Monthly Investment Newsletter - November 2025

Introduction: Senior housing continues to distinguish itself as one of the strongest performers in commercial real estate investment. PwC and the Urban Land Institute recently released the latest “Emerging Trends in Real Estate” report, breaking down key opportunities, risks, and market shifts for investors, developers, and city leaders. The 47th edition of the report draws on insights from over 1,700 leading real estate investors, lenders, and advisers across the United States and Canada, identifying risks and market shifts for the coming year.

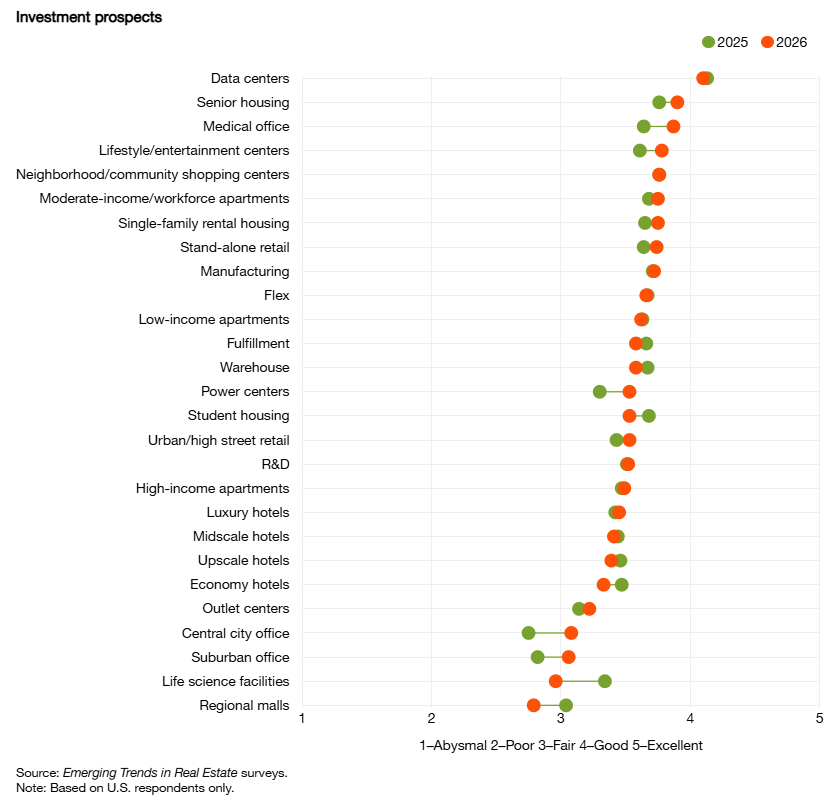

Of the 27 subsectors in the report, senior housing ranks second for best investment and development prospects going into 2026.

Why Is Senior Housing a Top Rated Investment in 2026?

Demographic Drivers and Record Breaking Fundamentals

Senior housing is entering one of the strongest fundamental periods in its history. Multiple performance indicators – occupancy, rent growth, absorption, and supply constraints are hitting record levels simultaneously, creating a compelling investment backdrop.

Highest Returns of any Real Estate Sector

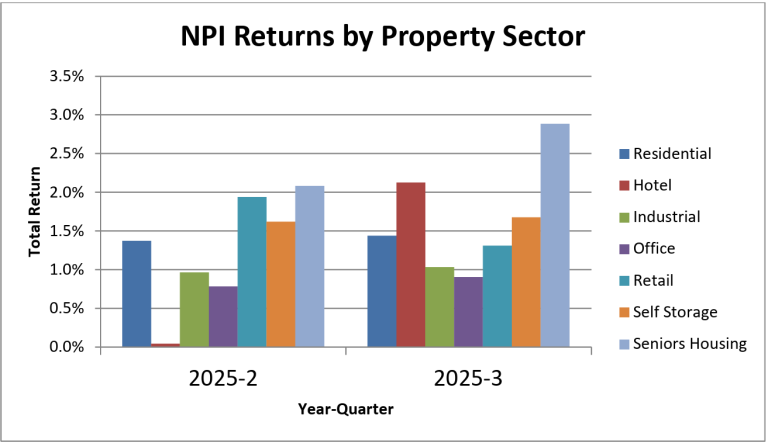

During Q3 2025 senior housing delivered the highest total return of any property sector for the third straight quarter, according to the National Council of Real Estate Investment Fiduciaries (NCREIF).

Within the index:

- Senior Housing: + 2.88 % total return

- Hotels: + 2.12 %

- Self-Storage: + 1.68 %

- Industrial, Retail, and Office: all trailing below 1 %

This consistent performance highlights what many institutional investors already recognize: strong demographic demand, stable occupancy, and income-yield potential continue to set senior housing apart from other sectors.

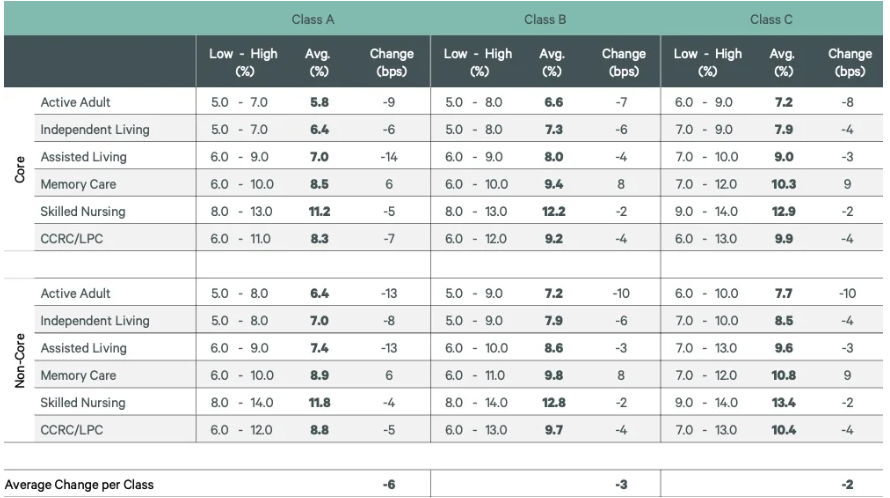

Highest Cap Rate Premium in Commercial Real Estate

At a time when multifamily, industrial, and even retail have seen cap rates compress meaningfully, senior housing transactions have been clearing at cap rates that are 150–250 basis points higher on average. When compared to the 10-year U.S. Treasury, the sector offers one of the widest yield spreads in commercial real estate, providing investors with robust income even before factoring in appreciation or operational growth.

The combination of elevated going-in yields, tightening occupancy, strong rent growth, and severely limited new supply positions senior housing as one of the most attractive risk-adjusted return opportunities in today’s environment.

Record Breaking Rent-Prices

According to Multi-Housing News, the average monthly asking rent for senior housing in Q3 2025 exceeded $5,650. This is a 4.5% increase from the previous year, and the highest ever recorded in the senior housing sector. It’s not uncommon today to see senior housing communities charging $8,000–$12,000 per month and still maintaining years-long waitlists. While this may seem surprising at first glance, it’s one of the clearest indicators of deep, resilient demand in our sector.

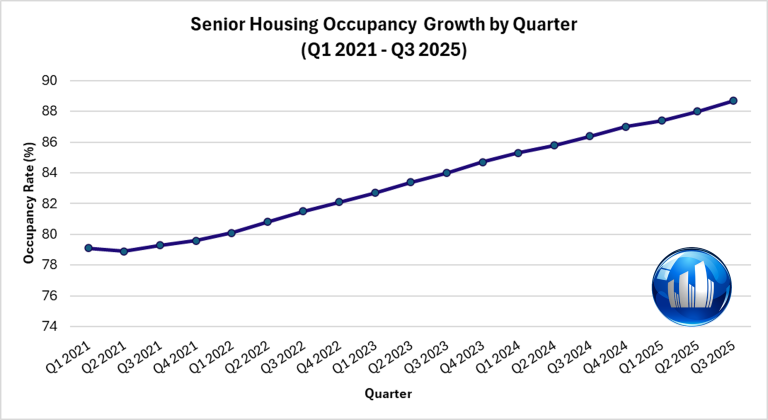

Record Occupancy: 17 Quarters of Growth

Despite rising rent prices, Q3 2025 marked 17 consecutive quarters of occupancy growth within the senior housing sector for both primary and secondary markets. This is the longest period of continuous growth ever recorded in the sector.

The senior housing sector has not experienced a single quarter of occupancy decline since early 2021. Over this four-year period, senior housing absorbed more than 40,000 units across primary and secondary markets, despite one of the most challenging construction and capital-market environments in recent memory. This level of consistency is unmatched elsewhere in commercial real estate.

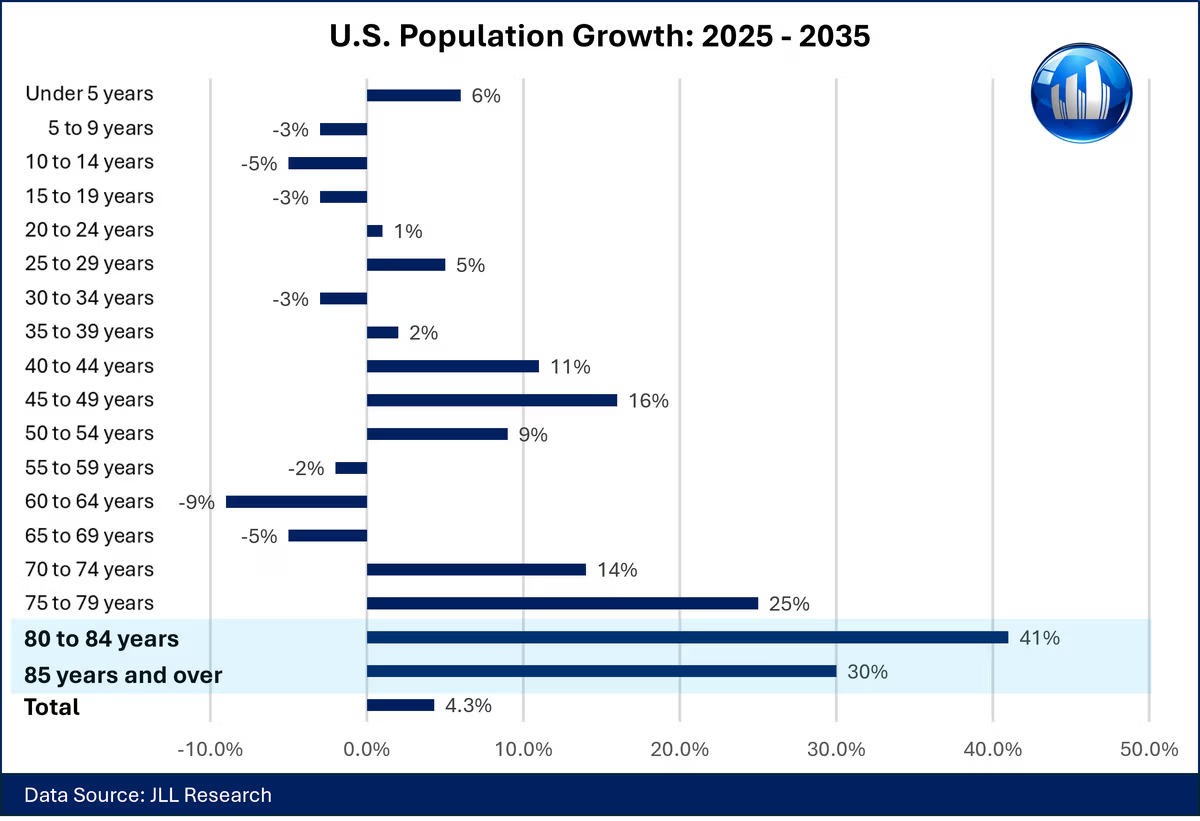

Record Demographic Push: Beginning 2026

In 2026, the oldest baby boomers will begin to turn 80. The 80+ population is forecasted to grow 36.1% in the next 10 years, compared to just 4.3% overall for the total population. These seniors will need housing, and currently there isn’t enough. Q3 2025 This is the ideal scenario for investors looking to capitalize on extreme supply/demand disparity. This demographic shift alone will reshape the industry, driving demand for decades.

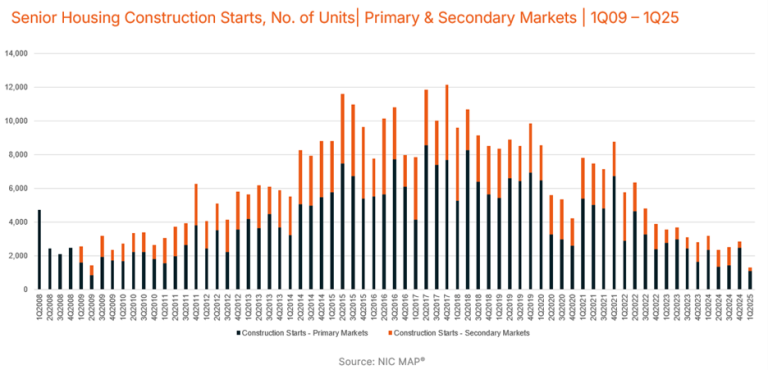

Record Low Construction

The senior housing industry has been dealing with a large supply issue. The National Investment Center for Seniors Housing & Care recently stated that senior housing units are currently “being filled faster than they can be built”. Construction starts are currently at a 16-year low while seniors are absorbing units 2.5 times the rate of new supply. The senior housing sector is estimated to require 35,000 – 45,000 new units annually to meet current demand. During Q3 2025, fewer than 1,400 units were opened. NIC recently stated that for every 10 units opened in any given market, 31 are occupied and absorbed.

Want To Participate?

SLF Investments (SLF) is a private equity investment company with 20+ assets under management that generated ~$100 million in revenues during 2025. If you would like to hear about our current offerings, contact our investor relations team today!

Sources:

How to Participate.

Senior Living Fund has five (5) investment offerings for accredited investors:

SLF Value-Add Fund 1 - (SLF VAF 1)

- Anticipated 4.5-5 Year Term

- Annual Accrual + Profit Participation

- 12.00% to 21.00% Projected Fund IRR

SLF Value-Add Fund 2 - (SLF VAF 2)

- Anticipated 4.5-5 year term

- Monthly Distributions + Profit Participation

- 10.50% to 20.00% Projected Fund IRR

F4 Fixed Note Offering

- Anticipated 3 Year Term

- Monthly Distributions

- Fixed Interest Rate Equal to 15% Per Annum

F5 Fixed Note Offering

- Anticipated 3 Year Term

- Monthly Distributions

- Fixed Interest Rate Equal to 15% Per Annum

F6 Fixed Note Offering

- Anticipated 3 year term

- Monthly Distributions

- Fixed Interest Rate Equal to 15% Per Annum

Interested in investing? Contact our Investor Relations Team today!

Team@seniorlivingfund.com | 913.283.7804

Our Team.

The Senior Living Fund investment team is comprised of industry, securities, financial, and investment experts, as well as support personnel, based primarily in the Kansas City metropolitan area.

SLF Executive Team.

Dan Brewer, Founder & Chief Fund Manager

Dan has 30+ years of business experience, including 25+ years as an executive and principal in real estate, capital placement, business development and management. Dan has 10+ years of experience in a business consulting and management role for Accenture. Dan also has 10+ years of experience in the senior housing sector.

Mark Shader, Chief Operating Officer

Mark brings strong operations management skills to the SLF team through his 30+ years of experience in business consulting, real estate investment and development, financial analysis and management. Mark currently serves as Chief Operations Officer for Senior Living Fund, LLC and its affiliated entities.

Rick Maner, Chief Financial Officer

Rick brings over 30 years of financial management experience, mostly focused on financial services industry. Rick oversees all of the accounting operations including financial reporting, cash planning, and managing external audit relationships and the Funds tax reporting.