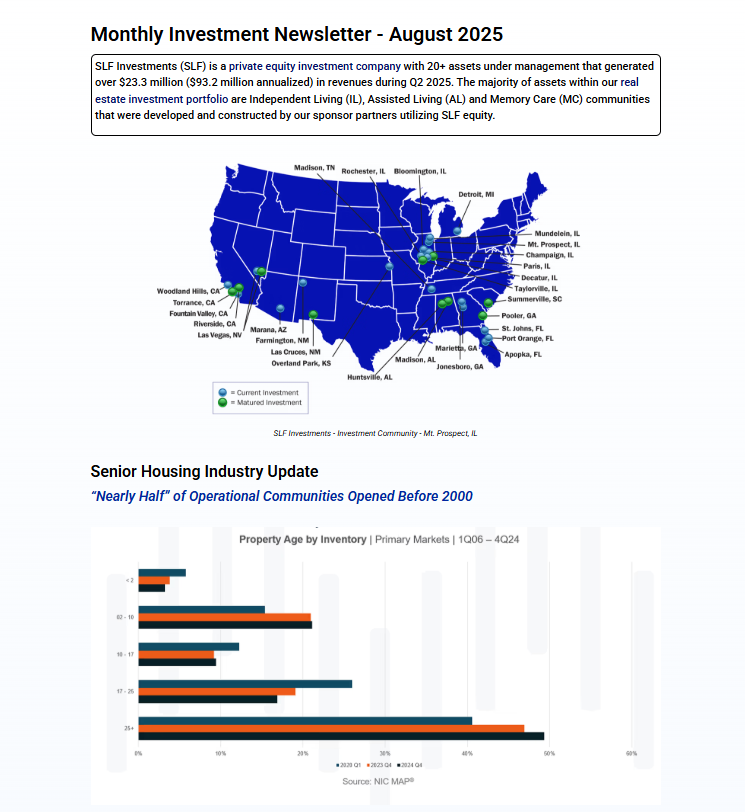

Monthly Investment Newsletter – August 2025 SLF Investments (SLF) is a private equity investment company with 20+ assets under management that generated over $23.3 million ($93.2 million annualized) in revenues during Q2 2025. The majority of assets within our real estate investment portfolio are Independent Living (IL), Assisted Living (AL) and Memory Care (MC) communities […]