Monthly Investment Newsletter – June 2025

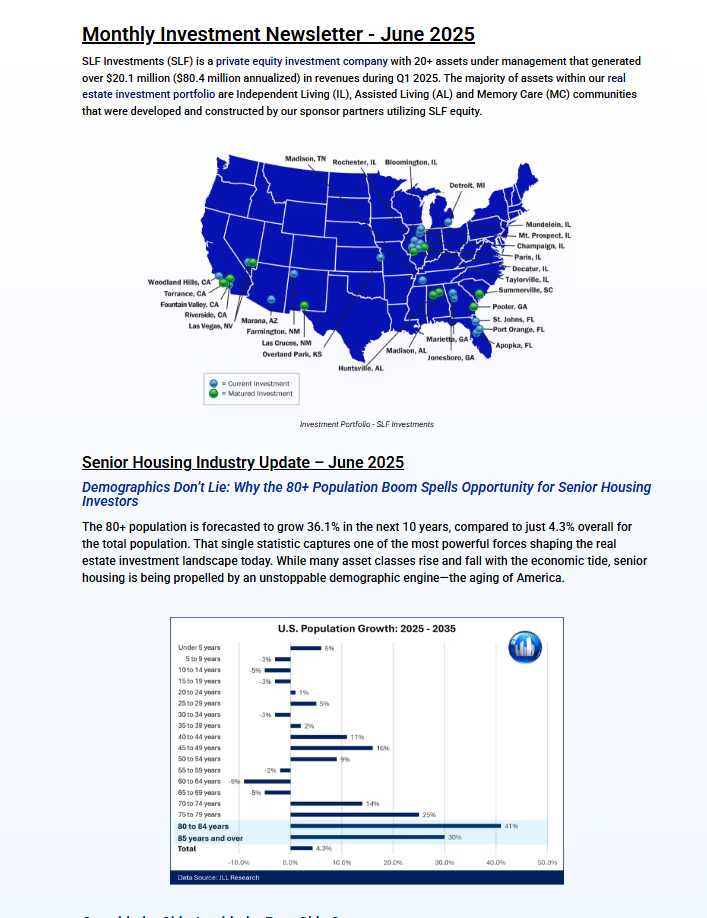

Discover why the aging U.S. population—now with 10,000 Americans turning 80 daily—is fueling a powerful investment opportunity in senior housing. With occupancy rising and new development at a 16-year low, learn how stabilized communities are positioned for long-term cash flow and pricing power.

Occupancy Up 15 Straight Quarters — and Counting.

The senior housing investment sector just marked a major milestone: Q1 2025 was the 15th consecutive quarter of occupancy rate growth, continuing the longest upward streak the industry has ever seen.

According to the National Investment Center for Seniors Housing & Care (NIC), net absorption remained strong, and occupancy for the 31 Primary Markets rose to 87.4%, up from pandemic-era lows that once dipped below 80%.

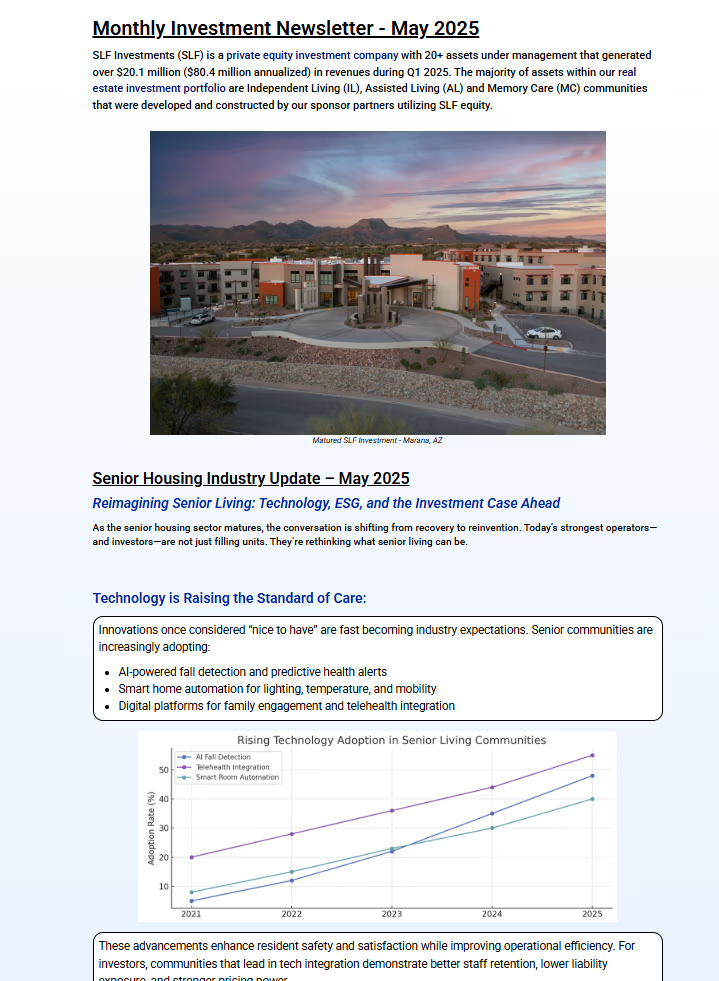

Monthly Investment Newsletter – May 2025

Explore how SLF Investments, a private equity investment company, is capitalizing on the future of senior housing with strong Q1 revenues, rising occupancy, and strategic innovations in technology, ESG, and lifestyle-focused design. Learn why purpose-built communities are outperforming in today’s competitive real estate landscape.