SLF Value-Add Fund 1 & 2

Investment Overview

8787 Renner Blvd, Suite 130

Lenexa KS, 66219

913.283.7804

Team@seniorlivingfund.com

Buy Low, Sell High!

SLF has had the opportunity to invest in dozens of quality senior housing communities that have suffered from poor management or inadequate cash flow, yet are well-designed senior housing communities in attractive locations. These communities can be acquired for a fraction of the price that would normally be paid if the communities had not been so severely impacted. They offer significant upside for SLF Investments and participating investors.

Investment Designed With Potential For:

-

Portfolio Diversification

Offering intends to secure multiple senior housing assets of varying size, value, operator and location.

-

Passive Gains & Losses

Investors can participate in pass-through gains and losses, which may provide meaningful tax advantages depending on individual circumstances.

-

Support of Social Cause

Capital deployed into senior living directly supports residents, care teams, and associated families. Beyond financial considerations, investors contribute to communities that promote safety, dignity, and quality of life for residents and their families.

-

Profit Participation

Investors participate in projected back-end profit sharing.

-

Monthly Income

Participating individuals are eligible for monthly investor payments, determined by investor "class".

Our Investment Approach

A large number of lower-quality senior housing owners and operators were recently

highlighted by market strains. Many are presently seeking exit at affordable cost.

This provides SLF an advantageous opportunity to procure these communities at

lower purchase prices. Once a community is deemed suitable for acquisition, we

will pursue all necessary modifications to the communities existing organizational

and/or physical structure in efforts to raise overall community sales value. SLF

intends to sell these assets at an increased valuation – providing a healthy return

to participating investors.

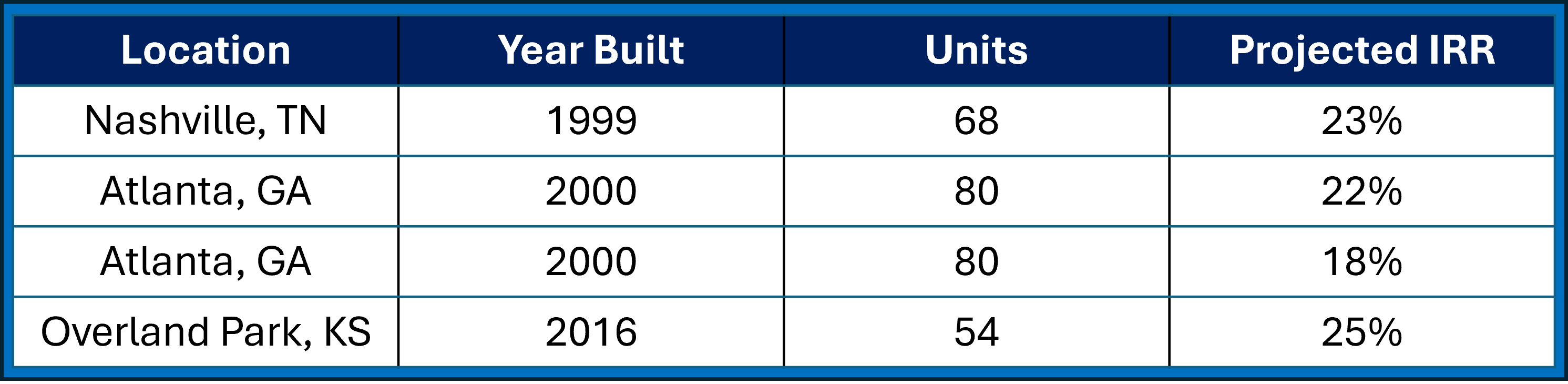

Value-Add Sample Properties:

SLF Value-Add Fund 1

Equity Fund

-

Offering Size:

$25 million

-

Anticipated Term:

4.5 - 5 Years

-

Geographic Focus:

Nationwide

-

Investor Suitability:

Accredited Investors

-

Minimum Investment:

$50,000

-

Investment of Retirement Funds:

Permitted

SLF Value-Add Fund 1 seeks investor capital to fund the acquisition, operations, and subsequent sale of senior housing communities across the U.S. identified as underperforming financially distressed, and/or operationally deficient. Once acquired, we will leverage in house experience as well as our extensive network of qualified industry partners with proven development and operational capabilities to increase sales values of these communities.

- Anticipating to invest in 6-10 “value-add” senior living projects throughout the United States.

- Projects will offer investors diversification in location, care type, community size, operator, and more.

- New-development investment opportunities will be considered on a risk-adjusted basis.

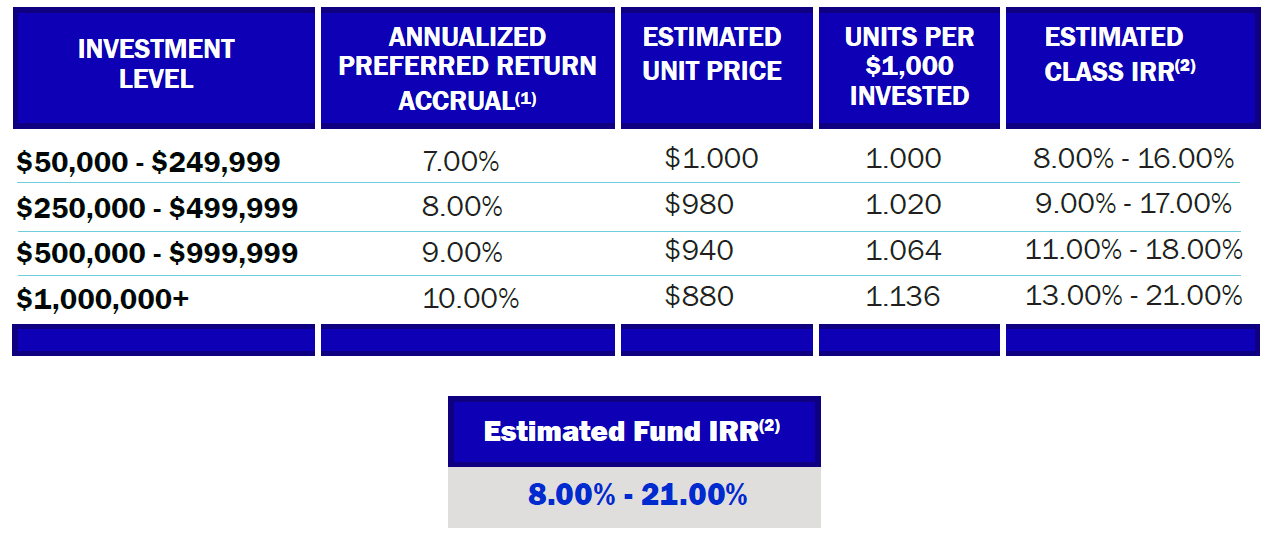

Estimated IRR

For Those Seeking SLF's Highest Potential Return Ranges

SLF Value-Add Fund 1 offers multiple levels of participation for accredited investors. With each increasing level of investment participation, investors will accrue a higher annualized preferred return rate, as well as receive reduced unit pricing. Overall, resulting in a higher estimated IRR per increasing investment class, as outlined in the below table:

(1) All Investors will accrue an annualized Preferred Return on their respective unreturned Capital Contribution from the date said capital is accepted by the Manager of the Fund until the entire Capital Contribution has been returned in full. For a detailed description and explanation of the preferences, see the Private Placement Memorandum of the Offering.

(2) Estimated IRR’s have been rounded to the nearest whole percent, are based on projections, and not guaranteed. Investor IRR range differs per investment level. For additional information, see the Private Placement Memorandum of the Offering.

SLF Value-Add Fund 2

Equity Fund

-

Offering Size:

$25 million

-

Anticipated Term:

4.5 - 5 Years

-

Geographic Focus:

Nationwide

-

Investor Suitability:

Accredited Investors

-

Minimum Investment:

$50,000

-

Investment of Retirement Funds:

Permitted

Similar to Value-Add Fund 1; SLF Value-Add Fund 2 will fund the acquisition, operations, and subsequent sale of senior housing communities across the U.S. that are identified as under-performing, financially distressed, and/or operationally deficient. Once acquired, SLF will leverage in house experience as well as our extensive network of industry partners with proven development and operational capabilities to increase sales values of these communities. The key differentiator for SLF Value Add Fund 2 is that participating investors receive monthly payments along with sharing in the back-end profits of the fund.

- Anticipating to invest in 6-10 “value-add” senior living projects throughout the United States.

- Projects will offer investors diversification in location, care type, community size, operator, and more.

- New-development investment opportunities will be considered on a risk-adjusted basis.

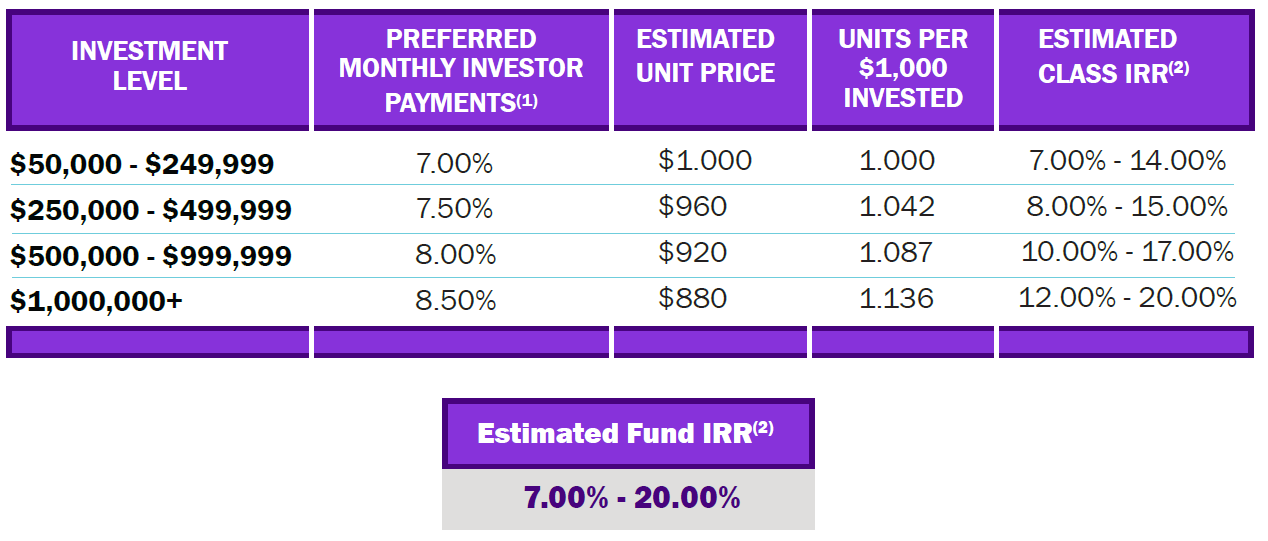

Estimated IRR

For Those Seeking Monthly Income + Backend Participation

SLF Value-Add Fund 2 offers multiple levels of participation for accredited investors. With each increasing level of investment participation, investors will accrue a higher annualized preferred return rate, as well as receive reduced unit pricing. Overall, resulting in a higher estimated IRR per increasing investment class, as outlined in the below table:

1) SLF VAF 2 investors will receive preferred monthly investor payments, payable monthly, for 36 months from the time of their investment.

Please see the Private Placement Memorandum of the Offering for additional information.

(2) Estimated IRR’s have been rounded to the nearest whole percent, are based on projections, and not guaranteed. Investor IRR range differs per investment level. For additional information, see the Private Placement Memorandum of the Offering.

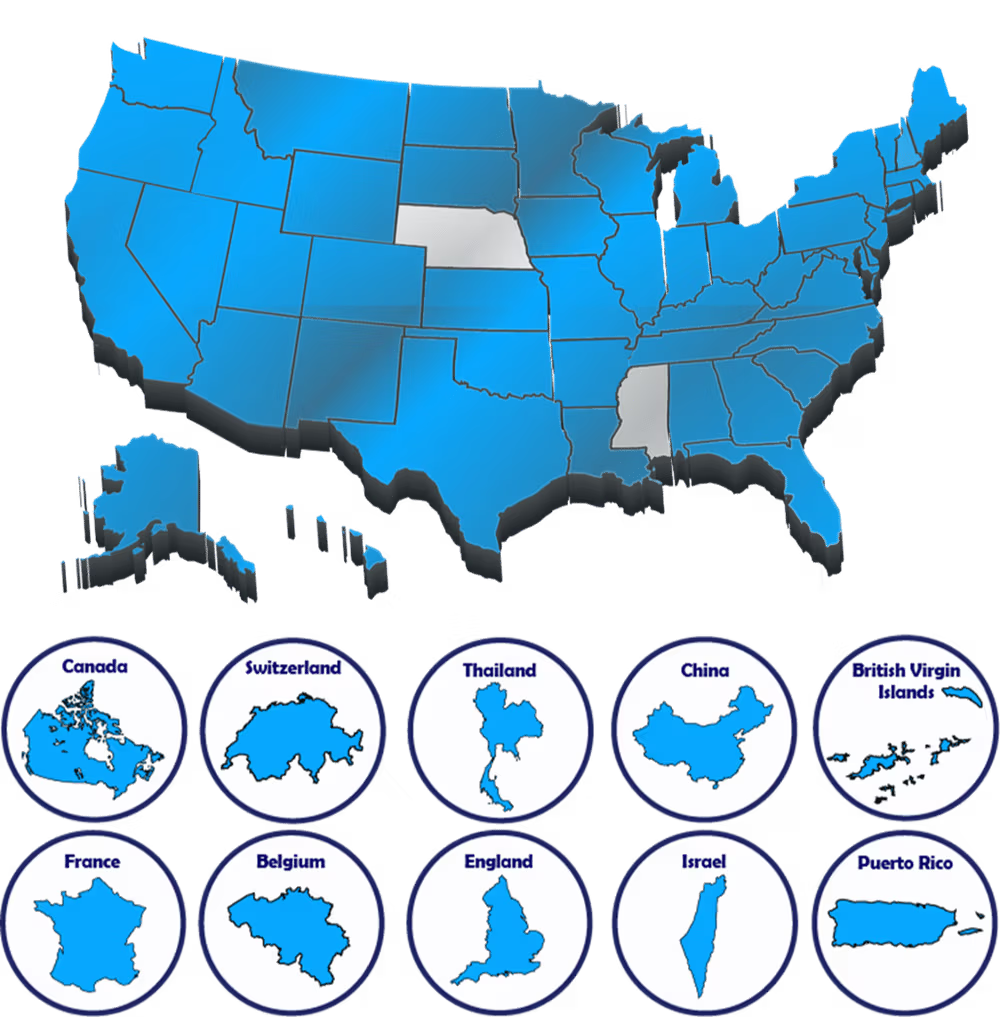

The SLF Community!

With ≈$150M actively under management, SLF hosts a diverse community of investors spanning 48 U.S. States and multiple International locations. While our investors may be unique from one-another, they typically share two similar core values: Make Money. Create Change.

SLF Investor Community:

Information on this document is not an offer or a solicitation to sell or purchase securities. Statements, descriptions, and data on these pages are for informational purposes only and relate to an investment opportunity which may be offered in the future. No offer or solicitation will be made until the necessary final documentation and agreements have been delivered to you. Forward Looking Statements. The Fund is including the following cautionary statement in this informational summary to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for any forward looking statements made by, or on behalf of, the Fund. Forward-looking statements include statements concerning plans, objectives, goals, projections, strategies, future events or performance, and underlying assumptions and other statements which are other than statements of historical facts. All such subsequent forward-looking statements, whether written or oral and whether made by or on behalf of the Fund, are also expressly qualified by these cautionary statements. Certain statements contained herein, including, without limitation, those that are identified by the use of the words “anticipates,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “predicts,” “projects,” “believes,” “seeks,” “targeted,” “will,” “may” and similar expressions, are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Forward looking statements involve risks and uncertainties, which could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. The Fund’s expectations, beliefs and projections are expressed in good faith and are believed by the Fund to have a reasonable basis, but there can be no assurance that management’s expectations, beliefs or projections will result or be achieved or accomplished.