Monthly Investment Newsletter - January 2026

The 90% Threshold: Why 2026 Could Be Breakout Year for Senior Housing NOI

Executive Summary (5 Key Takeaways):

Senior housing enters 2026 with one of the strongest setups in commercial real estate:

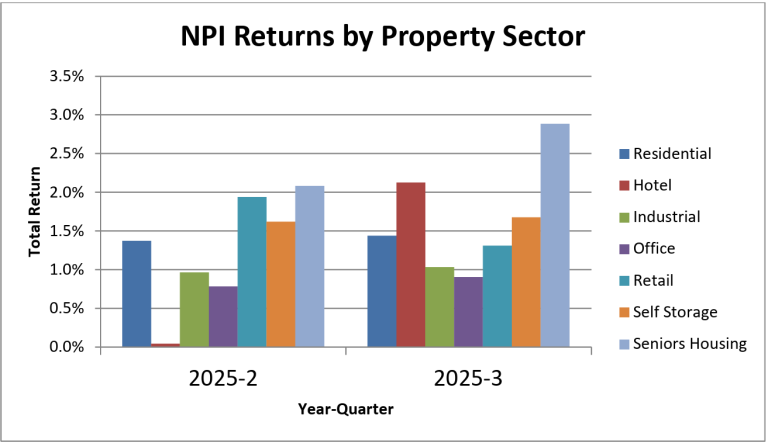

- Senior housing has emerged as a leading NCREIF property sector, extending its outperformance trend across recent quarters.

- Occupancy is pushing toward a critical “90% threshold”, the range where incremental move-ins can translate into disproportionate NOI expansion.

- New construction remains constrained, reinforcing favorable supply/demand balance and supporting pricing resilience.

- Long-term return data continues to support senior housing as a top-tier, institutional-grade sector.

- SLF remains focused on high-quality, needs-based, private-pay communities, where operational execution and occupancy momentum can drive durable cash-flow growth.

Senior Housing Has Moved From Recovering to Leading

For much of the post-COVID period, the senior housing conversation was framed around recovery. That narrative is proving increasingly outdated. Senior housing as a sector has moved from “improving” to “leading”.

Entering 2026, the sector’s financial performance has placed it as a clear leader. Senior housing continues to outperform other NCREIF property sectors, extending a multi-quarter streak.

The 90% Threshold: Where Occupancy Becomes Earnings

Occupancy growth is encouraging, but for investors the key question is what happens as occupancy climbs into the high-80s and low-90s.

In senior housing, this range often marks an “earnings inflection point,” where incremental move-ins begin to translate into disproportionate NOI expansion.

Why the 90% Threshold Matters:

Senior housing contains meaningful fixed and semi-fixed cost structures, including:

- staffing baseline requirements

- overhead and community administration

- utilities and building operations

- dining program infrastructure

- marketing, programming, and resident engagement

As communities lease up, incremental revenue can exceed incremental cost — expanding margins and accelerating NOI.

“As the industry approaches 90%, occupancy increasingly becomes earnings.” – Quinn Brewer, Chief Marketing Officer at SLF Investments

This dynamic is what makes 2026 uniquely compelling: the sector is entering a phase where improving fundamentals can drive a measurable step-change in financial performance.

The Track Record: A Top-Tier Sector Built on Income + Appreciation

Recent quarters have reinforced senior housing leadership — but the long-term return profile tells the bigger story.

Over the trailing one-year period, senior housing was the strongest financial performer, returning 9.21% and outperforming the NPI by nearly 450 basis points. Over the last decade-plus, senior housing has produced long-term performance competing with the strongest real estate sectors while delivering a return profile anchored in income.

Why 2026 Could Be the “NOI Breakout Year”

As occupancy climbs into the 90% range, the sector increasingly benefits from operating leverage.

2026 may represent the period where:

- occupancy momentum remains intact

- rent growth holds

- supply stays constrained

- labor pressure normalizes

- NOI expands at an accelerated pace

In our view, the sector may be entering one of the most favorable NOI expansion environments in years. However, only the highest-quality communities are positioned to benefit most.

SLF Spotlight: The “90% Threshold” in Action

Countryside Lakes Senior Living

One of the clearest examples of why the 90% threshold matters is Countryside Lakes Senior Living, an award-winning investment community of ours.

Countryside Lakes has maintained nearly 100% occupancy for multiple consecutive quarters, illustrating what high-quality senior housing looks like once fundamentals transition from “recovery” to sustained demand. At this stage, performance is no longer dependent on new move-ins; the community has established a durable resident base and consistent revenue stream.

With this strong occupancy foundation in place, the NOI growth strategy has naturally evolved from lease-up execution to operational optimization. Our asset management focus today is centered on ongoing NOI improvements through disciplined operations, including:

- staff retention initiatives that reduce turnover-related hiring and training costs

- tighter expense management in the culinary department

- more efficient staffing and supply oversight within housekeeping and building operations

When senior housing communities reach high occupancy levels, incremental NOI is increasingly driven by operational discipline rather than leasing risk.

As a result of sustained occupancy and strong operations, Countryside Lakes is generating approximately $200,000 in monthly net operating income, reinforcing the power of stabilized demand combined with execution-focused management.

Want To Participate?

If you’d like to learn more about SLF Investments and our approach to investing in high-quality senior housing communities, contact us today!

Our Team.

The Senior Living Fund investment team is comprised of industry, securities, financial, and investment experts, as well as support personnel, based primarily in the Kansas City metropolitan area.

SLF Executive Team.

Dan Brewer, Founder & Chief Fund Manager

Dan has 30+ years of business experience, including 25+ years as an executive and principal in real estate, capital placement, business development and management. Dan has 10+ years of experience in a business consulting and management role for Accenture. Dan also has 10+ years of experience in the senior housing sector.

Mark Shader, Chief Operating Officer

Mark brings strong operations management skills to the SLF team through his 30+ years of experience in business consulting, real estate investment and development, financial analysis and management. Mark currently serves as Chief Operations Officer for Senior Living Fund, LLC and its affiliated entities.

Rick Maner, Chief Financial Officer

Rick brings over 30 years of financial management experience, mostly focused on financial services industry. Rick oversees all of the accounting operations including financial reporting, cash planning, and managing external audit relationships and the Funds tax reporting.