17 Quarters and Counting: Senior Housing’s Unstoppable Occupancy Growth

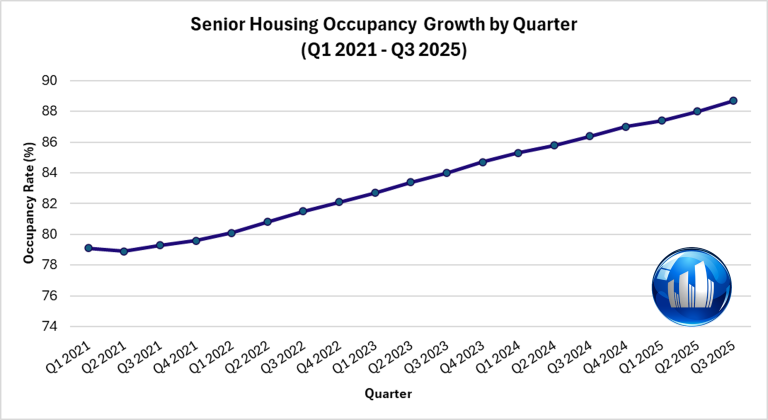

The senior housing investment sector just reached another milestone: Q3 2025 marked the 17th consecutive quarter of occupancy growth, extending the longest upward streak in the industry’s history.

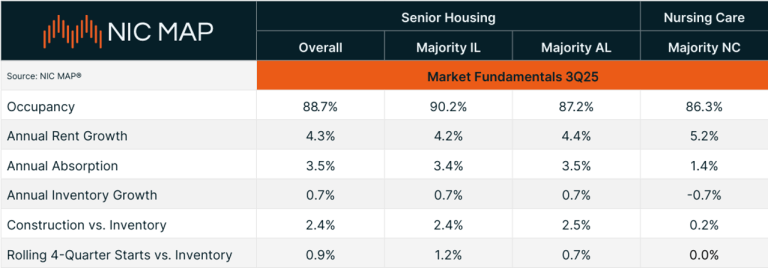

According to the National Investment Center for Seniors Housing & Care (NIC), occupancy across the 31 Primary Markets rose to 88.7%, up from 88.0% in Q2. Independent living climbed above 90% for the first time since 2019, while assisted living reached 87.2%.

In a real-estate world where supply frequently outpaces demand, here is one sector where demand is clearly leading supply – and it appears likely to remain that way for the foreseeable future.

Demand Is Surging, Supply Can’t Keep Up

In recent quarters, senior housing has absorbed between 4,500 and 6,000 units, a rate that far exceeds pre-pandemic norms. For perspective, that absorption level was reached only once in all of recorded history prior to 2021.

“This is one of the few real estate sectors where demand is not optional,” said Dr. Chuck Harry, Chief Operating Officer at NIC.“ The majority of senior housing decisions are needs-based, that makes this asset class fundamentally resilient.”

Meanwhile, new construction remains historically low. Rising costs of capital, labor shortages, and regulatory hurdles have all slowed development pipelines to near-record lows. As a result, existing communities are filling up faster than new ones can be built, creating favorable tailwinds for occupancy, rent growth, and valuations.

What’s Fueling the 17-Quarter Streak

For senior housing communities that rely on Medicaid reimbursements or government-subsidized housing vouchers, the proposed bill could have severe ripple effects:

- Operators may experience declining reimbursements, longer delays in funding, and tighter eligibility rules for incoming residents

- Skilled nursing and assisted living communities with high Medicaid census may be forced to reduce services, shrink staff, or raise private rates to remain viable

- Affordable housing projects may encounter increased resident turnover as housing assistance programs shrink, creating potential instability for investors in those segments

Investor Implications

For investors, the message is clear: supply-demand fundamentals have rarely been stronger.

Rising NOI and valuations: Occupancy gains translate directly into improved cash flow, even before factoring in potential rent growth.

A long-term structural story: The sector’s stability isn’t just cyclical, it’s demographic and needs-driven.

Selective opportunity: As always, execution and quality matter. Top operators with modern communities in supply-constrained markets are positioned to outperform.

Resilient amid volatility: In a broader real-estate landscape marked by office distress and retail contraction, senior housing stands out as one of the few growth sectors.

Looking Ahead

The industry’s next milestone may come soon, a national occupancy rate exceeding 90%, which could push valuations and transaction volume even higher.

But challenges remain: staffing shortages, wage inflation, and regulatory pressures continue to test operators’ margins. Balancing growth with sustainable operations will be key.

Still, the momentum is undeniable. As McKnight’s Senior Living recently summarized: “Boomers are filling up senior living communities faster than they can be built.”

Stay Ahead of the Curve

The senior housing recovery isn’t just a headline — it’s a trend with real staying power.

To learn more about how SLF is navigating this growth cycle and helping investors capitalize on it:

👉 Explore our current portfolio

👉 Read our October 2025 investor newsletter

👉 Get in touch with our investor relations team