Building a Smarter Investment Portfolio in 2025

Building a Smarter Real Estate Investment Portfolio in 2025: real estate investment or senior housing investments. Understanding the full spectrum of options within these industries. If you’re considering investing in senior housing, you might do so through a REIT, a private equity fund, a 1031 exchange, or even by acquiring property directly. Each approach has its own advantages and potential drawbacks, so take the time to explore which one aligns best with your financial goals.

Monthly Investment Newsletter – February 2025

SLF Investments (SLF) is a private equity investment company with 20+ assets under management that generated over $24.9 million ($99.8 million annualized) in revenues during Q4 2024. The majority of assets within our portfolio are Independent Living (IL), Assisted Living (AL) and Memory Care (MC) communities that were developed and constructed by our sponsor partners utilizing SLF equity.

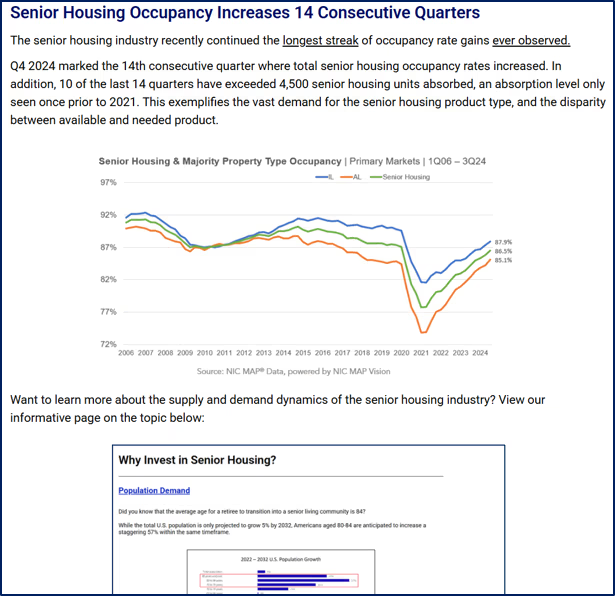

Senior Housing Occupancy Increases 14 Straight Quarters

Senior Housing Occupancy Increases 14 Consecutive Quarters The senior housing industry recently continued the longest streak of occupancy rate gains ever observed. Q4 2024 marked the 14th consecutive quarter where total senior housing occupancy rates increased. In addition, 10 of the last 14 quarters have exceeded 4,500 senior housing units absorbed, an absorption level only […]