Assisting Accredited Investors Across the Globe

(913) 283-7804

Mon - Fri: 9:00 a.m. - 5:00 p.m. CST

Team@seniorlivingfund.com

For Investment Inquiry

Mon - Fri: 9:00 a.m. - 5:00 p.m. CST

For Investment Inquiry

SLF Investments (SLF) is a private equity investment company with 20+ assets under management that generated over $20.1 million ($80.4 million annualized) in revenues during Q1 2025. The majority of assets within our real estate investment portfolio are Independent Living (IL), Assisted Living (AL) and Memory Care (MC) communities that were developed and constructed by our sponsor partners utilizing SLF equity.

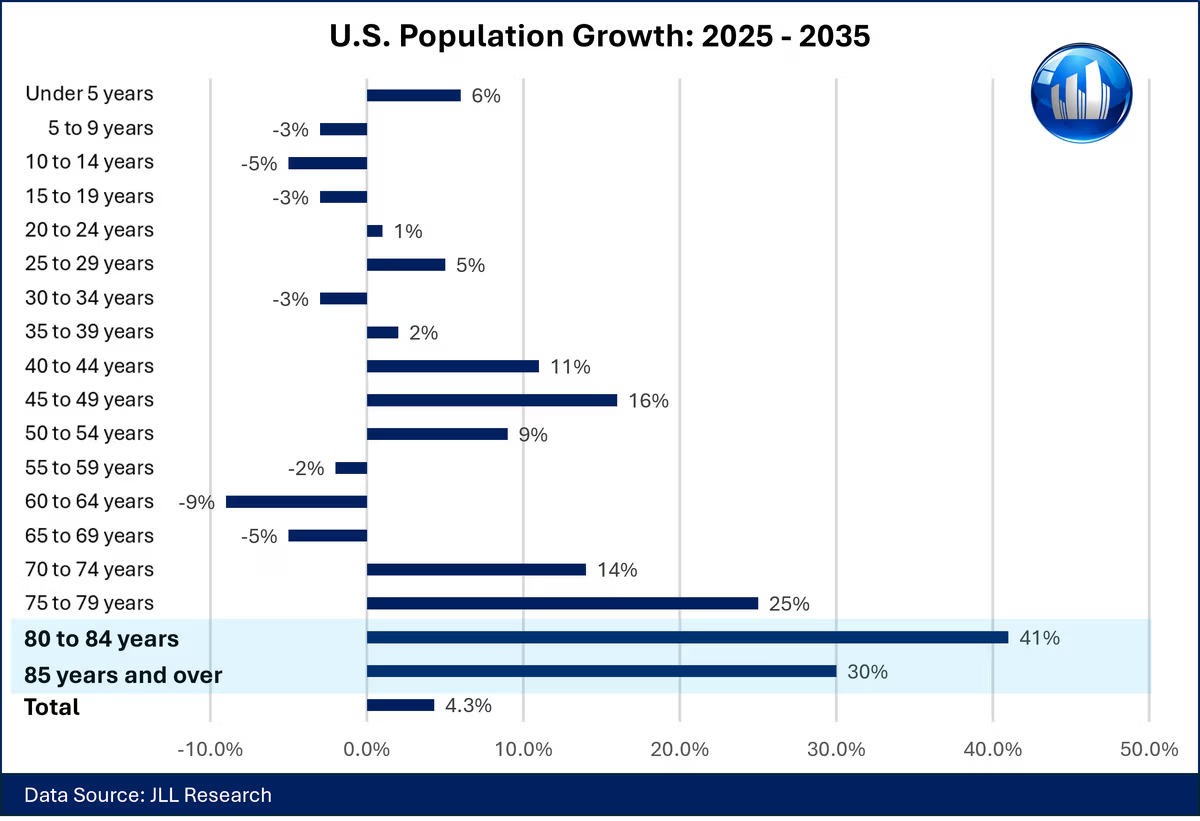

The senior housing investment narrative has long been supported by one powerful demographic stat: “10,000 Americans turning 65 each day”. Now that we have crossed into 2025, the conversation has matured: Beginning 2025, ~10,000 individuals are turning 80+ in the United States, daily.

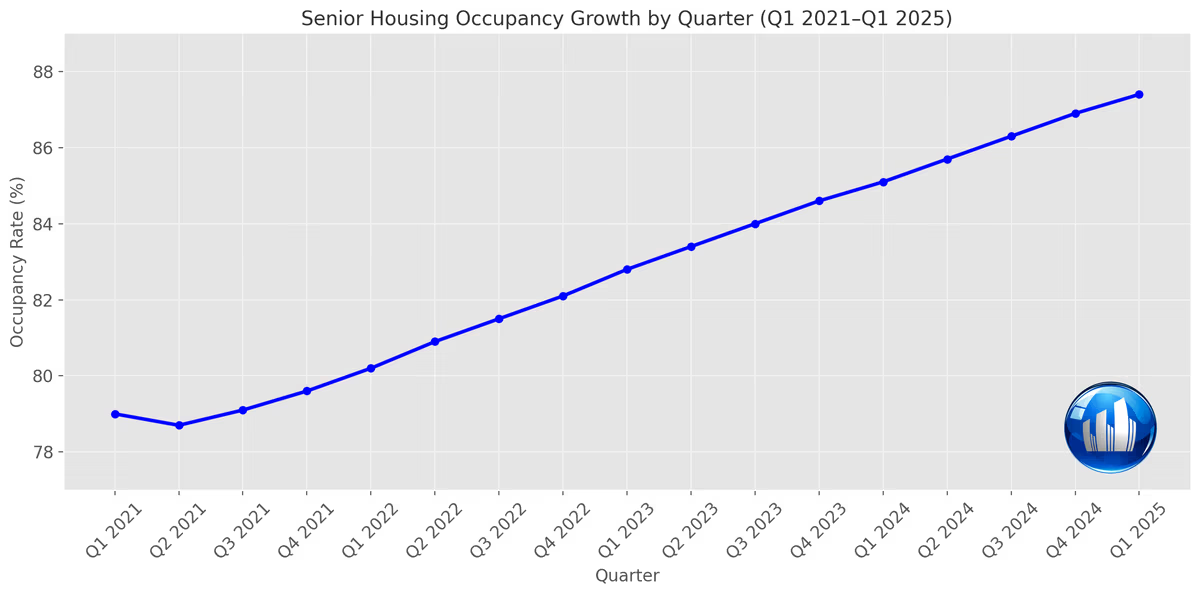

This isn’t just a fun fact — it’s a seismic shift. Because while 65 is about golf courses and grandkids, 80+ is when real senior housing demand kicks in. Those in their 80s and beyond are the primary driver of demand for senior living options, including independent living, assisted living, and memory care. And that demand is already being felt, as the Senior housing sector recently boasted 15 consecutive quarters of occupancy growth.

This sustained occupancy growth signals both rising demand and a return to operational health across the sector. Operators are regaining pricing power, rent growth is strengthening, and net operating income (NOI) is trending upward—all in an environment of constrained new supply.

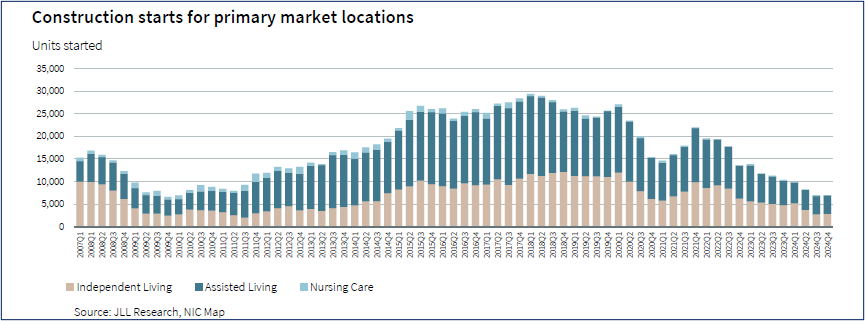

Despite surging demand, development is near a standstill. Construction starts are down 68% from peak in primary markets.

This is the lowest level of new development in 16 years—yet demand is accelerating. The result? Existing assets are poised to benefit from scarcity-driven pricing power for years to come.

The senior housing investment opportunity is no longer theoretical. With 10,000 Americans now turning 80 every day, this market is demand-driven—and constrained.

Investing in stabilized assets means:

Because fewer new units are entering the pipeline, well-managed communities are gaining pricing power—and long-term investor upside.

Park View Estates recently reached 100% capacity with a total of 150 residents per the State of California Licensing. Although capacity is maxed out the community still had ten (10) units unoccupied (140 out of 150). Our 3rd party manager reached out to the California Department of Social Services (DSS) and was approved to expand the license from 150 to 170 residents on May 28, 2025.

Where do we go from here? At the time of the license expansion approval there was a waitlist of 7-8 residents. The expectation is to obtain stabilized occupancy or 158 residents (93% occupancy) in the next 30-60 days at which point external and internal rental rates will begin to increase. Upon consistent stabilization and tight cost controls they expect to be cashflow positive (approximately $236,000 NOI) including debt service by mid- 2026.

Senior Living Fund has five (5) investment offerings for accredited investors:

The Senior Living Fund investment team is comprised of industry, securities, financial, and investment experts, as well as support personnel, based primarily in the Kansas City metropolitan area.

Dan has 30+ years of business experience, including 25+ years as an executive and principal in real estate, capital placement, business development and management. Dan has 10+ years of experience in a business consulting and management role for Accenture. Dan also has 10+ years of experience in the senior housing sector.

Mark brings strong operations management skills to the SLF team through his 30+ years of experience in business consulting, real estate investment and development, financial analysis and management. Mark currently serves as Chief Operations Officer for Senior Living Fund, LLC and its affiliated entities.

Rick brings over 30 years of financial management experience, mostly focused on financial services industry. Rick oversees all of the accounting operations including financial reporting, cash planning, and managing external audit relationships and the Funds tax reporting.