Monthly Investment Newsletter - July 2025

SLF Investments (SLF) is a private equity investment company with 20+ assets under management that generated over $23.3 million ($93.2 million annualized) in revenues during Q2 2025. The majority of assets within our real estate investment portfolio are Independent Living (IL), Assisted Living (AL) and Memory Care (MC) communities that were developed and constructed by our sponsor partners utilizing SLF equity.

Senior Housing Industry Update

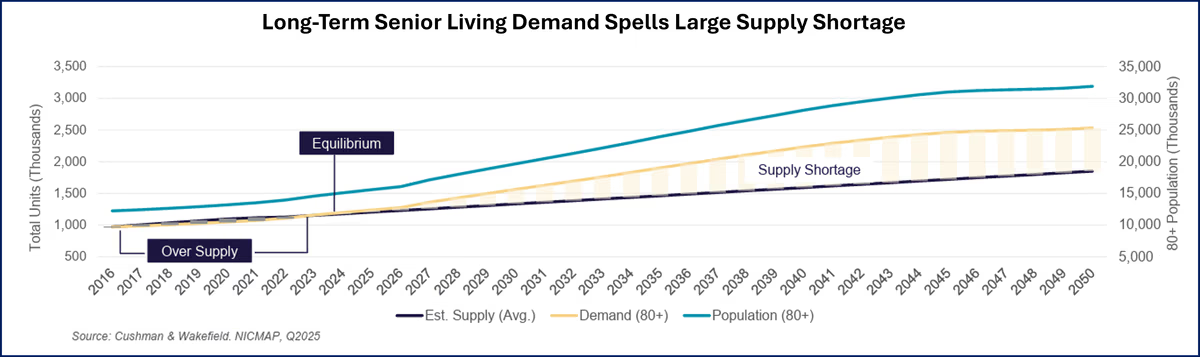

Supply Vs. Demand: We Have Passed Equilibrium

This is a pivotal year - 2025 marks the beginning of National undersupply in the senior housing industry.

This undersupply has long been anticipated, as new construction simply can’t keep up with the aging population.

- Projections state 35,000-45,000 new senior housing units must be built annually to meet current demand.

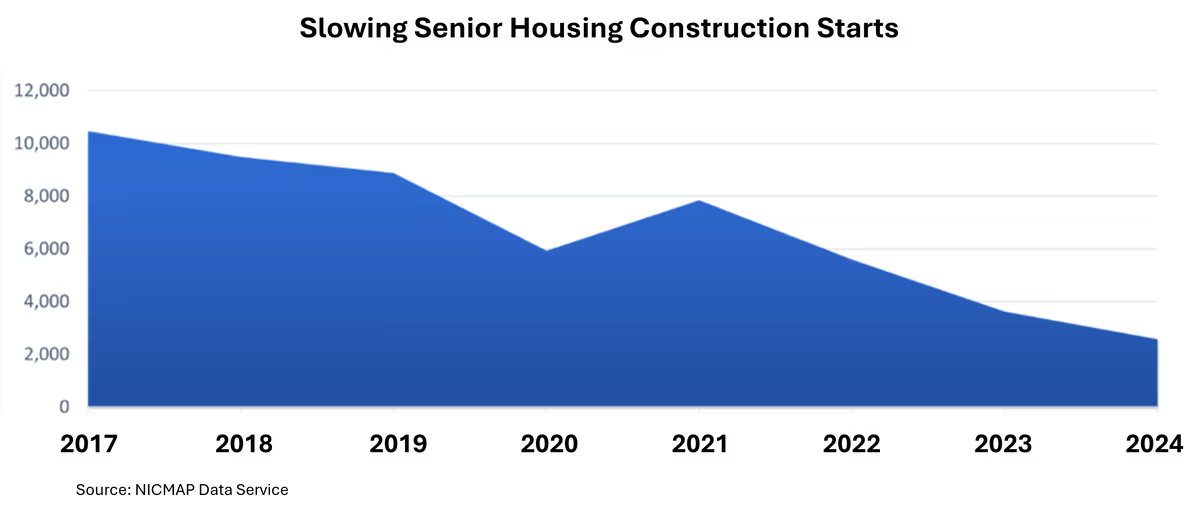

- Fewer than 10,000 units entered the market over the past 12 months, the lowest level of new construction since the Great Financial Crisis.

With these market characteristics compounding over nearly a decade, a tremendous supply/demand imbalance has been created.

These metrics are not projected to change any time soon, as several headwinds are keeping new supply constrained.

What’s Slowing Construction? Why Won’t it Catch Up?

The two main factors are cost and labor:

- Labor shortages and wage inflation have increased build durations 40% since 2017.

- Higher interest rates and tighter financing erode project feasibility, limiting new starts despite demographic demand.

- Immigration enforcement actions are further disrupting construction labor availability, worsening shortages that have long relied on this workforce.

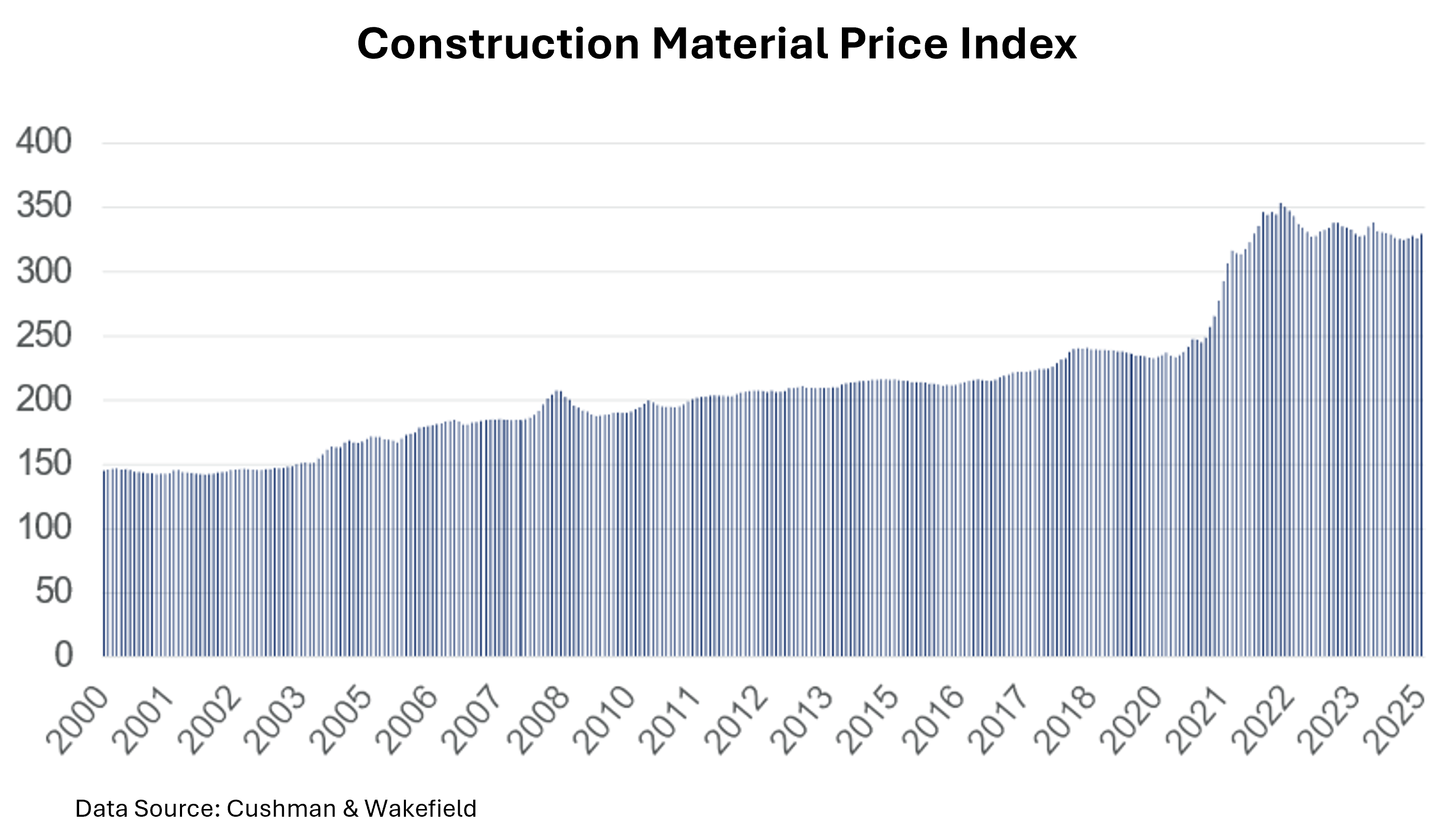

Construction cost pressures, although somewhat stabilizing in 2025, remain well above pre-pandemic levels (see following chart).

According to Cushman & Wakefield, a leading global real estate advisory and research firm, new tariffs enacted in 2024–25 are forecast to increase construction material costs by 5–7% – adding direct upward pressure to building budgets. Senior housing focused commentary echoes this risk, warning that “new tariffs could send construction prices higher” just as the sector strives to scale supply.

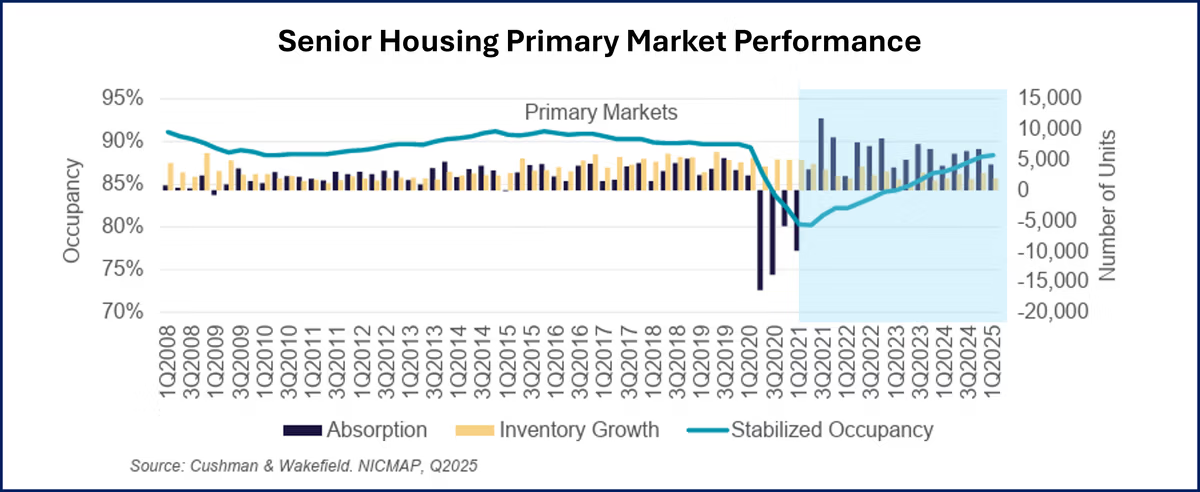

The 80+ Population Isn’t Waiting

The 80+ population is growing four times faster than the average U.S. population rate. Net unit absorption in the senior housing industry is at an all-time high in both primary and secondary markets, currently outpacing new supply growth by a 2.5:1 ratio. The senior housing sector is no longer just “recovering”. Since 2021 the sector has been in a phase of sustained, structural growth.

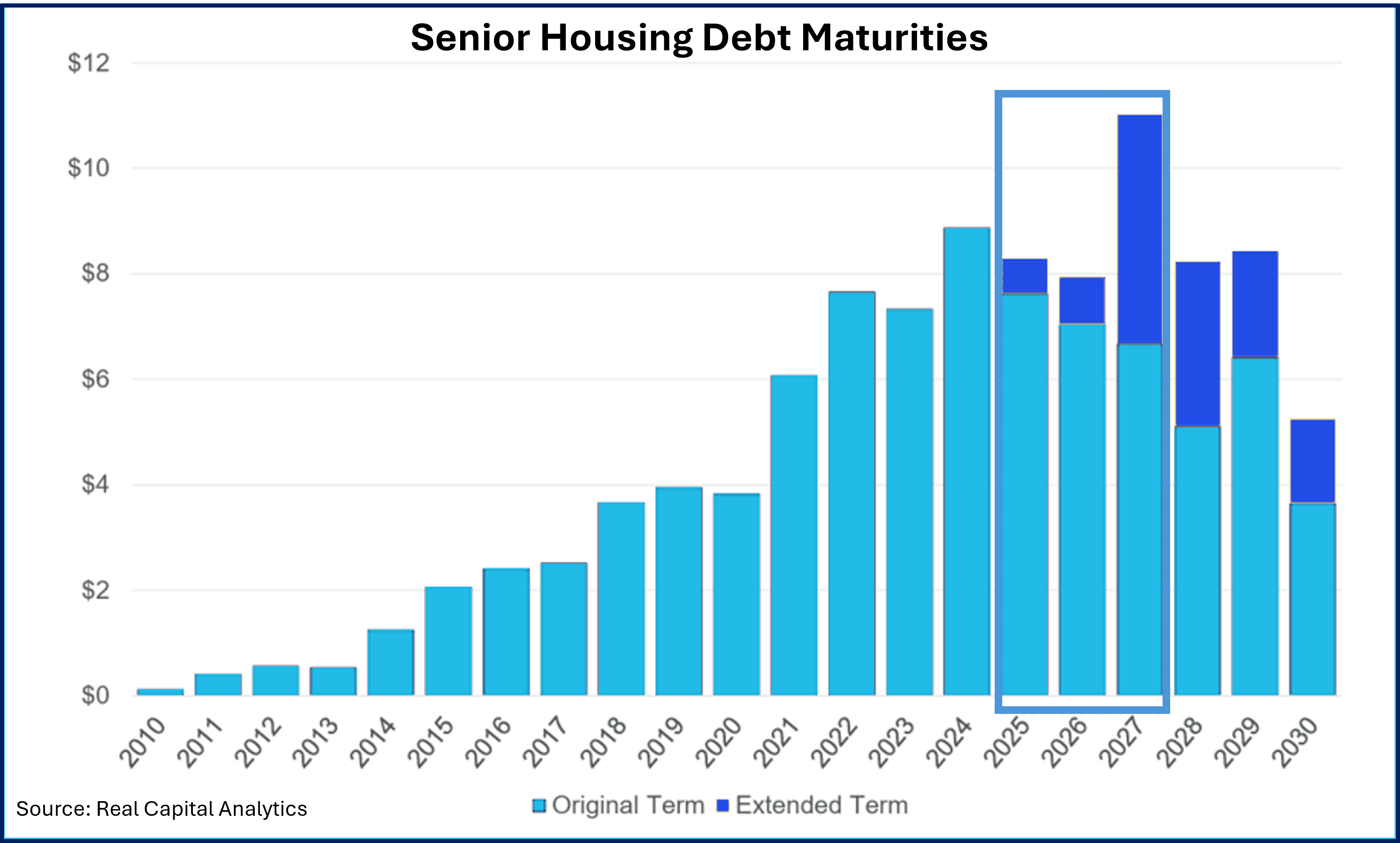

$18 Billion Debt Wall = Opportunity for Agile Investors

Approximately $8 billion of senior housing loans remain set to mature in 2025. $18 billion is maturing in the next 24 months. Many of these loans originated at sub-3% interest rates. With today’s refinancing environment commanding 5–7% rates and tighter lender covenants, operators will face pressure to extend, modify, or refinance their debt under more onerous terms.

We believe this “debt wall” represents an inflection point for deploying capital into a fundamentally strong sector, here’s why:

- Distressed Acquisition Pipeline: Owners unable to secure cost-effective refinancing may be forced to recapitalize or divest assets at discounts, presenting well-capitalized buyers with high-quality opportunities.

- Favorable Deal Structures: Borrowers under pressure often concede on loan-to-value ratios, covenant flexibility, and pricing, enabling investors to secure equity kickers or payment-in-kind structures that boost overall IRRs. By providing bridge-to-permanent financing or equity infusions, investors can negotiate attractive preferred returns.

Better Now Than Later

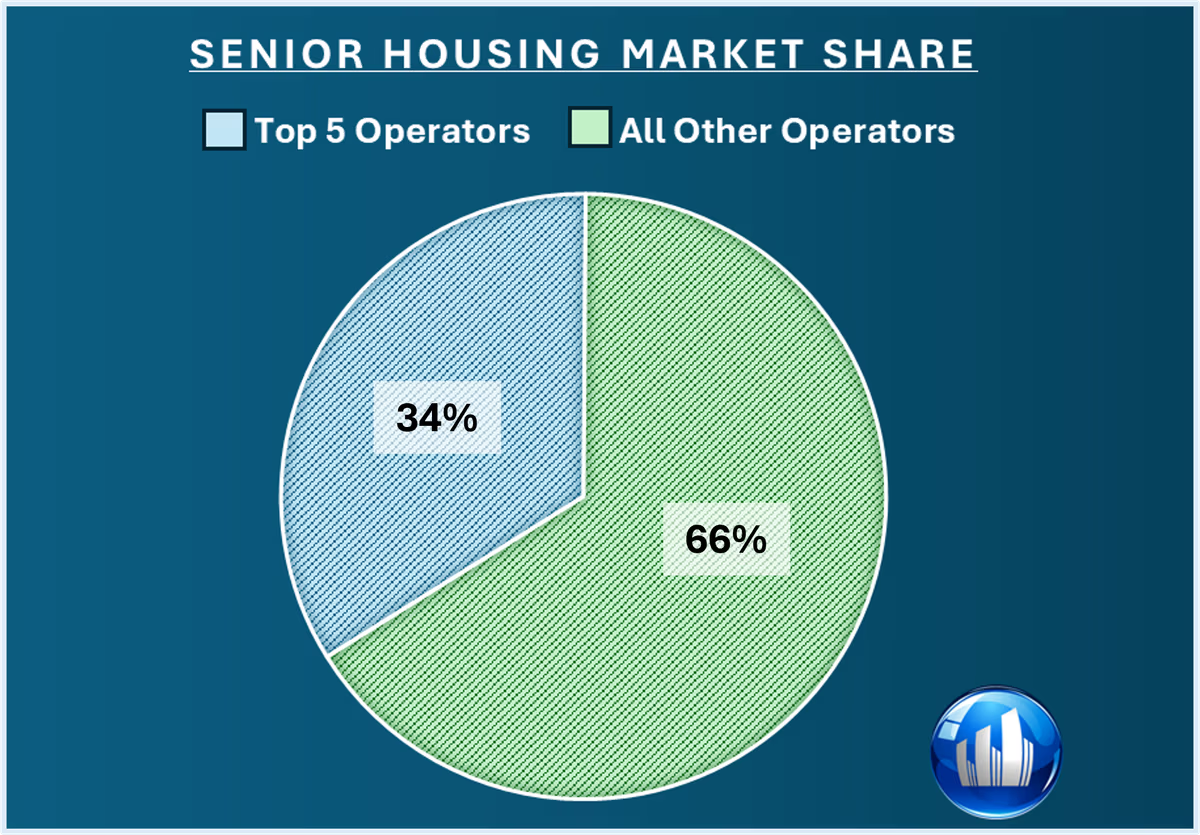

Within most industries, the biggest players dominate market share.

- Android & iOS encompass 99.65% of the smartphone market, leaving ~0.35% of the market to other competitors.

- The “Big Four” U.S. airlines transport 75% of domestic passengers, leaving just one quarter of the market to regional and low-cost competitors.

Within senior housing, the top five operators control just 34% of all units — leaving a massive 66% of the market open to newcomers and strategic roll-up plays.

A fragmented senior housing market spells opportunity for investors and operators alike. With so many mid-sized and local operators in play, communities can tailor services and amenities to residents’ exact needs. Investors who back these boutique operators benefit from higher resident satisfaction, premium pricing, and increased occupancy.

Interested in Senior Housing Investment?

Contact Us Today!

SLF Investment Community Spotlight:

Grand Montecito Memory Care in Las Vegas, NV

Grand Montecito Memory Care is a 46-unit purpose-built memory care community in Las Vegas – and a flagship example of how inspired leadership transforms performance. In September 2024, after a period of elevated turnover, we recruited a new Executive Director to restore the identity and performance of this senior housing investment community.

The new Executive Director brought a rare blend of strategic vision, operational discipline, and genuine empathy. The new E.D. revitalized resident-centric programming, stabilizing staffing, and rebuilt community trust – all in less than 6-months. By Q2 2025, a new hand-picked leadership team was fully in place, and enhanced training protocols as well as streamlined workflows had already driven net operating income significantly higher.

As a result, in Q3 2025 we currently project a 29% reduction in expenses, and a significant increase in monthly net operating income compared to Q3 2024. This assets turnaround underscores a simple truth: in senior living, exceptional people unlock exceptional results.

Want to Get Involved?

How to Participate.

Senior Living Fund has five (5) investment offerings for accredited investors:

SLF Value-Add Fund 1 - (SLF VAF 1)

- Anticipated 4.5-5 Year Term

- Annual Accrual + Profit Participation

- 12.00% to 21.00% Projected Fund IRR

SLF Value-Add Fund 2 - (SLF VAF 2)

- Anticipated 4.5-5 year term

- Monthly Distributions + Profit Participation

- 10.50% to 20.00% Projected Fund IRR

F4 Fixed Note Offering

- Anticipated 3 Year Term

- Monthly Distributions

- Fixed Interest Rate Equal to 15% Per Annum

F5 Fixed Note Offering

- Anticipated 3 Year Term

- Monthly Distributions

- Fixed Interest Rate Equal to 15% Per Annum

F6 Fixed Note Offering

- Anticipated 3 year term

- Monthly Distributions

- Fixed Interest Rate Equal to 15% Per Annum

Interested in investing? Contact our Investor Relations Team today!

Team@seniorlivingfund.com | 913.283.7804

Our Team.

The Senior Living Fund investment team is comprised of industry, securities, financial, and investment experts, as well as support personnel, based primarily in the Kansas City metropolitan area.

SLF Executive Team.

Dan Brewer, Founder & Chief Fund Manager

Dan has 30+ years of business experience, including 25+ years as an executive and principal in real estate, capital placement, business development and management. Dan has 10+ years of experience in a business consulting and management role for Accenture. Dan also has 10+ years of experience in the senior housing sector.

Mark Shader, Chief Operating Officer

Mark brings strong operations management skills to the SLF team through his 30+ years of experience in business consulting, real estate investment and development, financial analysis and management. Mark currently serves as Chief Operations Officer for Senior Living Fund, LLC and its affiliated entities.

Rick Maner, Chief Financial Officer

Rick brings over 30 years of financial management experience, mostly focused on financial services industry. Rick oversees all of the accounting operations including financial reporting, cash planning, and managing external audit relationships and the Funds tax reporting.