Assisting Accredited Investors Across the Globe

(913) 283-7804

Mon - Fri: 9:00 a.m. - 5:00 p.m. CST

Team@seniorlivingfund.com

For Investment Inquiry

Mon - Fri: 9:00 a.m. - 5:00 p.m. CST

For Investment Inquiry

SLF Investments (SLF) is a private equity investment company with 20+ assets under management that generated over $20.1 million ($80.4 million annualized) in revenues during Q1 2025. The majority of assets within our real estate investment portfolio are Independent Living (IL), Assisted Living (AL) and Memory Care (MC) communities that were developed and constructed by our sponsor partners utilizing SLF equity.

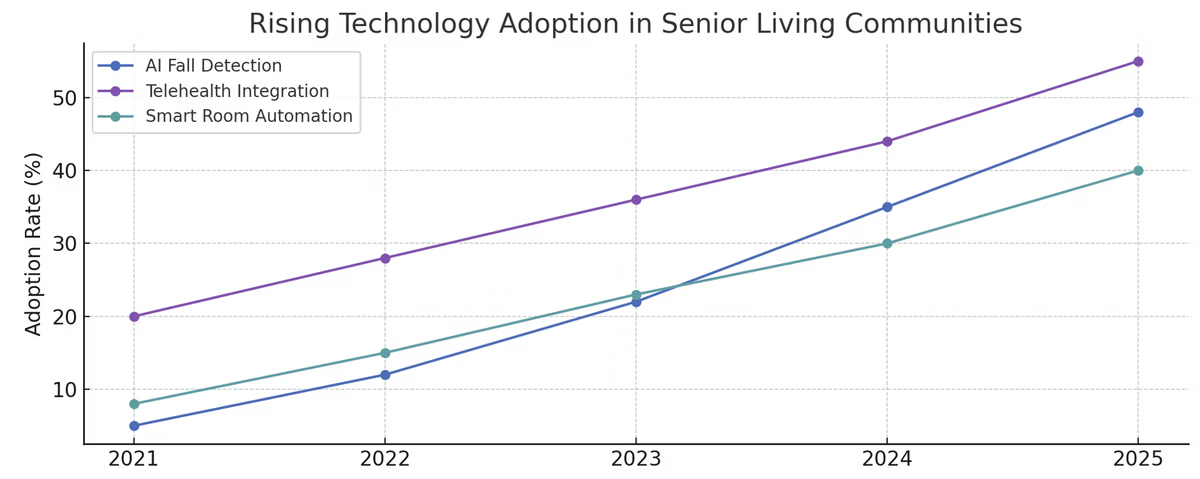

Innovations once considered “nice to have” are fast becoming industry expectations. Senior communities are increasingly adopting:

These advancements enhance resident safety and satisfaction while improving operational efficiency. For investors, communities that lead in tech integration demonstrate better staff retention, lower liability exposure, and stronger pricing power.

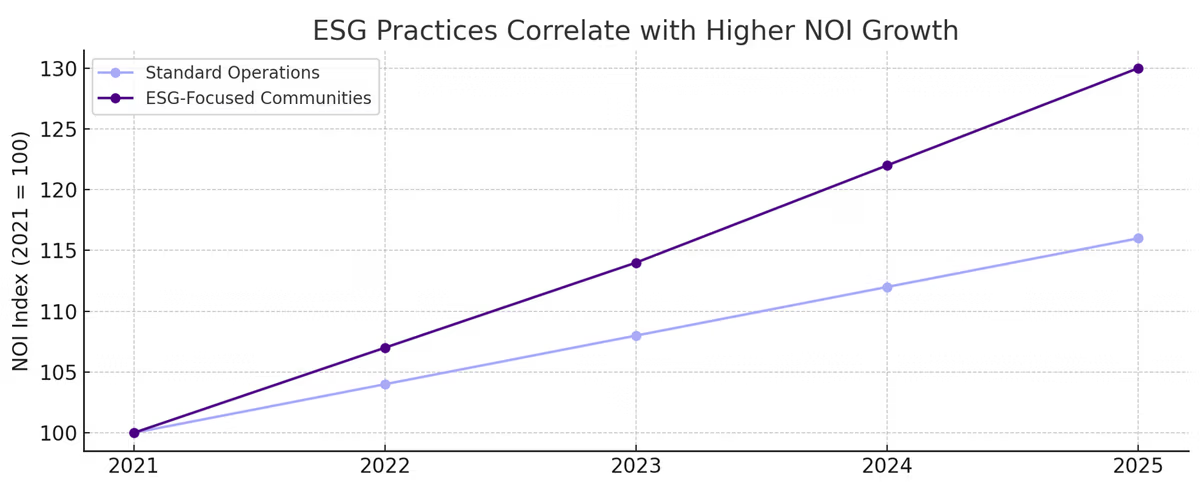

Environmental, Social, and Governance (ESG) principles are gaining ground—not only to meet investor expectations but also to reflect the values of a new generation of residents and families. Industry leaders are:

These aren’t just feel-good initiatives—they directly impact NOI and asset longevity. ESG alignment is quickly becoming a mark of quality in real estate underwriting.

Modern senior housing is about lifestyle, not limitation. Communities are moving away from institutional models and toward environments that emphasize:

This reflects the desires of today’s aging adults, many of whom are active, tech-savvy, and looking for purpose—not passive care.

The senior housing sector is entering its next phase—one defined not just by growing demand, but by growing expectations. Those positioned to meet these evolving needs with innovation, sustainability, and hospitality-focused design will benefit from:

At SLF Investments, we’re not just responding to these trends—we’re getting ahead of them. By focusing on purpose-built assets with long-term upside, we’re helping our investors capitalize on both the present and the future of senior housing investment.

Senior Living Fund’s assets under management thru the end of Q1 realized a 2.1% gain in total revenue compared to Q4 2024. The revenue gains were lead by an occupancy growth of thirty-seven (37) net units in Q1. We are projecting based upon current sales metrics and pipelines our combined funds will reach double digit revenue gains in Q3.

Projected gains are the byproduct of efforts initiated in the latter half of 2024 to grow occupancy and increase revenue. SLF has worked diligently with our operators to increase and improve outreach efforts in the competitive marketplace for each asset, increase internal and external rental rates and capture all level of care revenue for services provided.

Most or our Operators vastly improved their expense management during 2024 and this carried over to Q1 2025. Improved expense management and our emphasis on the above sales and marketing efforts should provide an upward trending Net Operating Income (NOI) thru the end of 2025 for the combined funds.

If you would like to learn more surrounding investment in the senior housing sector, contact us today and a member of our team will be happy to help!

Senior Living Fund has five (5) investment offerings for accredited investors:

The Senior Living Fund investment team is comprised of industry, securities, financial, and investment experts, as well as support personnel, based primarily in the Kansas City metropolitan area.

Dan has 30+ years of business experience, including 25+ years as an executive and principal in real estate, capital placement, business development and management. Dan has 10+ years of experience in a business consulting and management role for Accenture. Dan also has 10+ years of experience in the senior housing sector.

Mark brings strong operations management skills to the SLF team through his 30+ years of experience in business consulting, real estate investment and development, financial analysis and management. Mark currently serves as Chief Operations Officer for Senior Living Fund, LLC and its affiliated entities.

Rick brings over 30 years of financial management experience, mostly focused on financial services industry. Rick oversees all of the accounting operations including financial reporting, cash planning, and managing external audit relationships and the Funds tax reporting.