The Great Wealth Transfer: How to Ensure Your Legacy Lasts

As we grow older and build families, discussions about wills and estate planning become increasingly important. Financial planners and family members want to ensure assets are distributed according to our wishes, avoiding probate and ensuring a smooth transfer to loved ones. But there’s an often-overlooked aspect: what happens after the transfer?

We are currently on the brink of the largest intergenerational wealth transfer in history. How families handle this transition will determine whether this wealth creates lasting financial security or quickly disappears.

The $84 Trillion Wealth Transfer

According to a 2023 report from Cerulli Associates, nearly $84 trillion will pass from older generations to their heirs and charities by 2045, with $72.6 trillion going directly to heirs. This is a significant increase from earlier estimates. However, financial research continues to show that 70% of intergenerational wealth transfers fail by the second generation, and 90% by the third—a phenomenon often referred to as “Shirtsleeves to shirtsleeves in three generations.”

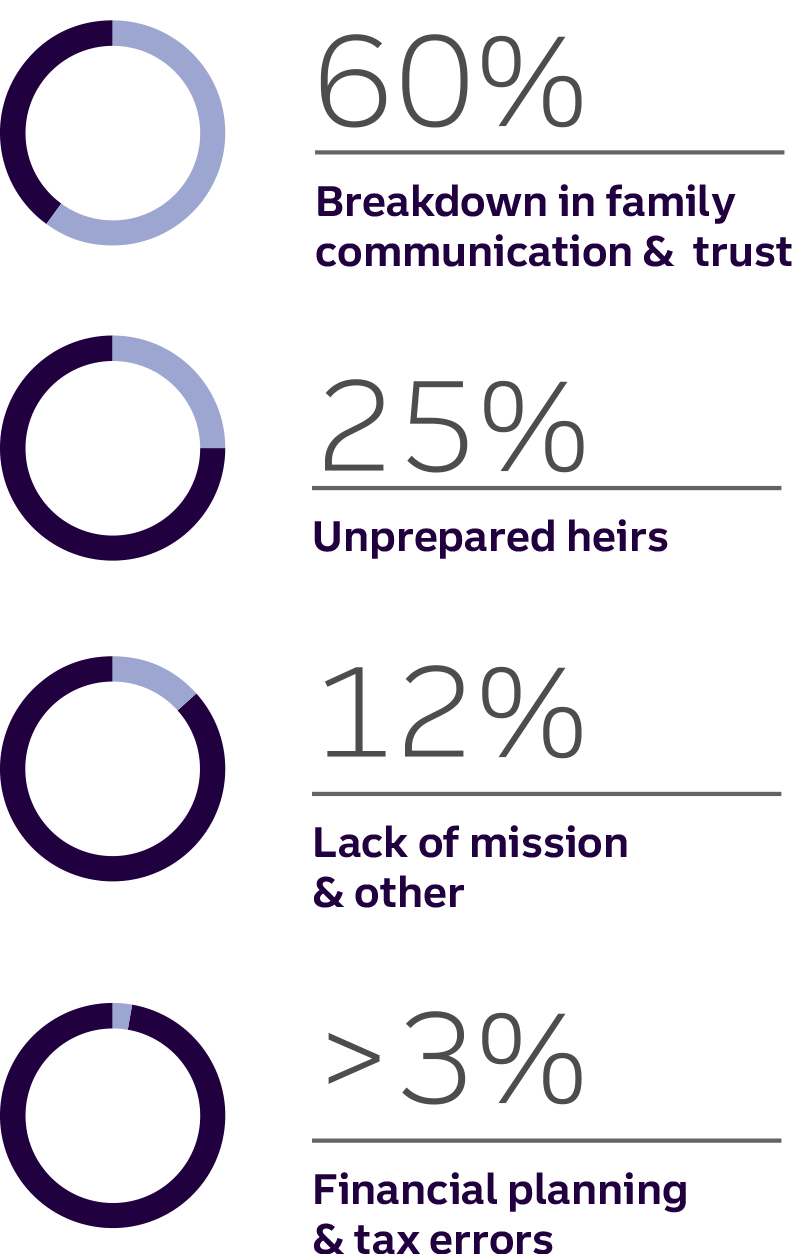

A 2022 study from the National Bureau of Economic Research found that nearly one-third of people who receive an inheritance spend it all within two years. If families don’t prepare, wealth that took a lifetime to build can disappear in a fraction of that time. Truist Financial Corporation attributes the most common reasons for this breakdown in the image below:

How to Pass On Wealth and Values

While estate planning ensures assets are legally protected, it doesn’t guarantee they’ll be used wisely. To increase the chances of a lasting legacy, consider these three steps:

1. Make Wealth a Family Conversation

Wealth should not be a taboo topic. Families who regularly discuss financial values and strategies are more likely to successfully transition assets across generations.

Start by sharing why financial security matters to you and how you hope your heirs will use the money. Encourage open conversations about budgeting, investing, philanthropy, and long-term financial planning.

Examples:

- Warren Buffett has openly discussed his belief in giving his children “enough so they can do anything, but not so much that they do nothing.”

- Families like the Rockefellers have successfully transferred wealth for generations by focusing on education and structured philanthropy.

2. Prioritize Values Over Bank Balances

Instead of focusing on how much wealth will be inherited, emphasize why the wealth exists in the first place. Instilling financial values—such as saving, investing, and giving back—can help ensure wealth is preserved.

Consider:

- Setting up donor-advised funds (DAFs) to encourage charitable giving.

- Creating a family mission statement that defines how money should support shared values, such as education, entrepreneurship, or philanthropy.

- Teaching younger generations about financial literacy, possibly through mentorship or professional guidance.

3. Establish a Clear Purpose for Your Wealth

You worked hard for your wealth, and you have the right to dictate how it is used. Modern estate planning tools allow you to attach conditions to inheritances, ensuring money is spent wisely.

Ways to add structure:

- Incentive Trusts: These require beneficiaries to meet specific conditions (such as graduating college or maintaining employment) before receiving funds.

- Investment Funds: Designating a portion of the inheritance to be invested for long-term growth.

- Philanthropic Legacies: Directing wealth into charitable foundations or scholarship programs.

Final Thoughts: Legacy Beyond Money

The coming decades will see a historic shift in wealth, but financial inheritance is only part of the equation. Equally important is the transfer of knowledge, values, and financial responsibility.

Whether passing on a small nest egg or a large estate, ensuring your wealth is used wisely and purposefully can create lasting financial security for generations to come. The key is preparation—because money isn’t just for spending. It’s for building a better future.

SLF Investments is a private investment company assisting accredited individuals access investment opportunities in the senior housing sector. For more information, please contact Team@seniorlivingfund.com.

SLF Investments (SLF) is a private equity investment company with 20+ assets under management that generated over $24.9 million ($99.8 million annualized) in revenues during Q4 2024. The majority of assets within our portfolio are Independent Living (IL), Assisted Living (AL) and Memory Care (MC) communities that were developed and constructed by our sponsor partners utilizing SLF equity.

Our Team.

The Senior Living Fund team is comprised of industry, securities, financial, and investment experts, as well as support personnel, based primarily in the Kansas City metropolitan area.

SLF Executive Team.

Dan Brewer, Founder & Chief Fund Manager

Dan has 30+ years of business experience, including 25+ years as an executive and principal in real estate, capital placement, business development and management. Dan has 10+ years of experience in a business consulting and management role for Accenture. Dan also has 10+ years of experience in the senior housing sector.

Mark Shader, Chief Operating Officer

Mark brings strong operations management skills to the SLF team through his 30+ years of experience in business consulting, real estate investment and development, financial analysis and management. Mark currently serves as Chief Operations Officer for Senior Living Fund, LLC and its affiliated entities.

Rick Maner, Chief Financial Officer

Rick brings over 30 years of financial management experience, mostly focused on financial services industry. Rick oversees all of the accounting operations including financial reporting, cash planning, and managing external audit relationships and the Funds tax reporting.