Assisting Accredited Investors Across the Globe

(913) 283-7804

Mon - Fri: 9:00 a.m. - 5:00 p.m. CST

Team@seniorlivingfund.com

For Investment Inquiry

Mon - Fri: 9:00 a.m. - 5:00 p.m. CST

For Investment Inquiry

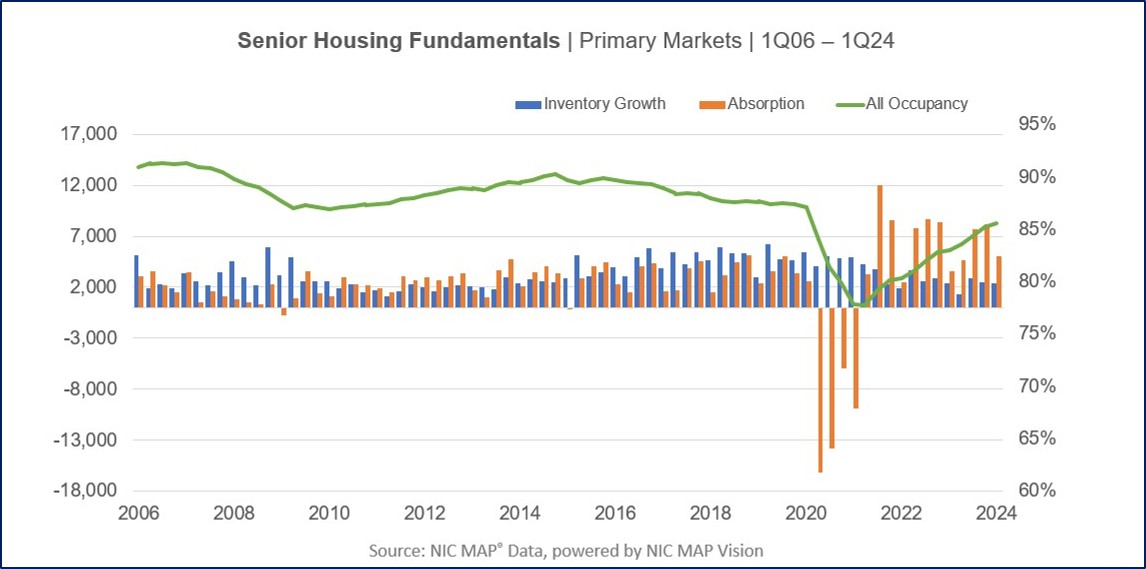

The pandemic was a challenging time for many commercial real estate investors, including accredited investors. Just after onset, senior housing occupancy dropped from a high of 87.1% in Q1 2020, to 77.8% in Q2 2021. A steady occupancy recovery then began, and as of the end of Q2 2024, senior housing occupancy has reached 85.9%, only 1.2% below its previous peak. This can be attributed to the industry’s robust demand being coupled with moderate new supply. At this current pace, senior housing occupancy rates are on track to reach pre-pandemic levels during 2024.

The total number of occupied senior housing units set another high in Q2 2024, approximately 38,000 units higher than the pre-pandemic levels. Evidence that more older adults than ever before are residents in senior housing properties.

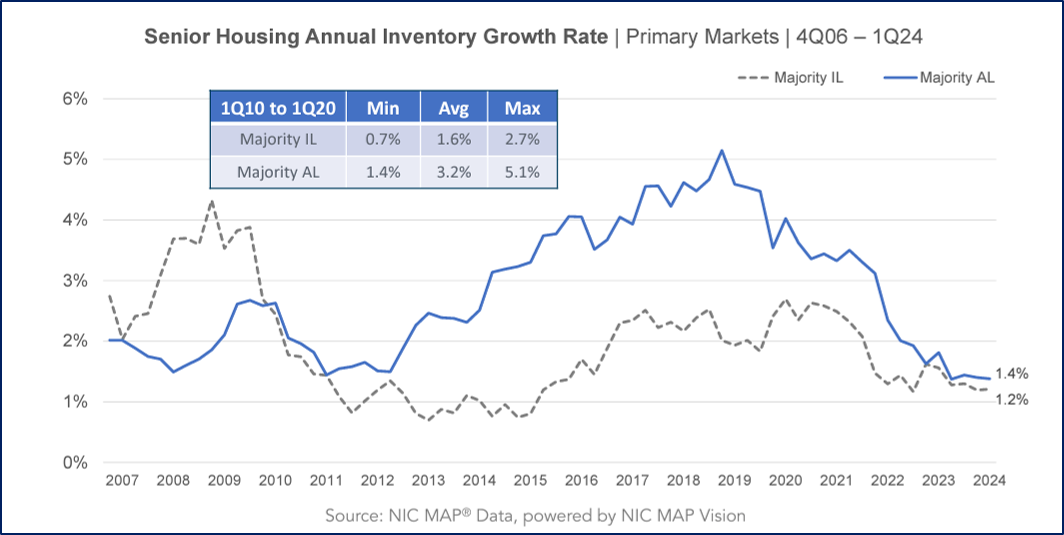

Overall, inventory growth has trended down from 2019 through a combination of the pandemic and the high cost of construction loans and credit tightening from the dramatic increase in interest rates. Less than 15,000 new senior housing units were being constructed in 2023, the lowest number of senior housing construction starts since 2010, the year following the Great Recession. In addition, the average number of months for construction has increased from 21 months in 2017 to 29 months in 2023. The trend has continued into 2024. The preliminary estimates for Q2 2024 attributed only 1,300 construction starts for new senior housing units, which when finalized is likely to set a record for lowest quarterly starts since the Great Recession.

The historical decline in new construction starts from 2022 into 2024 is a harbinger of a future pinch in inventory. The market is expected to feel the squeeze of such construction slowdown as early as next year and worsen each year depending on how soon and aggressively new development increases.

This impending scarcity of new units will intensify competition for available spaces, likely leading to increased rental rates. The intersection of high consumer demand and lack of new supply in senior housing will have profound effects on future seniors, investors, and operators in the industry. As the baby boomer generation continues to enter retirement age, the demand for senior housing is only expected to escalate.

Investors in the senior housing market are apt to see the impact of this supply demand gap as a massive investment opportunity. Existing properties will likely appreciate in value and exhibit strong performance from high occupancy rates and improving margins driven by existing supply unable to keep pace. This should present attractive returns for investors who are already positioned in the market, as well as new investors entering the market.

The declining trend of new construction starts from 2022 and continuing in 2024, combined with consistent high demand, will quickly and profoundly create a situation where inventory is chasing demand. The National Investment Center for Senior Housing recently estimated 200,000 new senior housing units will need to be constructed by 2025 to meet current demand, and a total of 800,000+ units will be needed by 2030. Such demand will not be met at the current pace of new supply entering the market. Furthermore, this gap between high demand and decreasing new supply is likely to widen in the coming years depending on when capital becomes more readily available, and investors are ready to get aggressive on new construction.

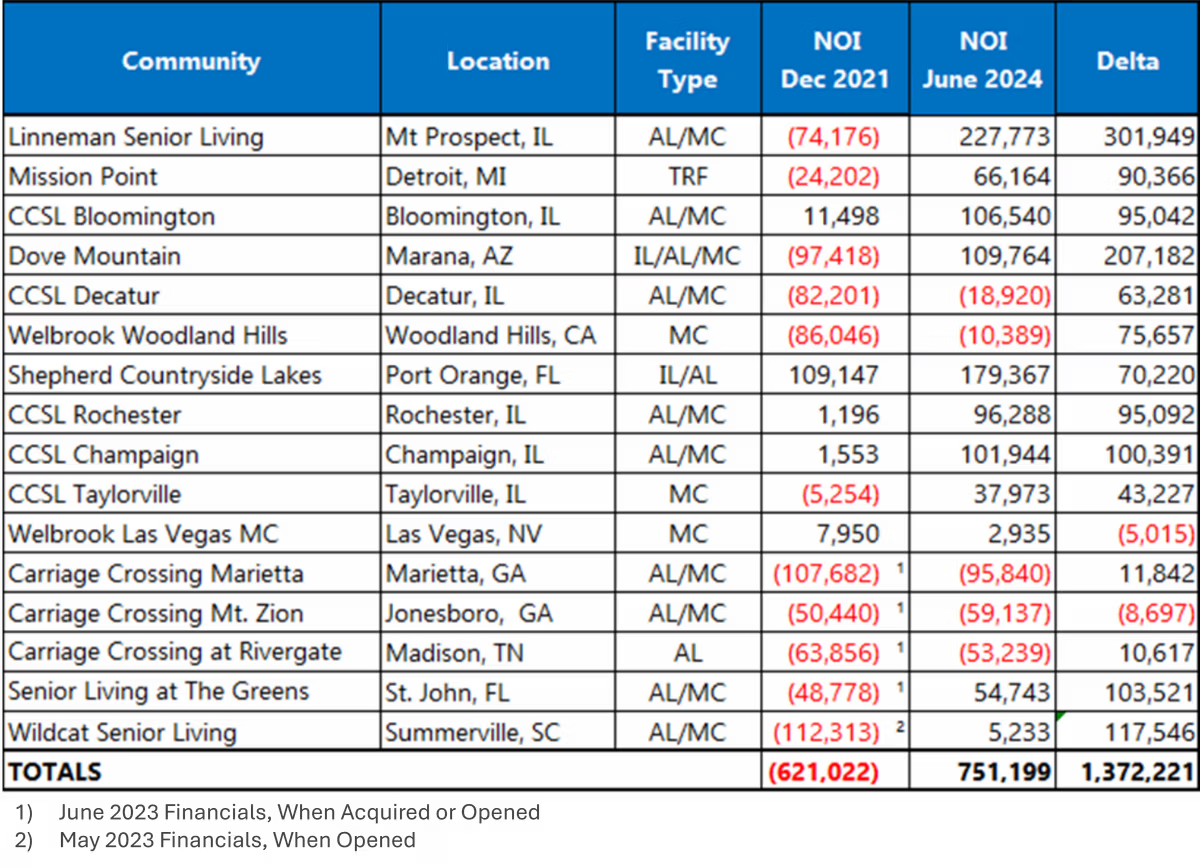

The impact on occupancy in Senior Living Fund assets has been consistent with the broader senior housing market. However, with time and significant involvement of SLF’s Asset Management team, occupancy and related NOI have improved significantly. The chart on the following page shows the overall monthly NOI improvement for the assets in which SLF has a significant influence on operations.

Labor costs, which account for approximately two-thirds of the operational costs of a typical assisted living or memory care community, have been extremely high from the effects of the pandemic, high employment and inflation. Those cost factors have been moderating and are expected to continue to moderate for the next 12 to 18 months. We expect NOI to continue to improve through these anticipated cost reductions, combined with stronger occupancy and increases in room rental rates.

This did not happen without an associated cost. The additional operational deficits caused by loss of occupancy, exacerbated by rapidly increasing labor costs, supply chain issues and other inflationary events created a major burden on SLF Fund reserves. To gain control over inflation, the Federal Reserve responded by increasing the Federal Funds rate from mid-2022 to mid-2023 from 0% to 5.25%. This increase directly correlated to a commercial bank’s cost of capital. Many commercial lenders passed these rate increases on to their borrowers through variable rate loans. Loans made prior to the onset of the pandemic have or soon will mature, requiring loan paydowns, more reserves, and much higher rates. Ultimately, all these factors dramatically drained reserves as SLF did all it could do to prevent aggressive lenders from taking many of the Fund assets and thereby creating significant investment losses for the Funds.

Commercial lenders for the senior housing communities in which SLF’s Funds have made an investment are largely working with SLF, and the likelihood of any of these communities being lost to the lenders has been greatly mitigated. In time, these lenders do expect SLF to continue to provide capital to support operations until the communities are cash flowing enough to make debt service, to pay the debt service when the communities are not yet able to make debt service, and to provide needed reserves and debt paydowns.

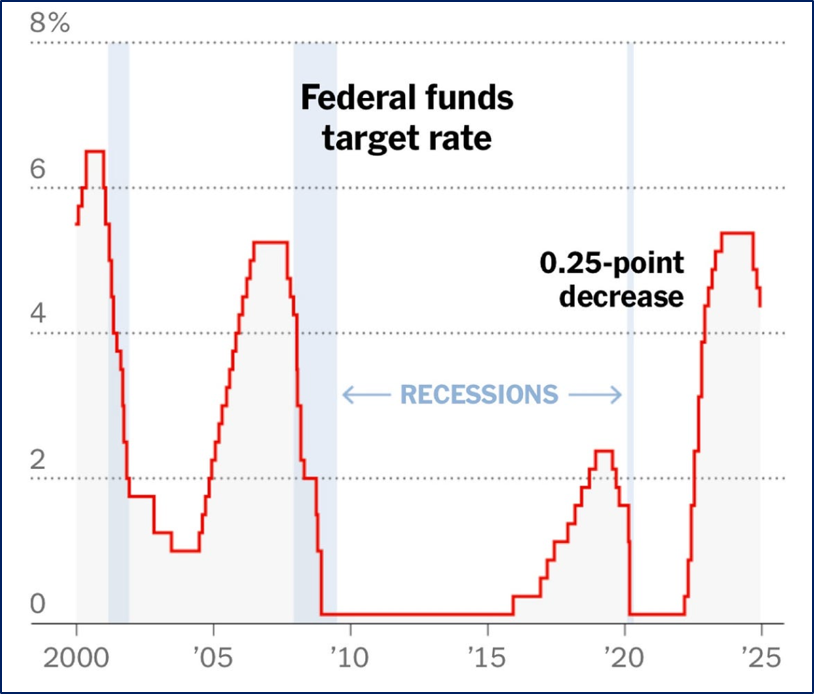

The high interest rate environment has been present for quite some time, as the Fed works though their process to manage the economy. The Fed rate had not changed since mid-2023, its highest level in over 4 years. Since mid-2023, the economy, particularly inflation, had subsided enough that the likelihood of imminent Fed rate decreases was very high. Early September unemployment and inflation reports where inflation is now at 2.5% annualized, further supported Fed rate changes were imminent. The Fed met on 9/18/24, and reduced the Fed funds rate by ½ point. Looking at the history of Fed rate management, once the Fed begins lowering rates, they continue to do so on a very consistent basis. The Fed anticipates reducing the Fed rate approximately 2.0% m/l in the next 12-18 months, even further by the end of 2026, consistent with the opinion of a significant percentage of nationally recognized economists and financial institutions, including Wells Fargo as shown in the chart below:

The Fed rate reduction was wonderful news for the broader economy, and certainly for SLF Funds. A falling Federal funds rate translates to lower borrowing costs. This creates a more competitive market for senior housing assets, since it allows more buyers into the market who use less expensive debt financing to purchase the senior housing assets. Greater buyer demand for senior housing assets will increase

We have significant reason to forecast a strong sustained period of economic growth and stability, with reasonably priced debt to further bolster the buyer market. This gives SLF the confidence to acquire the necessary capital to continue to provide support for the assets as they improve their individual performance, allow the markets to improve, and ultimately sell the communities into a healthier market when the timing it right. As part of our planning process, SLF projected NOI thru 2026, and consulted with industry advisors on future market cap rates for each SLF investment. The combination of improved NOI and improved cap rates can be profound. Future NOI projections and asset valuations are approximate, conditional upon Fed rate reductions and continued NOI improvement with the communities.

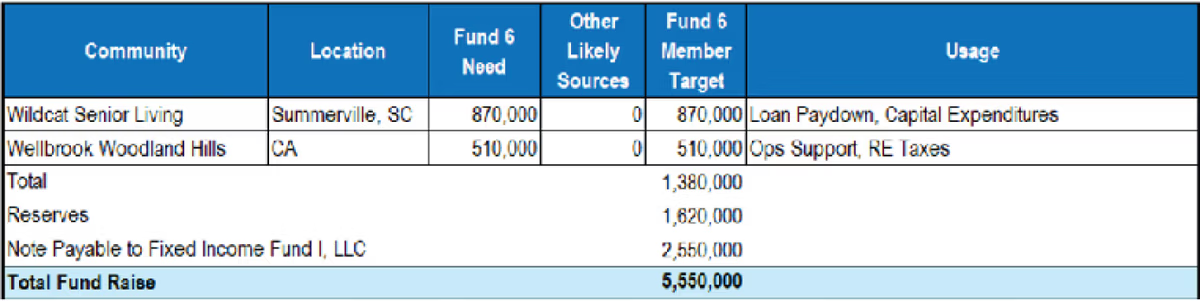

The performance of each asset, our capital-raising efforts with other SLF Funds and with outside investment sources may increase or decrease the need. In addition, some investment companies may want to provide additional capital to reduce the debt on some of these assets, reducing the monthly debt service payments and the time needed for the assets to begin cash-flowing above debt service.

Fund members will have 1st priority for a limited period to participate in this opportunity through the purchase of Fixed Rate Notes. Investors who purchase Fixed Rate Notes or “Noteholders” will be unsecured creditors of the Fund.

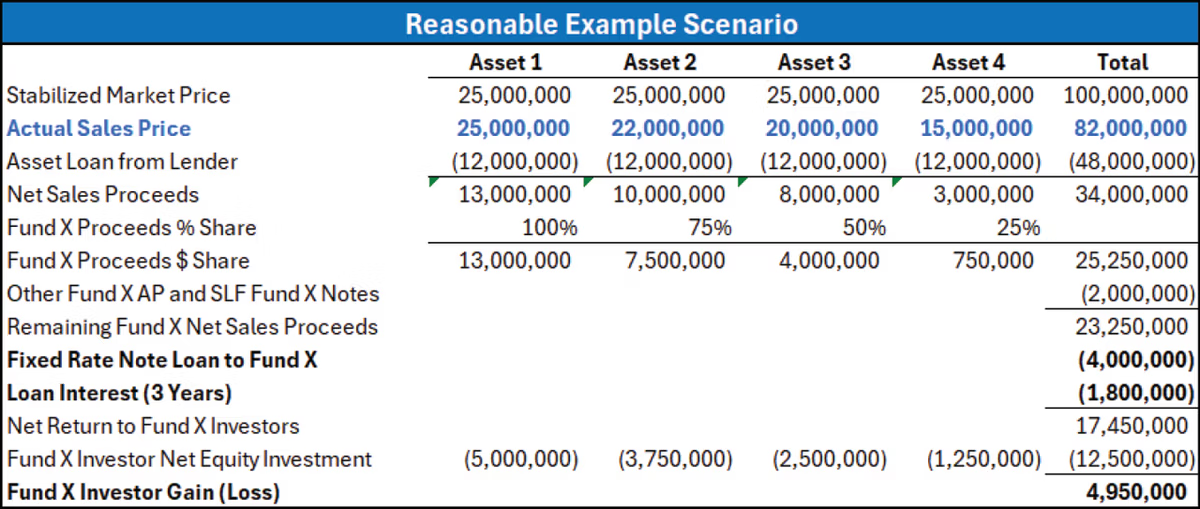

An investor in such Fixed Rate Notes has a relatively strong distribution priority position. This, combined with a relatively strong projected rate of return, provides a relatively higher rate of return compared to the associated risk, in the opinion of SLF. The following example is provided to help a illustrate this:

In this theoretical example:

This offering provides investors:

Further:

SLF is in the process of acquiring the projected capital from many sources at generally similar targeted return ranges. Some sources may require a higher return range. SLF prefers to distribute these returns to Fund investors.