Monthly Investment Newsletter - August 2025

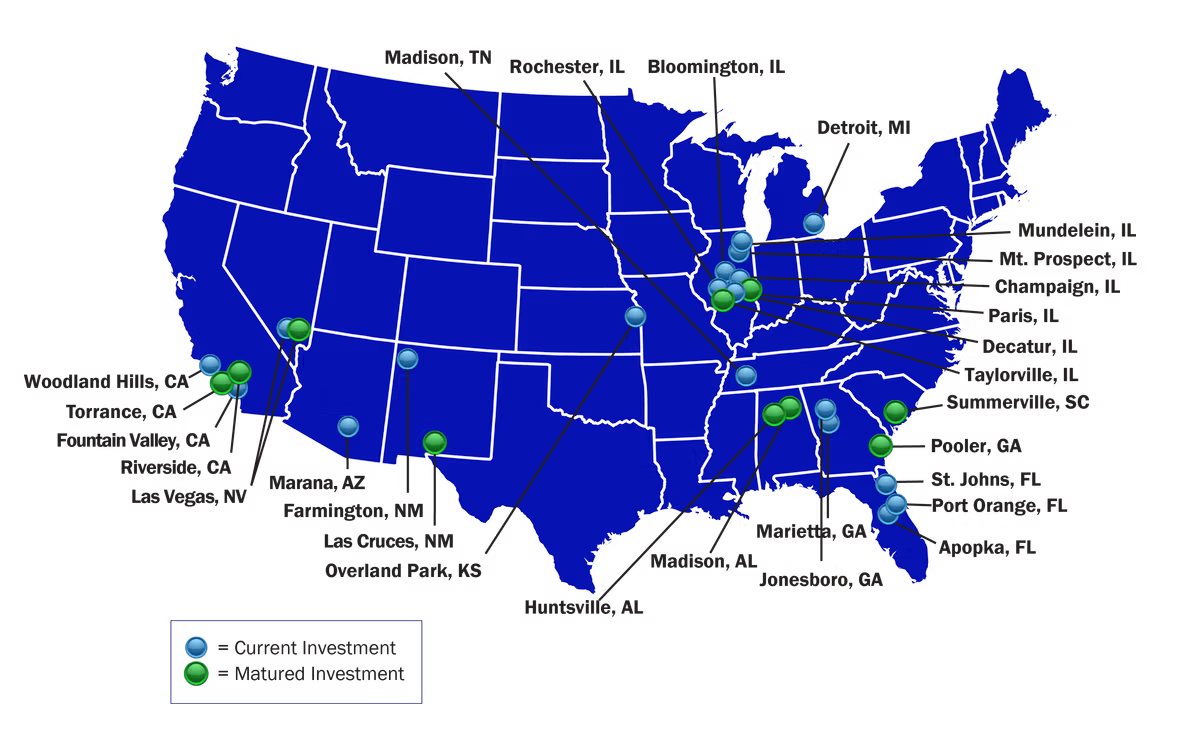

SLF Investments (SLF) is a private equity investment company with 20+ assets under management that generated over $23.3 million ($93.2 million annualized) in revenues during Q2 2025. The majority of assets within our real estate investment portfolio are Independent Living (IL), Assisted Living (AL) and Memory Care (MC) communities that were developed and constructed by our sponsor partners utilizing SLF equity.

Senior Housing Industry Update

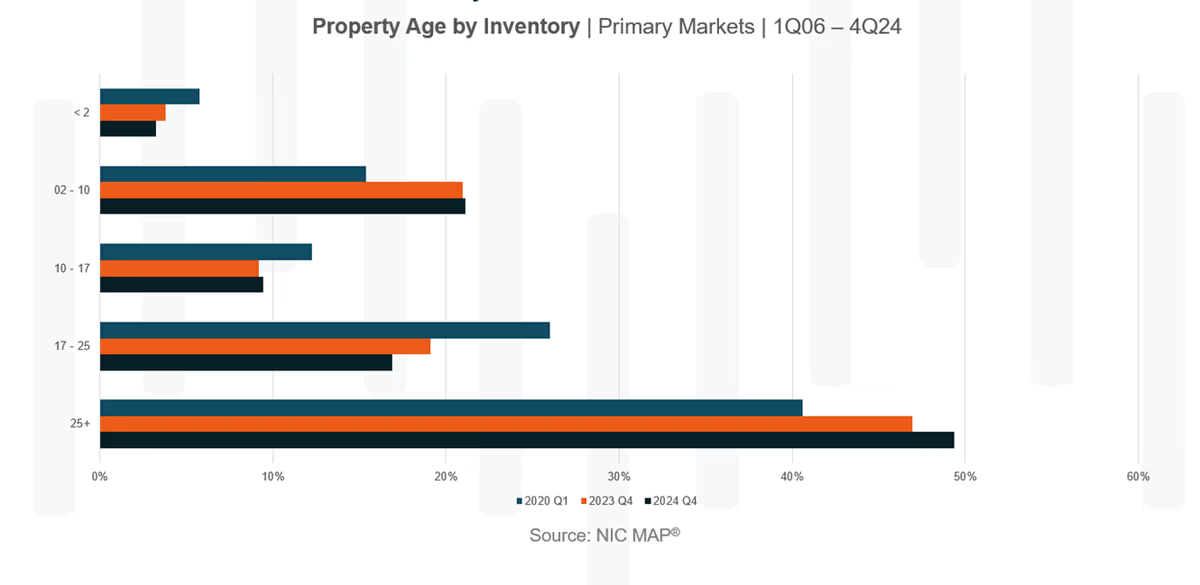

“Nearly Half” of Operational Communities Opened Before 2000

When given the choice, most people prefer new to old. This is true within the senior housing market as well. Most retirees would prefer to move into a new senior housing community.

However, fulfilling that preference is becoming increasingly difficult. Nearly half of the U.S. existing senior housing supply was constructed before 2000. With new development at historic lows, the share of older properties is growing.

To remain competitive, many operators are investing heavily in upgrading amenities and expanding care capabilities—transforming aging properties into vibrant, resort-style communities.

Ease of Life: Resort-Style Amenities Meet Quality Care

Today’s seniors are seeking both lifestyle and peace of mind. The most successful upscale communities combine luxury amenities with exceptional end-of-life care, creating environments that feel more like high-end resorts than traditional “nursing homes.”

Common features in these premium communities include:

- Chef-prepared dining programs

- On-site spas, salons, and fitness centers

- Expansive activity calendars

- Private apartments with modern finishes

- Specialized care programs for memory care residents

Rent Prices at All-Time High

The senior housing industry has felt the positive effects of these improvements. As of Q2 2025, the average asking rent for the senior housing industry exceeded $5,600 per month, marking an all-time high in the sector. However, it’s not uncommon today to see senior housing communities charging $8,000–$12,000 per month — and still maintaining years-long waitlists. While this may seem surprising at first glance, it’s one of the clearest indicators of deep, resilient demand in our sector.

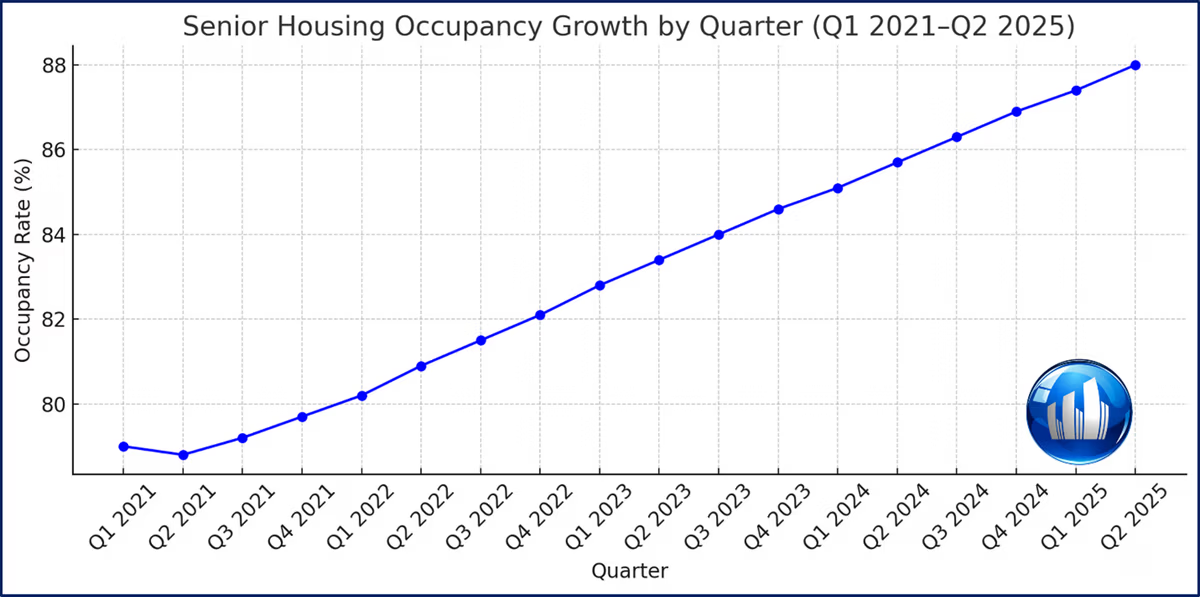

Occupancy at All-Time High

Despite aging supply and rising prices, Q2 2025 marked 16 consecutive quarters of occupancy growth within the senior housing sector for both primary and secondary markets.

What’s Driving These High Rental Rates?

The Baby Boomer generation holds more wealth than any prior U.S. age cohort. Many are selling homes, downsizing portfolios, and prioritizing lifestyle, wellness, and care in their retirement years. Due to rising construction costs and regulatory hurdles, quality senior housing supply remains limited. High demand + low supply = pricing power for high-tier communities and operators. In addition, care complexity justifies cost. Memory care and assisted living rates reflect increasing acuity. Skilled caregivers, 24/7 staff, and specialty programs like Montessori Inspired Lifestyle® increase operating costs — but also value.

What This Means for Investors

- Strong Revenue Per Unit: Communities earning $10k/month per resident generate robust operating income, even with elevated labor and service costs.

- Pricing Power: High-end communities can raise rates more easily, providing a hedge against inflation.

- Market Resilience: Residents are less price-sensitive when care is essential. Even during downturns, occupancy and rates stay strong.

- High Exit Value: Premium assets with consistent NOI attract top-tier buyers — a key consideration for long-term exit strategy.

Investment Community Spotlight

The Preserve at Woodland Hills

One of our standout properties, The Preserve at Woodland Hills, continues to command top-tier rental rates while also earning national recognition — most recently, the Gold Credential from the Center for Applied Research in Dementia. It’s a perfect example of how premium care and pricing translate to stability and investor value. We have attached a video of this community below:

Despite aging supply and rising prices, Q2 2025 marked 16 consecutive quarters of occupancy growth within the senior housing sector for both primary and secondary markets.

Want to Get Involved?

How to Participate.

Senior Living Fund has five (5) investment offerings for accredited investors:

SLF Value-Add Fund 1 - (SLF VAF 1)

- Anticipated 4.5-5 Year Term

- Annual Accrual + Profit Participation

- 12.00% to 21.00% Projected Fund IRR

SLF Value-Add Fund 2 - (SLF VAF 2)

- Anticipated 4.5-5 year term

- Monthly Distributions + Profit Participation

- 10.50% to 20.00% Projected Fund IRR

F4 Fixed Note Offering

- Anticipated 3 Year Term

- Monthly Distributions

- Fixed Interest Rate Equal to 15% Per Annum

F5 Fixed Note Offering

- Anticipated 3 Year Term

- Monthly Distributions

- Fixed Interest Rate Equal to 15% Per Annum

F6 Fixed Note Offering

- Anticipated 3 year term

- Monthly Distributions

- Fixed Interest Rate Equal to 15% Per Annum

Interested in investing? Contact our Investor Relations Team today!

Team@seniorlivingfund.com | 913.283.7804

Our Team.

The Senior Living Fund investment team is comprised of industry, securities, financial, and investment experts, as well as support personnel, based primarily in the Kansas City metropolitan area.

SLF Executive Team.

Dan Brewer, Founder & Chief Fund Manager

Dan has 30+ years of business experience, including 25+ years as an executive and principal in real estate, capital placement, business development and management. Dan has 10+ years of experience in a business consulting and management role for Accenture. Dan also has 10+ years of experience in the senior housing sector.

Mark Shader, Chief Operating Officer

Mark brings strong operations management skills to the SLF team through his 30+ years of experience in business consulting, real estate investment and development, financial analysis and management. Mark currently serves as Chief Operations Officer for Senior Living Fund, LLC and its affiliated entities.

Rick Maner, Chief Financial Officer

Rick brings over 30 years of financial management experience, mostly focused on financial services industry. Rick oversees all of the accounting operations including financial reporting, cash planning, and managing external audit relationships and the Funds tax reporting.