Assisting Accredited Investors Across the Globe

(913) 283-7804

Mon - Fri: 9:00 a.m. - 5:00 p.m. CST

Team@seniorlivingfund.com

For Investment Inquiry

Mon - Fri: 9:00 a.m. - 5:00 p.m. CST

For Investment Inquiry

In an era where traditional real estate sectors like multifamily and office are experiencing compressed yields and increased volatility, senior housing stands out as a beacon of opportunity. Its enduring cap rate premium over risk-free benchmarks and other asset classes offers investors a compelling case for portfolio diversification and enhanced returns.

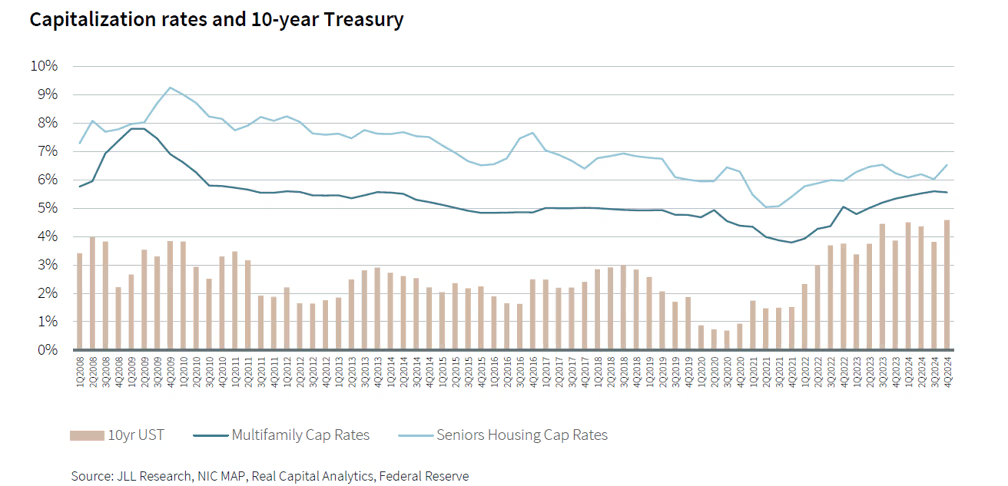

The cap rate premium, or yield spread, refers to the difference between a property’s capitalization rate and the yield on a risk-free investment, typically the 10-year U.S. Treasury. This spread compensates investors for the additional risks associated with real estate investments, such as illiquidity and operational complexities.

Historically, senior housing has maintained a robust cap rate spread. According to JLL’s 2025 Seniors Housing & Care Investor Survey, the sector has averaged a 442 basis point (bps) spread over the 10-year Treasury since 2008. This is notably higher than the multifamily sector, which averaged a 270 bps spread over the same period.

As of Q4 2024, senior housing cap rates have expanded by approximately 150 bps from their lows in Q2 2021, reaching around 6.5%. This expansion is attributed to higher debt costs and broader market repricing. Despite this, the sector continues to offer a significant yield advantage over other asset classes.

In contrast, multifamily cap rates have risen from a low of 3.8% in Q4 2021 to 5.6% as of Q4 2024, narrowing the spread between multifamily cap rates and the 10-year Treasury to just 97 bps – the smallest it has been in a decade. When the yield premium shrinks, investors are taking on comparable levels of market and operational risk for significantly less return. This tightening spread underscores the relative attractiveness of senior housing investments, who enjoy more than double the spread of multifamily.

The U.S. is on the cusp of a demographic shift that will significantly impact the senior housing sector. The population aged 80 and above is projected to grow by 36% over the next decade, compared to just 4.3% for the rest of the population. This “silver tsunami” is expected to drive sustained demand for senior housing, bolstering occupancy rates and rental income.

While demand is set to surge, the supply of new senior housing units is not keeping pace. Construction starts have declined by 68–69% since 2021 in both primary and secondary markets. This slowdown in new development is likely to exacerbate the supply-demand imbalance, supporting rent growth and occupancy rates.

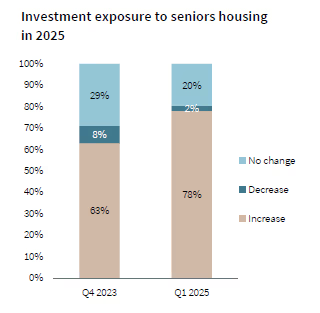

Investor confidence in the senior housing sector is on the rise. JLL’s recent survey indicates that 78% of investors plan to increase their exposure to the sector in 2025, while only 2% intend to decrease it. This bullish sentiment is driven by the sector’s favorable demographics, strong yield profile, and resilience during economic downturns.

Despite challenges such as staffing shortages and rising operational costs, senior housing operators have demonstrated resilience. Occupancy rates have rebounded, and rent growth remains robust. For instance, as of Q4 2024, senior housing rents averaged $5,207 across primary and secondary markets, representing a 22.5% increase from pre-COVID levels.

The combination of a strong cap rate premium, favorable demographic trends, limited new supply, and operational resilience makes senior housing an attractive investment. Investors seeking stable, long-term returns should consider allocating capital to this sector, particularly in light of the compressed yields in traditional real estate asset classes.

Senior housing offers a unique blend of high yields, demographic-driven demand, and resilience, making it a compelling addition to any real estate investment portfolio. As the sector continues to mature and institutionalize, investors who act now stand to benefit from the enduring cap rate premium and the growth opportunities presented by the aging U.S. population.