Assisting Accredited Investors Across the Globe

(913) 283-7804

Mon - Fri: 9:00 a.m. - 5:00 p.m. CST

Team@seniorlivingfund.com

For Investment Inquiry

Mon - Fri: 9:00 a.m. - 5:00 p.m. CST

For Investment Inquiry

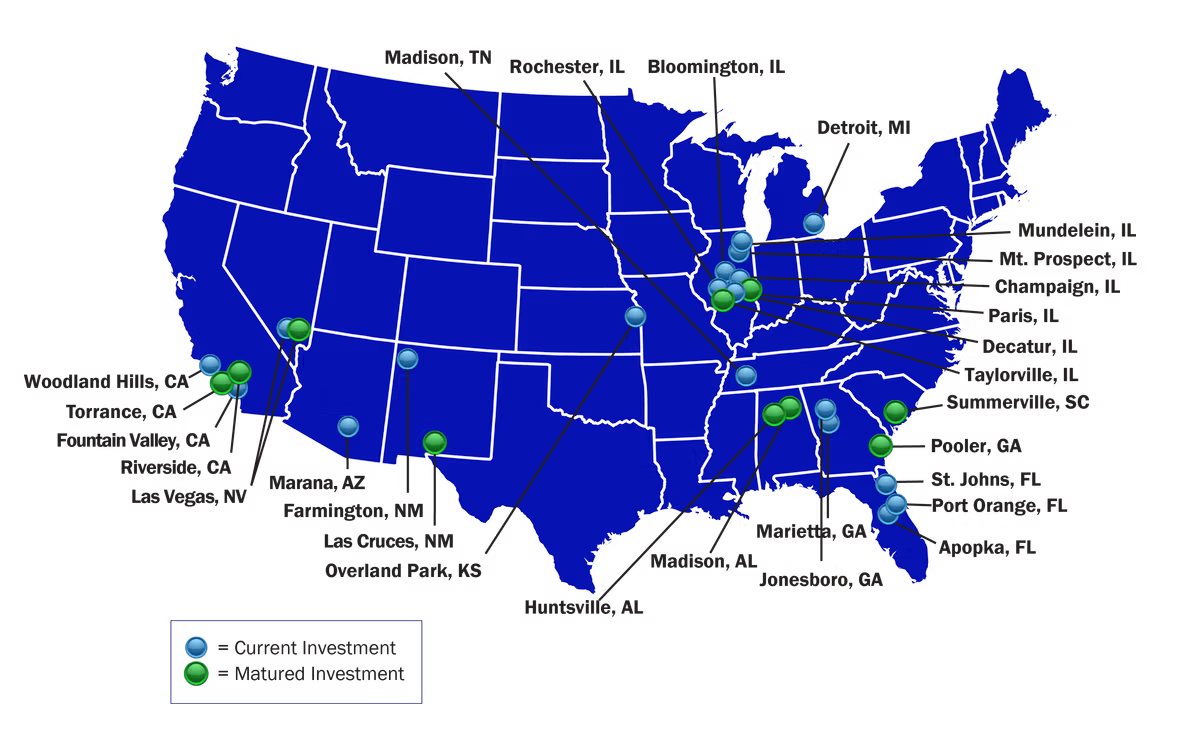

SLF Investments (SLF) is a private equity investment company with 20+ assets under management that generated over $23.3 million ($93.2 million annualized) in revenues during Q2 2025. The majority of assets within our real estate investment portfolio are Independent Living (IL), Assisted Living (AL) and Memory Care (MC) communities that were developed and constructed by our sponsor partners utilizing SLF equity.

Back in 2021, Hertz made headlines with its bold entry into the electric vehicle (EV) market, announcing the purchase of 100,000 Teslas and enlisting Tom Brady to lead a national ad campaign. What began as a high-profile bet on electrification quickly shifted course. By 2024, mounting repair costs, accelerated depreciation, and lower-than-expected resale values forced the company to reconsider its strategy, prompting large-scale EV sell-offs and renewed purchases of gasoline vehicles.

Now, well into 2025, Hertz is still working through the fallout of that decision. The company is actively offering rental customers the opportunity to purchase EVs as it continues to shrink its fleet. The reason is clear: electric vehicles have proven materially more expensive to maintain, with collision-repair costs often running nearly double those of traditional combustion-engine cars.

Just as Hertz has discovered that “newer” doesn’t always mean better—or cheaper—the same is true for property investment:

Construction Challenges

Increased construction costs, labor pressures, licensing hurdles, and tension within the capital markets have strained the incoming supply of new senior housing construction for years.

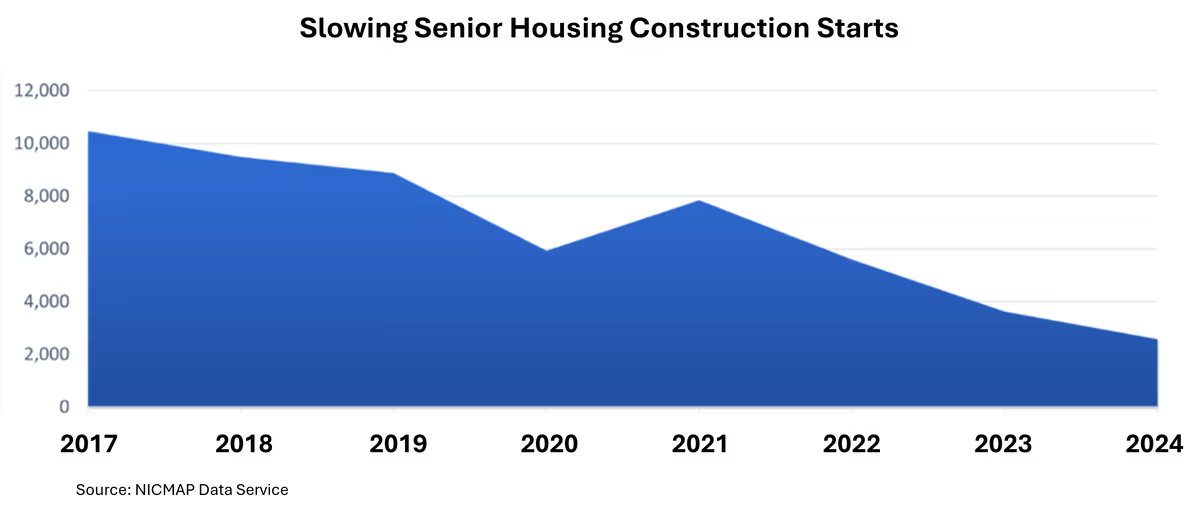

· Current projections state 35,000-45,000 new senior housing units must be built annually to meet current demand.

· Fewer than 10,000 units have entered the market annually since 2017. 2024 experienced the lowest level of new construction since the Great Financial Crisis.

Cost

Put simply, new senior housing communities cost more. Construction and material cost increases have been a theme since 2018, with supply shortages and shipping delays adding instability to the challenges. Further, todays “latest and greatest” amenities are far from what they were. On-site movie theatres, spas, and carefully crafted rotating menus (to name a few) are essential for a new senior housing product to remain competitive in 2025. These “lifestyle” amenities coupled with advancements in technology/telehealth to improve caregiver efficacy harbor significant costs.

Time

Not only does the construction of a new senior housing community require a significant amount of capital, it also requires a considerable amount of time. In 2024, the industry average for the construction of a new senior housing community was 29 months. This has grown from an average of 16 months in 2017, 19 months in 2019, and 24 months in 2023. Challenges stemming from the pandemic, high interest rates, and other economic factors have only contributed to the observed prolonged construction durations.

Once construction has been completed, these communities will need to be licensed, staffed, and ~90%+ occupied with residents before any operational income can be produced – if operated effectively.

Acquiring and improving existing assets can often generate stronger returns than navigating the rising costs, delays, and risks of new construction. Non-stabilized existing senior housing assets are often trading at 40-50% below replacement cost. With replacement costs expected to continue to rise over the coming years, investors have been turning their eye toward value-add investments.

Though the senior housing sector is performing strongly, not all communities have enjoyed this positive performance. The economic and operational strains over the last several years have highlighted numerous underperforming communities throughout the nation. Many of these communities are well-designed and in attractive locations yet lacked the infrastructure to remain competitive amidst the intricacies of changing regulations and economic strains. Investors have been locating these “underperforming” communities and making necessary operational or physical improvements to enhance values of these communities.

The advantage: these issues are usually solvable at a fraction of the cost relative to the upside. For example, modest capital improvements or operational fixes can reposition an underperforming community into a stabilized, cash-flowing asset worth millions more.

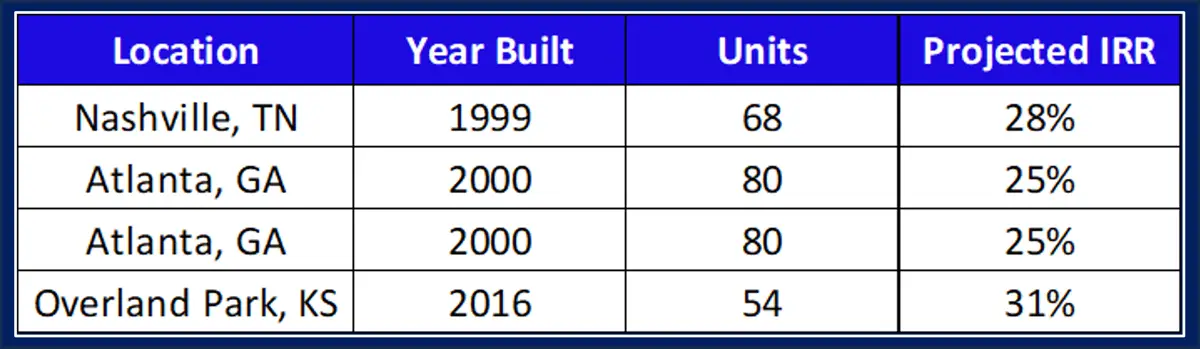

In 2023, SLF Investments finalized the acquisition of a senior housing portfolio in the Southeast valued at $20 million. The portfolio consisted of two communities in Georgia, as well as one community in Tennessee. We purchased these communities as value-add investments, with intent to improve operational performance at all three of the locations before seeking exit and returning associated profits to the Value-Add funds. We now have invested in four value-add communities, with more such investments anticipated.

We are currently projecting the IRR for each of our value-add communities to be higher than how the Value-Add fund NOIs were modeled. We have attached our current projections for these communities below:

The Senior Living Fund investment team is comprised of industry, securities, financial, and investment experts, as well as support personnel, based primarily in the Kansas City metropolitan area.

Dan has 30+ years of business experience, including 25+ years as an executive and principal in real estate, capital placement, business development and management. Dan has 10+ years of experience in a business consulting and management role for Accenture. Dan also has 10+ years of experience in the senior housing sector.

Mark brings strong operations management skills to the SLF team through his 30+ years of experience in business consulting, real estate investment and development, financial analysis and management. Mark currently serves as Chief Operations Officer for Senior Living Fund, LLC and its affiliated entities.

Rick brings over 30 years of financial management experience, mostly focused on financial services industry. Rick oversees all of the accounting operations including financial reporting, cash planning, and managing external audit relationships and the Funds tax reporting.