Monthly Investment Newsletter – February 2026

The senior housing sector is currently experiencing a rare alignment: occupancy momentum, limited new supply, and improving capital markets – all while demographics continue to build in the background. Early 2026 has shown signs of cap rate compression returning, and this has dramatic implications for investors.

Monthly Investment Newsletter – January 2026

Senior housing investment enters 2026 with a rare alignment of fundamentals: improving occupancy, constrained new supply, and strong NCREIF performance. In this month’s investment brief, we explore the “90% threshold” — the point where incremental move-ins can translate into outsized NOI expansion through operating leverage. We also highlight Countryside Lakes Senior Living as a real-world example of occupancy-driven stability paired with operational NOI optimization.

Monthly Investment Newsletter – December 2025

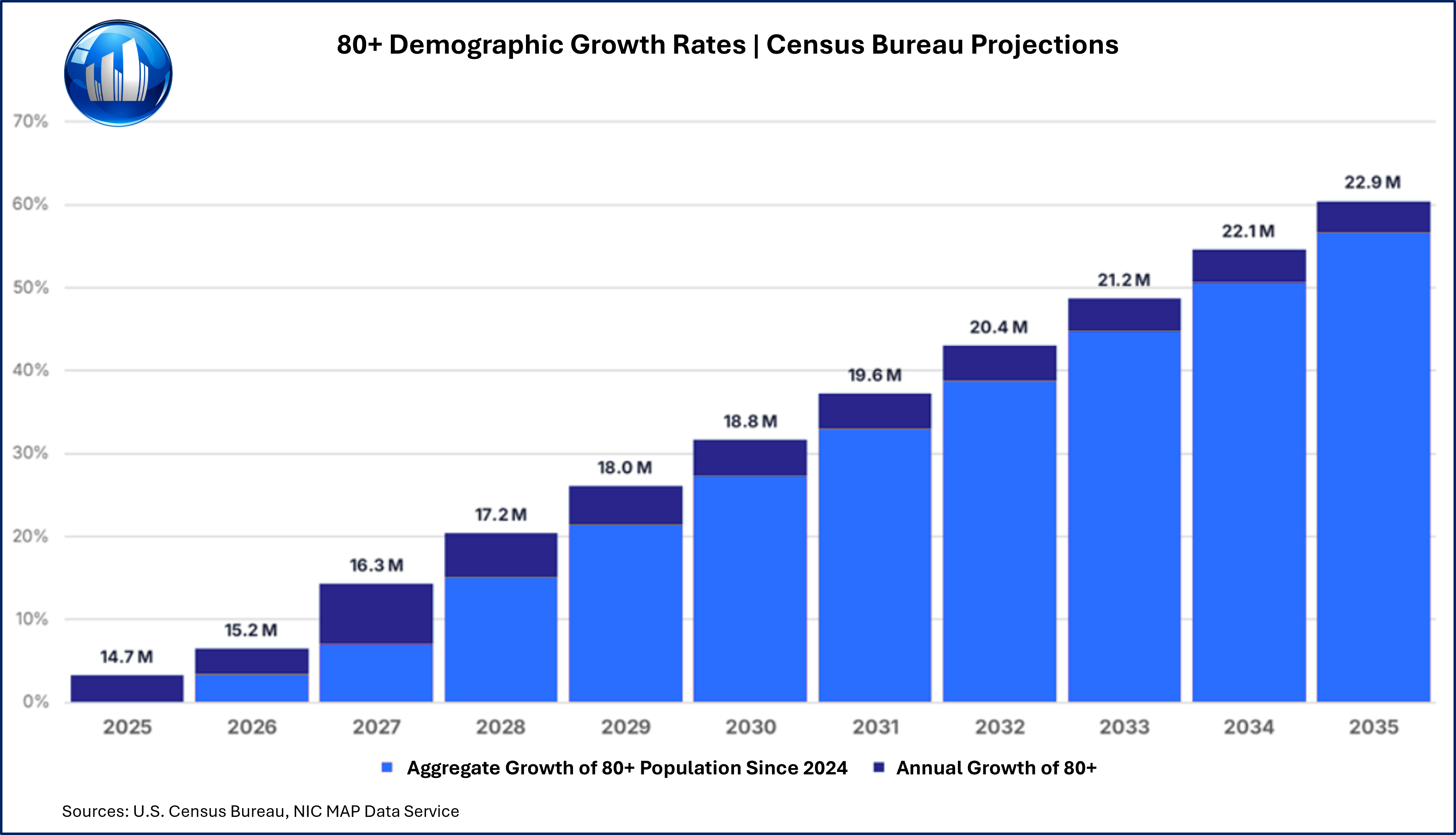

Senior housing investments are increasingly supported by strong demographic tailwinds, rising care needs, and a growing supply-demand imbalance. With the 80+ population expanding rapidly and new development at multi-year lows, assisted living, memory care, and skilled nursing are positioned for long-term occupancy growth. Investors focused on healthcare real estate, operational quality, and risk-adjusted returns may find senior housing to be a durable asset class.