Assisting Accredited Investors Across the Globe

(913) 283-7804

Mon - Fri: 9:00 a.m. - 5:00 p.m. CST

Team@seniorlivingfund.com

For Investment Inquiry

Mon - Fri: 9:00 a.m. - 5:00 p.m. CST

For Investment Inquiry

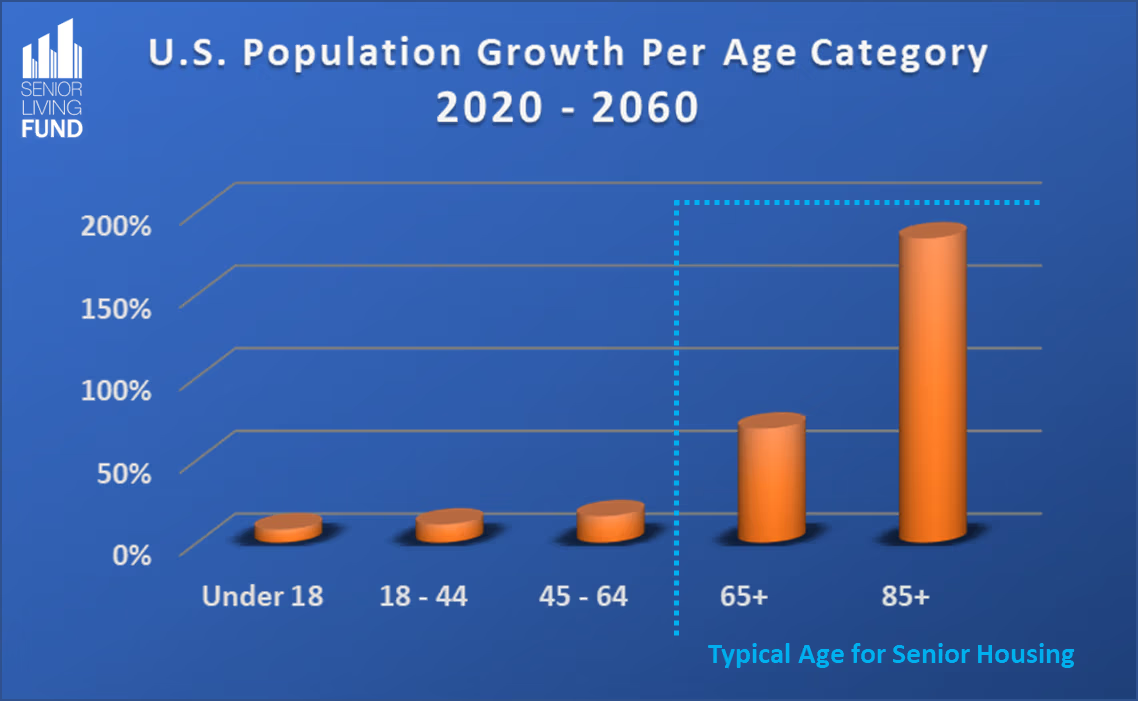

Center for Senior Housing & Care found that regardless of penetration rates (ranging from 13% conservatively or 23% on the higher level), demand for new senior housing inventory will continue to grow exponentially through 2060.