Monthly Investment Newsletter - January 2025

Senior Living Fund (SLF) is a private equity investment company with 20+ assets under management that generated over $25.8 million ($103.2 million annualized) in revenues during Q3 2024. The majority of assets within our portfolio are Independent Living (IL), Assisted Living (AL) and Memory Care (MC) communities that were developed and constructed by our sponsor partners utilizing SLF equity.

Senior Housing Market Update

Investing in the Senior Housing Sector: Cap Rate Trends and Opportunities.

The senior housing sector continues to be an attractive investment opportunity, offering both income stability and long-term growth potential. Historical capitalization rate (cap rate) trends further illuminate the sector’s resilience and dynamics, providing essential data to guide investor strategies.

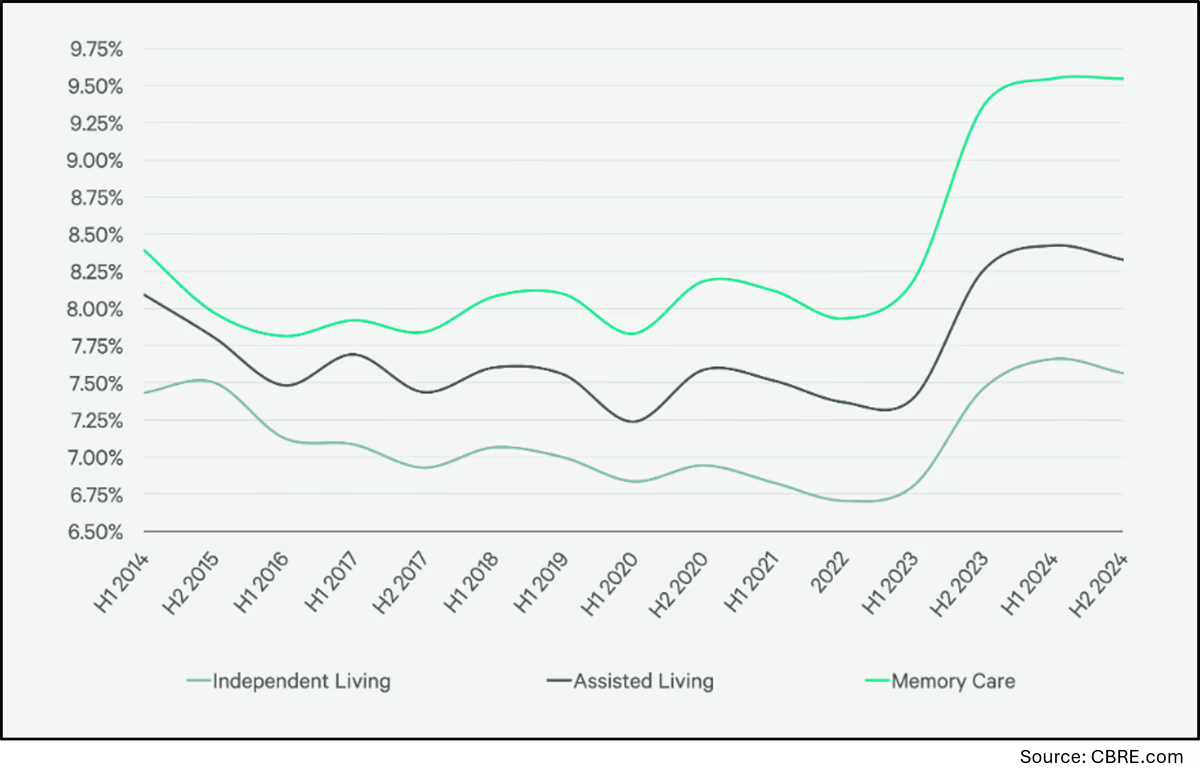

The above chart detailing cap rate trends from 2014 to the second half of 2024 highlights the shifting dynamics within senior housing asset classes, including Independent Living, Assisted Living, and Memory Care. Here are the some of the main takeaways:

1.) Steady Compression Pre-2020: Cap rates for all asset classes, particularly Independent Living, experienced gradual compression through the latter half of the 2010s. This reflected growing investor confidence in the sector’s long-term fundamentals, including demographic tailwinds driven by an aging Baby Boomer population.

2.) COVID-19 Impact and Recovery: The COVID-19 pandemic disrupted the market in 2020 and 2021, leading to a temporary widening of cap rates, particularly in Memory Care, as operators faced challenges such as increased operating costs and fluctuating occupancy levels. However, the post-pandemic recovery has been robust. By H2 2024, Independent Living and Assisted Living cap rates have normalized or compressed further, reflecting renewed investor confidence.

3.) Divergence in Memory Care: While Assisted Living and Independent Living cap rates compressed, Memory Care cap rates have risen slightly in recent periods, averaging 9.5% in H2 2024. This may indicate perceived operational risks or challenges with maintaining consistent occupancy rates, despite rising demand for specialized care.

Recent Trends in H2 2024:

According to the latest data:

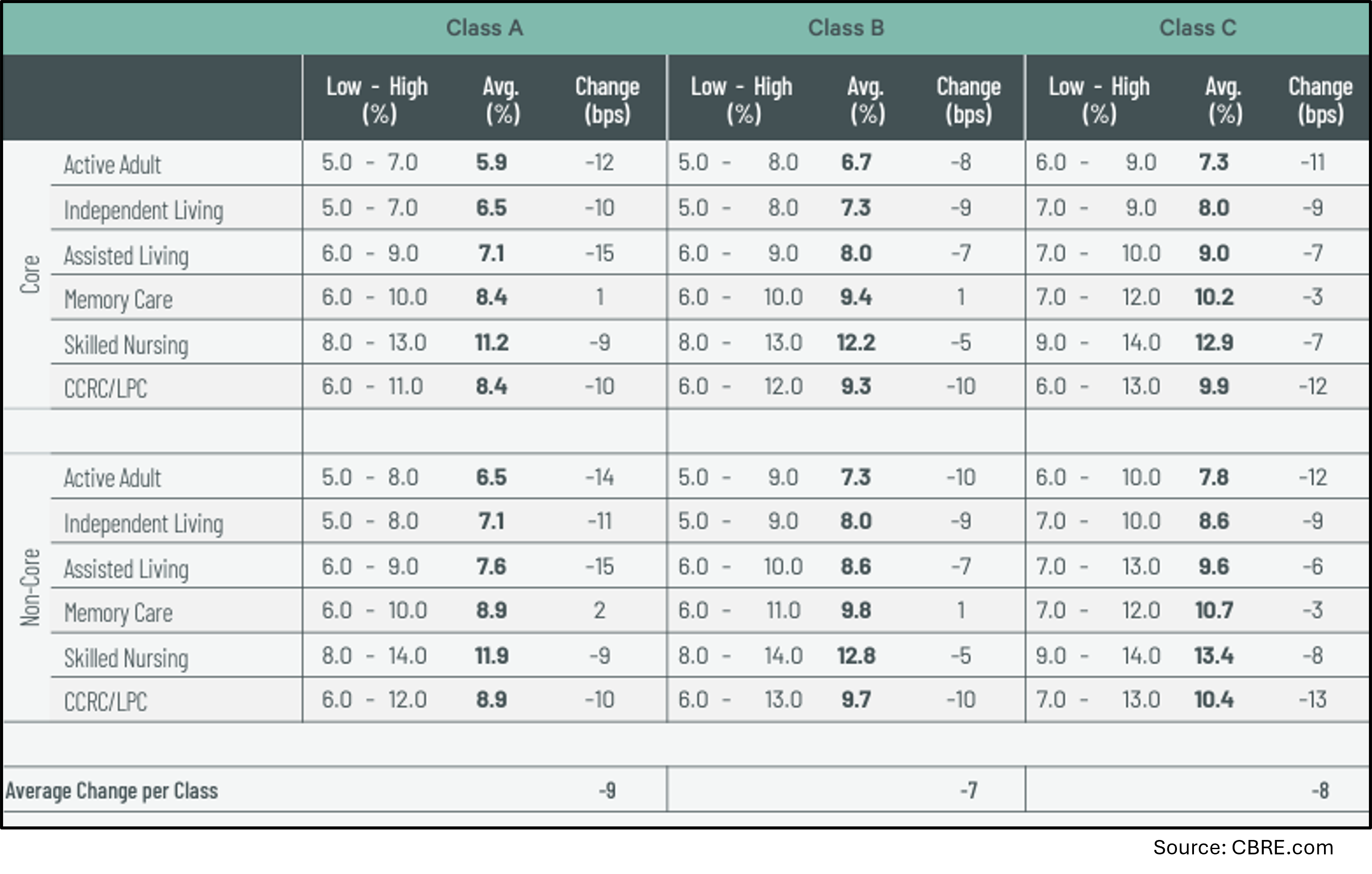

- Non-core Class A Active-Adult communities saw cap rates decline by 14 basis points, averaging 6.5%, while Assisted Living cap rates fell by 15 basis points to 7.6%.

- The spread between core and non-core markets remains steady at 54 basis points, underscoring the enduring premium investors place on core market assets.

- Memory Care was the only category with a cap rate increase, rising by 1–2 basis points to an average of 9.5%, signaling investor caution in this niche.

Opportunities for Investors:

With these trends in mind, investors can take advantage of specific opportunities within the senior housing sector:

- Focus on Independent and Assisted Living:

- Both asset classes show resilience and appreciation over time. The sustained cap rate compression indicates strong demand and stability, particularly in non-core markets, which offer higher yields without compromising income security.

- Both asset classes show resilience and appreciation over time. The sustained cap rate compression indicates strong demand and stability, particularly in non-core markets, which offer higher yields without compromising income security.

- Strategic Positioning in Memory Care:

- While Memory Care cap rates remain higher, they may present value opportunities for long-term investors willing to navigate operational challenges. The rising demand for specialized care ensures steady growth potential.

- While Memory Care cap rates remain higher, they may present value opportunities for long-term investors willing to navigate operational challenges. The rising demand for specialized care ensures steady growth potential.

- Leverage Historical Trends for Market Timing:

- Understanding the long-term cap rate trajectory highlights how timing plays a pivotal role in investment success. The pre-pandemic compression demonstrates the sector’s stability during periods of economic strength, while post-pandemic recovery reflects its resilience.

Want to learn more about investment in the senior housing sector?

Contact Us Today!

Team@seniorlivingfund.com

Investment Community Spotlight:

Carriage Crossing Bloomington

Carriage Crossing Senior Living-Bloomington is an eighty unit combined assisted living (AL) and memory care community in Bloomington, Illinois. CCSL-Bloomington set record high net operating income (NOI) results in both October and November 2024. The NOI for these months exceeded the target exit NOI by over $18,000. The solid performance was due to strong onsite leadership, effective expense management and record high revenue in November driven by nearly 100% occupancy.

Successful AL/MC communities are not an accident and occur when ownership and operator interests are aligned and in sync with the needs of market area. In an effort to further enhance the SLF and CCSL brand in Bloomington we are currently pursuing the final design and financing for a 70,000+ square foot independent living (IL) community that would be adjacent to the existing community also be operated by Generation Healthcare Managers. The IL community would provide additional exposure to valuable referral sources and be a natural feeder to the existing AL/MC community.

Our Team.

The Senior Living Fund team is comprised of industry, securities, financial, and investment experts, as well as support personnel, based primarily in the Kansas City metropolitan area.

SLF Executive Team.

Dan Brewer, Founder & Chief Fund Manager

Dan has 30+ years of business experience, including 25+ years as an executive and principal in real estate, capital placement, business development and management. Dan has 10+ years of experience in a business consulting and management role for Accenture. Dan also has 10+ years of experience in the senior housing sector.

Mark Shader, Chief Operating Officer

Mark brings strong operations management skills to the SLF team through his 30+ years of experience in business consulting, real estate investment and development, financial analysis and management. Mark currently serves as Chief Operations Officer for Senior Living Fund, LLC and its affiliated entities.

Rick Maner, Chief Financial Officer

Rick brings over 30 years of financial management experience, mostly focused on financial services industry. Rick oversees all of the accounting operations including financial reporting, cash planning, and managing external audit relationships and the Funds tax reporting.

How to Participate.

Senior Living Fund has five (5) offerings currently open for investment:

SLF Value-Add Fund 1 - (SLF VAF 1)

- Anticipated 4.5-5 Year Term

- Annual Accrual + Profit Participation

- 12.00% to 21.00% Projected Fund IRR

SLF Value-Add Fund 2 - (SLF VAF 2)

- Anticipated 4.5-5 year term

- Monthly Distributions + Profit Participation

- 10.50% to 20.00% Projected Fund IRR

F4 Fixed Note Offering

- Anticipated 3 Year Term

- Monthly Distributions

- Fixed Interest Rate Equal to 15% Per Annum

F5 Fixed Note Offering

- Anticipated 3 Year Term

- Monthly Distributions

- Fixed Interest Rate Equal to 15% Per Annum

F6 Fixed Note Offering

- Anticipated 3 year term

- Monthly Distributions

- Fixed Interest Rate Equal to 15% Per Annum

Interested in investing? Contact our Investor Relations Team today!

Team@seniorlivingfund.com | 913.283.7804