Assisting Accredited Investors Across the Globe

(913) 283-7804

Mon - Fri: 9:00 a.m. - 5:00 p.m. CST

Team@seniorlivingfund.com

For Investment Inquiry

Mon - Fri: 9:00 a.m. - 5:00 p.m. CST

For Investment Inquiry

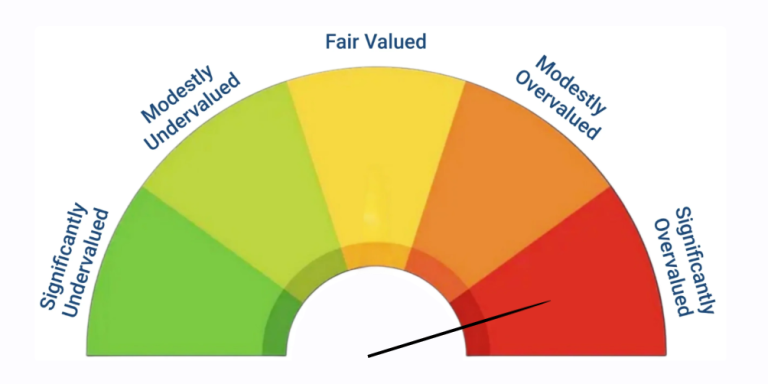

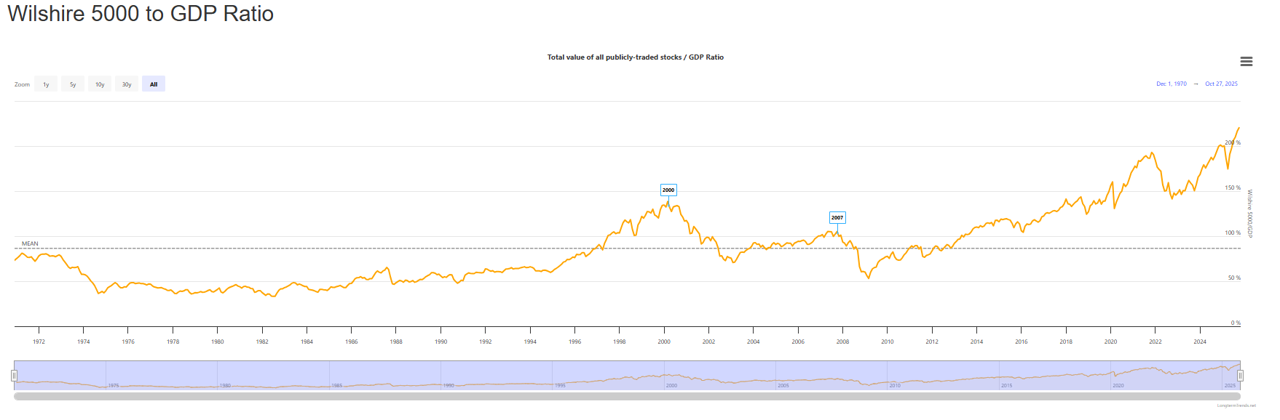

The Buffett Indicator, which compares the total U.S. stock-market value to the nation’s GDP, has surged past 200%. The stock market is now worth roughly twice the size of the American economy. Buffett once warned that when this ratio climbs near 200%, investors are “playing with fire”. That moment has arrived.

The Buffett Indicator is elegant in its simplicity. It measures how inflated market prices are relative to the real economy that underpins them.

Historically, a range of 70% – 100% has represented “fair value”, where stocks tend to trade in reasonable balance with GDP growth. During periods of speculative excess – such as the dot-com boom, the 2021 tech surge, and now again in 2025 – the ratio spiked far above that range, foreshadowing long stretches of muted returns or sharp corrections.

As of October 2025, the Buffett indicator has reached 220.34%.

The current valuation of 200%+ implies that every dollar of U.S. economic output is being valued at over two dollars in market capitalization.

Investors often interpret this environment as one of asymmetric risk: limited upside remains in broad public markets, while plenty of potential downsides exist if earnings or liquidity tighten.

Sophisticated investors aren’t panicking, they’re preparing: