Senior Housing Leads the NPI - Third Consecutive Quarter

More Evidence for Senior Housing Investment

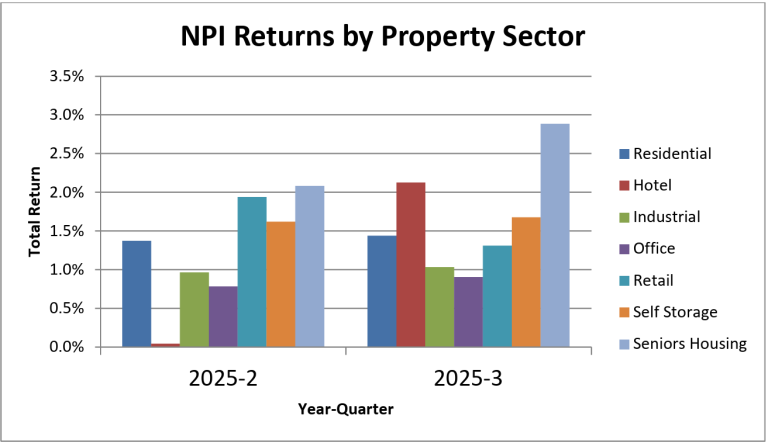

According to the National Council of Real Estate Investment Fiduciaries (NCREIF), senior housing delivered the highest total return of any property sector for the third straight quarter, reinforcing its reputation as one of the most resilient and income-driven real estate asset classes.

In Q3 2025, the NCREIF Property Index (NPI) recorded a total unleveraged return of 1.22 %, marking its fifth consecutive positive quarter. Within the index:

- Senior Housing: + 2.88 % total return

- Hotels: + 2.12 %

- Self-Storage: + 1.68 %

- Industrial, Retail, and Office: all trailing below 1 %

This consistent performance highlights what many institutional investors already recognize: strong demographic demand, stable occupancy, and income-yield potential continue to set senior housing apart from other sectors.

Why This Matters to Accredited Investors

Income resilience: When equity markets or debt markets wobble, asset classes with stable cash flows become more valuable. Senior housing’s out-performance signals that cash-flow assets are winning in this phase.

Private market edge: For investors deploying capital via private vehicles or club deals (versus widely traded REITs), consistent out-performance can translate into stronger valuations, more competitive terms and better partner selection.

Risk/return recalibration: As broad valuations stretch or capital markets become more volatile, the premium from specialized real-estate sectors (like senior housing) becomes clearer — but so does the importance of underwriting, operator quality and structural liquidity.

Strategic allocation decision: If senior housing is showing structural resilience while other sectors lag, it may warrant re-evaluating target allocations in institutional-quality real estate funds or direct investments.

At SLF Investments, we specialize in sourcing and managing institutional-grade senior housing projects designed to generate consistent cash flow and strong total returns — independent of broader market volatility.