Monthly Investment Newsletter - October 2025

Introduction: As of Q3 2025, the senior housing sector is outperforming most commercial property types on returns, experiencing record absorption and benefiting from structural supply shortages. Cap rates are compressing, yet they still offer a meaningful premium over risk‑free rates and over multifamily yields. Occupancy is approaching pre‑pandemic highs, and long‑term demographic drivers remain unchanged. Occupancy, cap rates and investor sentiment all improved through Q3 2025, while macroeconomic conditions remained volatile. With cap rates hovering around 6.8 % (the highest absolute yield in more than a decade) and spreads over the 10‑year U.S. Treasury still above 250 basis points, senior housing offers a rare window where investors can capture both outsized income and room for further cap-rate compression.

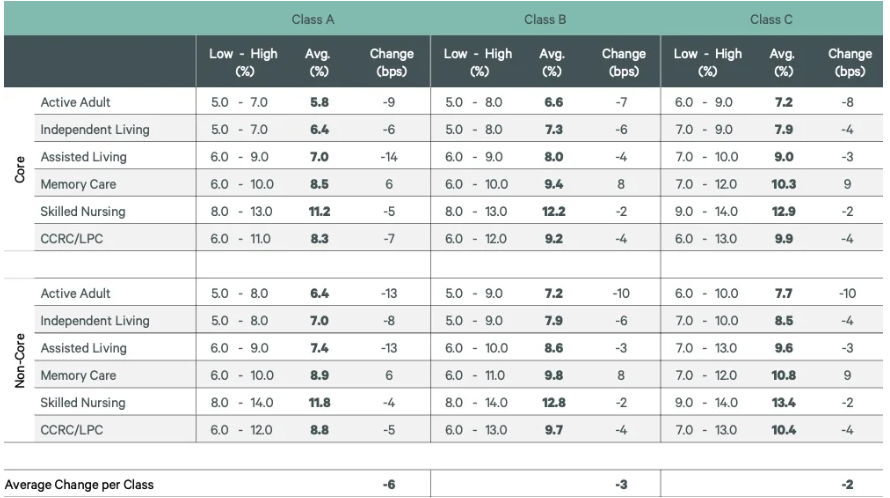

Cap Rate Premium: A Yield Advantage for Long Term Investors

Understanding the Cap Rate Premium

The cap rate premium refers to the difference between a property’s capitalization rate and the yield on a risk‑free investment, usually the 10‑year U.S. Treasury. This spread compensates investors for real estate‑specific risks such as illiquidity and operational complexity. Because senior housing is an operationally intensive asset class with unique demographics and care requirements, cap rates for the sector have historically run higher than other real estate sectors. Today, the sector offers some of the highest absolute yields in commercial real estate, even as rates have been tightening.

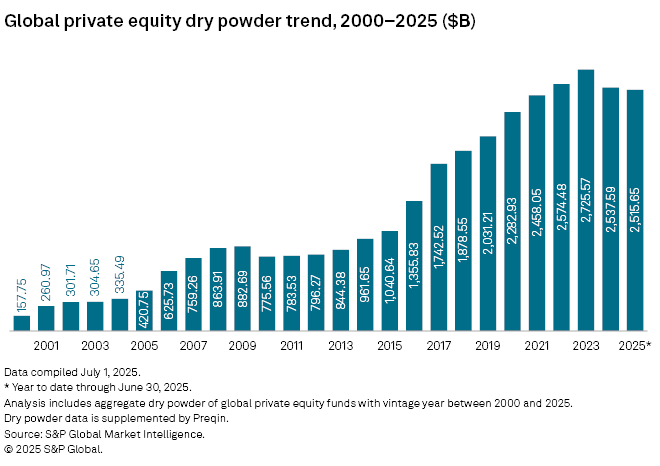

H1 2025 Transaction Boom

Transaction activity has rebounded across the sector. H1 2025 transaction volume increased 70% year-over-year, and price per unit rose 46%. Cushman & Wakefield attribute this resurgence to lenders opening their balance sheets and making debt more accessible/affordable, a shift that could release roughly $382 billion of global “dry powder” back into the market.

Rents Reach Record Highs

The average asking rent for seniors housing during Q2 2025 exceeded $5,600, the highest average rent in the sectors measured history. This represents a 4% increase compared to 2024. According to CBRE’s April 2025 investor survey, the majority of investors expect senior housing rent prices to continue to increase a modest 3%-7% through 2026. No investors forecasted a decline in asking prices.

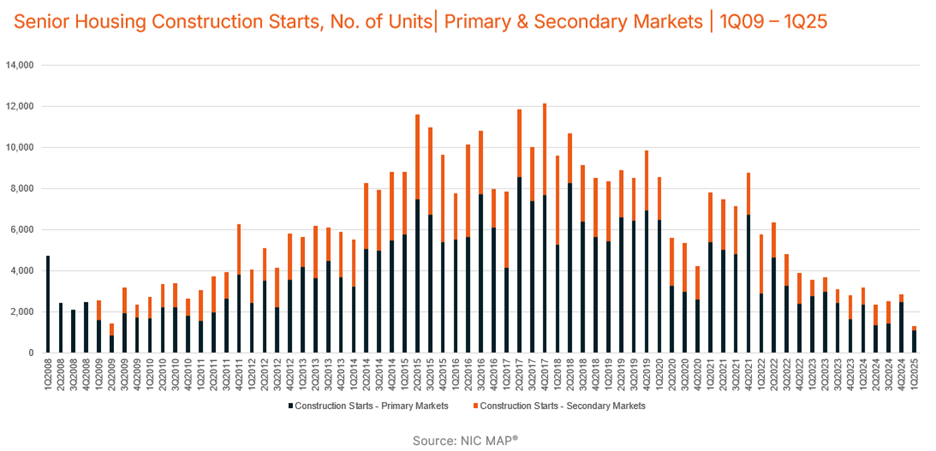

Supply Constraints Continue

Supply remains the primary bottleneck for senior housing. Construction starts are currently at a 16-year low while seniors are absorbing units 2.5 times the rate of new supply. The senior housing sector is estimated to require 35,000 – 45,000 new units annually to meet current demand. During Q3 2025, fewer than 1,400 units were opened.

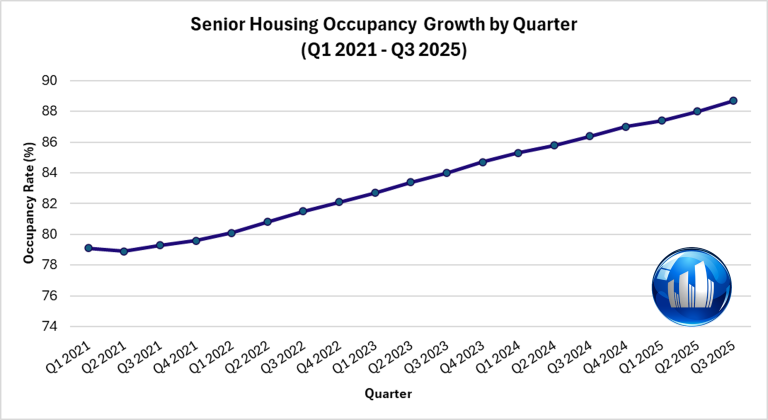

Occupancy at All-Time High

Despite aging supply and rising prices, Q3 2025 marked 17 consecutive quarters of occupancy growth within the senior housing sector for both primary and secondary markets.

Seventeen straight quarters of occupancy growth show that senior housing demand is not cyclical, it’s demographic.

Conclusion: As we close out 2025, senior housing continues to distinguish itself from other real estate sectors by combining durable income, demographic certainty, and measurable resilience. With occupancy at record highs, supply at multi-decade lows, and cap-rate spreads still wider than most alternatives, investors today are positioned to capture both strong current yield and future appreciation as the market rebalances. For long-term investors, this may prove to be one of the most compelling entry points in more than a decade.

SLF Investment Spotlight:

Countryside Lakes - Port Orange, FL

Our investment community in Port Orange, FL has been named Best Independent and Assisted Living Retirement Community for the 14th consecutive year!

We’re proud to be partnered with an operator and team that continue to make such a meaningful impact on the lives of seniors across the nation.

Want to Get Involved in Senior Housing Investment?

Contact Us Today!

Our Team.

The Senior Living Fund investment team is comprised of industry, securities, financial, and investment experts, as well as support personnel, based primarily in the Kansas City metropolitan area.

SLF Executive Team.

Dan Brewer, Founder & Chief Fund Manager

Dan has 30+ years of business experience, including 25+ years as an executive and principal in real estate, capital placement, business development and management. Dan has 10+ years of experience in a business consulting and management role for Accenture. Dan also has 10+ years of experience in the senior housing sector.

Mark Shader, Chief Operating Officer

Mark brings strong operations management skills to the SLF team through his 30+ years of experience in business consulting, real estate investment and development, financial analysis and management. Mark currently serves as Chief Operations Officer for Senior Living Fund, LLC and its affiliated entities.

Rick Maner, Chief Financial Officer

Rick brings over 30 years of financial management experience, mostly focused on financial services industry. Rick oversees all of the accounting operations including financial reporting, cash planning, and managing external audit relationships and the Funds tax reporting.