Monthly Investment Newsletter - December 2025

For many, December is the time of year when we look inward:

Have I used my time well? How have I cared for the people who depend on me?

In senior housing, those questions are not abstract. Every day, millions of families are deciding how best to care for aging parents and loved ones whose needs are changing.

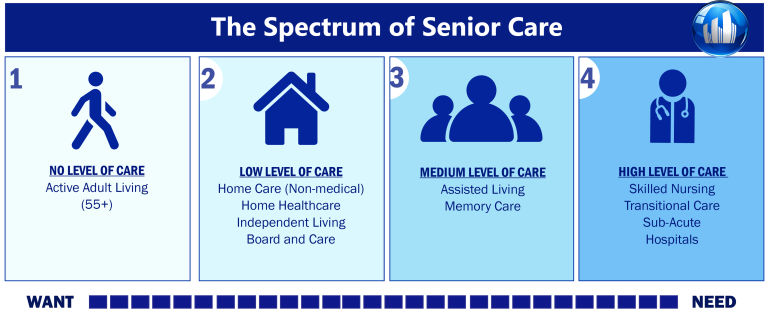

Senior housing is often described as one sector, but in reality it is a progression of settings tied closely to aging and health status.

At one end of the spectrum are Active Adult (55+) communities—beautiful, amenity-rich properties that offer social connection, low-maintenance living, and lifestyle upgrades, but no formal health-care services.

As people age, many will eventually require more support: help with medications, dressing, bathing, mobility, transportation, or management of chronic conditions such as diabetes, heart disease, dementia, or Parkinson’s.

- In the U.S., ~33.4% of individuals age 85+ currently have Alzheimer’s dementia. Total dementia prevalence is higher when other causes are included.

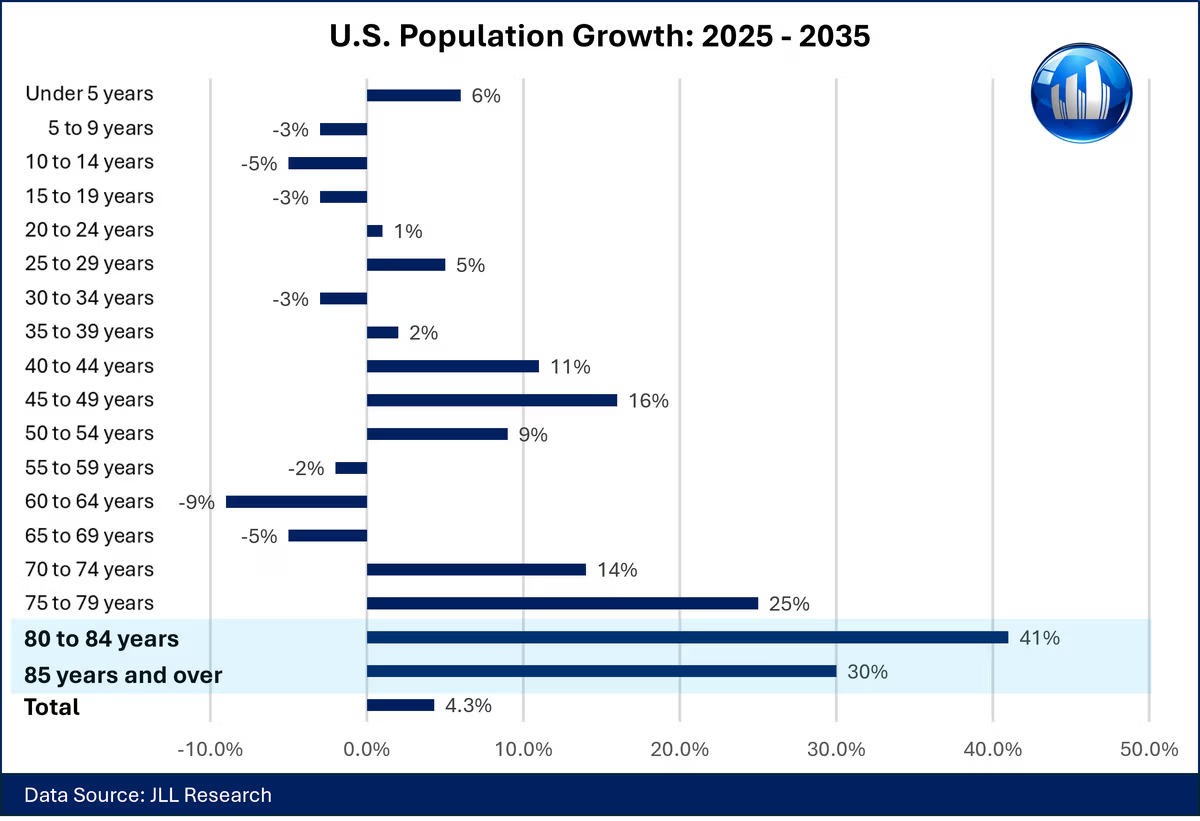

That is where Assisted Living, Memory Care, and Skilled Nursing come in. These communities operate much closer to healthcare, with trained staff, care plans, and 24/7 support. The 80+ population is forecasted to grow 36.1% in the next 10 years, compared to just 4.3% overall for the total population.

Majority of Senior Will Need More Than a Pool & Pickleball

The senior housing investment narrative has long been supported by one powerful demographic stat: “10,000 Americans turning 65 each day”. Now that we are crossing into 2026, the conversation has matured: ~10,000 individuals are turning 80+ in the United States, daily.

The 70% Problem:

We're Building the Wrong Thing

Currently, the senior living market is heavily weighted toward Active Adult communities, which today make up around ~70% of the sector.

While Active Adult serves a valuable role for younger and healthier individuals, most older adults will eventually require additional support. According to the U.S. Department of Health & Human Services, ~70% of seniors will eventually require long-term care ranging from home-based care to assisted living or skilled nursing.

This has created a structural imbalance: the categories designed for higher-acuity care represent only a small fraction of today’s supply, despite the fact that age-related care needs increase sharply after age 65. For investors and operators, this chart illustrates a major long-term opportunity: the market will require significant new development in Assisted Living, Memory Care, and Nursing Care to support an aging America. Communities that can meet these needs will be well positioned in the decade ahead.

Why Quality Care Matters

Ask yourself, how many medications do you currently take?

National data show that roughly half of Americans used at least one prescription drug in the past 30 days, and about 14% used five or more. Among older adults, the numbers are far higher. Analyses of federal health surveys and Lown Institute’s Medication Overload work suggests that more than four in ten adults 65+ take five or more prescriptions, and nearly one in five take ten or more.

This “medication overload” can be directly tied to falls, confusion, hospitalizations, and even premature death. Lown’s report estimates that medication overload could contribute to millions of hospitalizations and well over 100,000 premature deaths among older Americans over the current decade if left unaddressed.

Proper senior living environments, especially Assisted Living and Memory Care,can help mitigate these risks by:

- Coordinating with physicians and pharmacies to avoid duplicative or contraindicated prescriptions.

- Ensuring medications are taken correctly and on time.

- Monitoring residents for side effects, falls, and cognitive changes.

- Supporting non-pharmacologic interventions such as nutrition, activity, and social engagement.

Recent research from NORC at the University of Chicago, funded by NIC, found that older adults living in senior housing communities live longer and experience fewer hospitalizations and adverse health events than similar peers remaining in the community, in part because they receive more preventive and rehabilitative care.

More Than Just a Building

Medication safety, fall prevention, nutrition, and social engagement all point to the same reality: senior housing is far more than real estate. Resident outcomes, and ultimately asset performance, depend on culture, staffing, leadership, and the quality of daily life inside the community.

The smallest items can transition culture. A recent example of ours at SLF Investments was the recent incorporation of a new Chef into one of our top performing communities in Las Vegas.

Flexible dining hours, personalized menu adjustments, and small resident-requested touches have assisted in building family trust (and referrals). Thoughtful operations directly enhance both quality of care and long-term results.

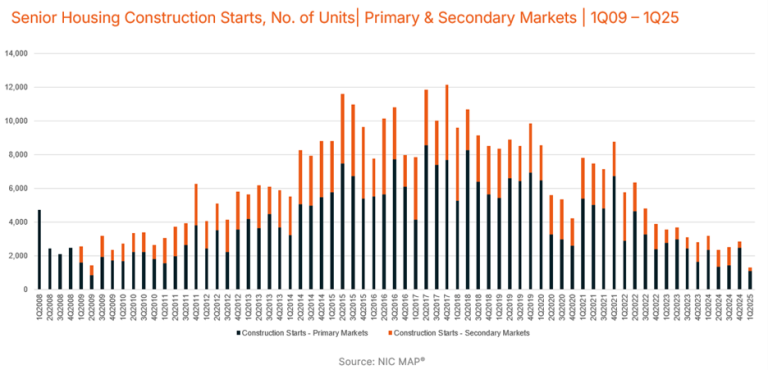

The Wave Has Already Started

The National Investment Center for Seniors Housing & Care recently stated that senior housing units are currently “being filled faster than they can be built”. Construction starts are currently at a 16-year low while seniors are absorbing units 2.5 times the rate of new supply. The senior housing sector is estimated to require 35,000 – 45,000 new units annually to meet current demand. During Q3 2025, fewer than 1,400 units were opened. NIC recently stated that for every 10 units opened in any given market, 31 are occupied and absorbed.

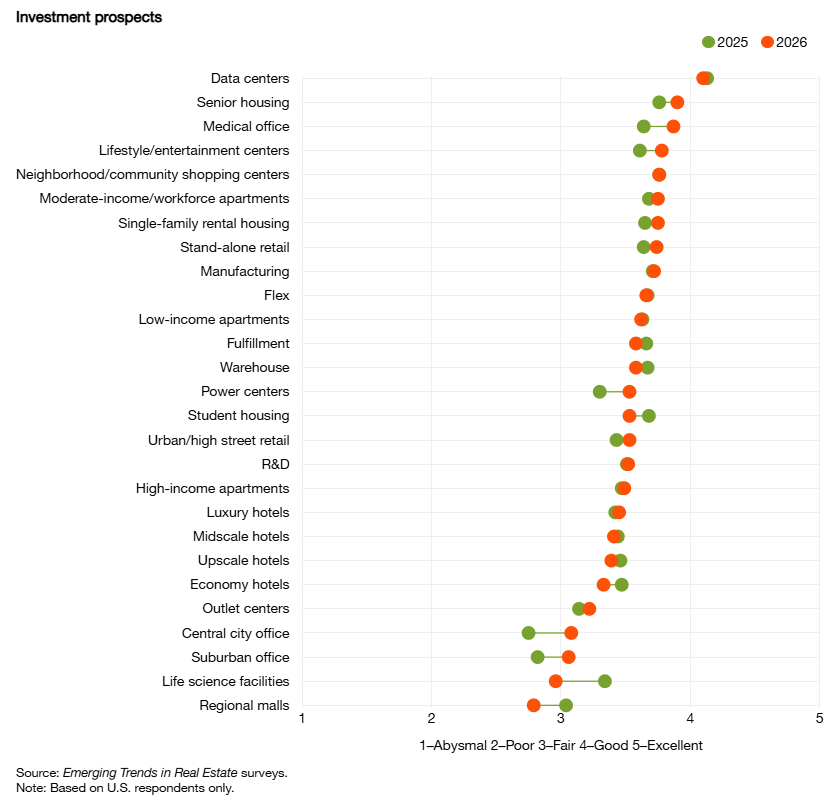

Senior Housing - Top Rated Investment in 2026

PwC and the Urban Land Institute recently released the latest “Emerging Trends in Real Estate” report, breaking down key opportunities, risks, and market shifts for investors, developers, and city leaders. The 47th edition of the report draws on insights from over 1,700 leading real estate investors, lenders, and advisers across the United States and Canada, identifying risks and market shifts for the coming year.

Of the 27 subsectors in the report, senior housing ranks second for best investment and development prospects going into 2026.

Want To Participate in a Growing Sector?

SLF Investments (SLF) is a private equity investment company with 20+ assets under management that generated ~$100 million in revenues during 2025. If you would like to hear about our current offerings, contact our investor relations team today!

Sources:

How to Participate.

Senior Living Fund has five (5) investment offerings for accredited investors:

SLF Value-Add Fund 1 - (SLF VAF 1)

- Anticipated 4.5-5 Year Term

- Annual Accrual + Profit Participation

- 12.00% to 21.00% Projected Fund IRR

SLF Value-Add Fund 2 - (SLF VAF 2)

- Anticipated 4.5-5 year term

- Monthly Distributions + Profit Participation

- 10.50% to 20.00% Projected Fund IRR

F4 Fixed Note Offering

- Anticipated 3 Year Term

- Monthly Distributions

- Fixed Interest Rate Equal to 15% Per Annum

F5 Fixed Note Offering

- Anticipated 3 Year Term

- Monthly Distributions

- Fixed Interest Rate Equal to 15% Per Annum

F6 Fixed Note Offering

- Anticipated 3 year term

- Monthly Distributions

- Fixed Interest Rate Equal to 15% Per Annum

Interested in investing? Contact our Investor Relations Team today!

Team@seniorlivingfund.com | 913.283.7804

Our Team.

The Senior Living Fund investment team is comprised of industry, securities, financial, and investment experts, as well as support personnel, based primarily in the Kansas City metropolitan area.

SLF Executive Team.

Dan Brewer, Founder & Chief Fund Manager

Dan has 30+ years of business experience, including 25+ years as an executive and principal in real estate, capital placement, business development and management. Dan has 10+ years of experience in a business consulting and management role for Accenture. Dan also has 10+ years of experience in the senior housing sector.

Mark Shader, Chief Operating Officer

Mark brings strong operations management skills to the SLF team through his 30+ years of experience in business consulting, real estate investment and development, financial analysis and management. Mark currently serves as Chief Operations Officer for Senior Living Fund, LLC and its affiliated entities.

Rick Maner, Chief Financial Officer

Rick brings over 30 years of financial management experience, mostly focused on financial services industry. Rick oversees all of the accounting operations including financial reporting, cash planning, and managing external audit relationships and the Funds tax reporting.