Monthly Investment Newsletter - February 2025

SLF Investments (SLF) is a private equity investment company with 20+ assets under management that generated over $24.9 million ($99.8 million annualized) in revenues during Q4 2024. The majority of assets within our real estate investment portfolio are Independent Living (IL), Assisted Living (AL) and Memory Care (MC) communities that were developed and constructed by our sponsor partners utilizing SLF equity.

Senior Housing Market Update

Senior Housing Surpasses Pre-Covid Performance. Continues With Cautious Optimism.

The senior housing sector continues to be an attractive investment opportunity, offering both income stability and long-term growth potential.

Over the past 18 to 24 months, persistently high interest rates and rising cap rates have sidelined sponsors and capital providers, prompting many to adopt a “wait-and-see” stance. Concurrently, heightened regulatory scrutiny on federally regulated financial institutions has significantly constrained permanent refinancing options, compelling banks to curtail new loan originations and impose more stringent terms on existing loan modifications. This environment has exerted additional financial pressure on senior housing assets, irrespective of their operational performance or cash flow stability.

As 2025 unfolds, early signs suggest a gradual shift in market dynamics. The fourth quarter of 2024 marked the first decline in interest rates in several years, contributing to a rebound in asset valuations and instilling optimism across the sector. While inflation and Federal Reserve policy remain critical variables influencing interest rate trajectories, relative stability in borrowing costs offers a reprieve from the upward rate environment that has characterized recent years.

Capital markets appear to be selectively re-engaging in the sector, with banks increasingly willing to extend new loan commitments following loan payoffs in late 2024. Additionally, debt funds and equity groups that had previously retreated from the market are re-entering, signaling a modest but notable rise in liquidity. For existing inventory, traditional bank financing is becoming more accessible for assets demonstrating positive leasing momentum, while alternative lenders are showing interest in recapitalization and repositioning opportunities. Meanwhile, new development remains constrained, with annual inventory growth declining since 2019 to approximately 1% as of Q3 2024, per NIC MAP data. Nonetheless, well-capitalized sponsors with patient equity and development efficiencies continue to find financing opportunities.

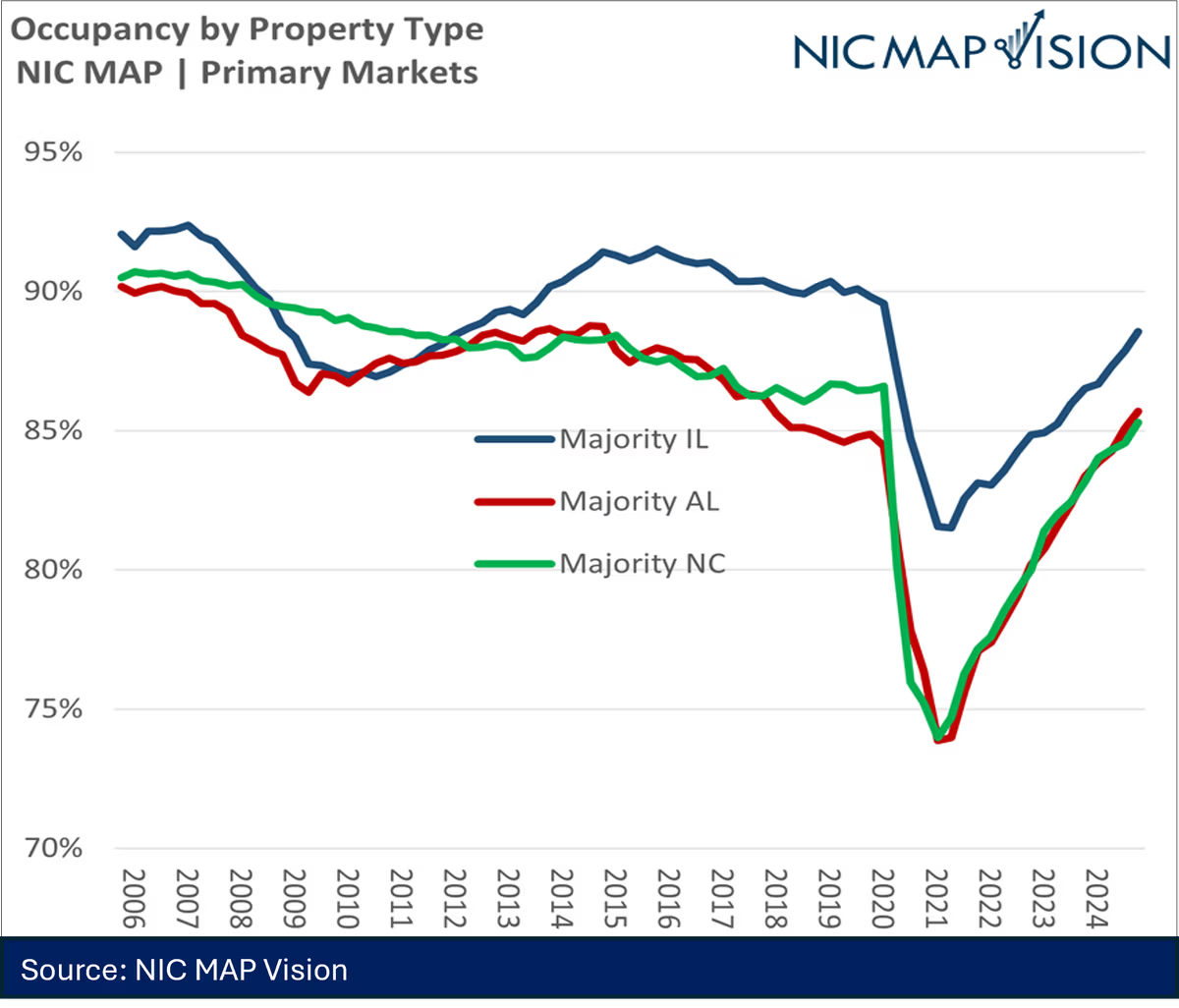

Looking ahead, the ability to leverage flexible and strategic partnerships between sponsors and capital providers will remain crucial in navigating the evolving senior housing investment landscape. The gradual restoration of liquidity indicates a market on the path to stabilization. The senior housing investment industry also boasts continually improving fundamentals. Q4 2024 marked the 14th consecutive quarter where total senior housing occupancy rates increased. This continued the longest streak of occupancy rate gains ever observed – and pulled the industry ahead of its pre-pandemic performance.

Investment Community Spotlight:

CountrySide Lakes Senior Housing

CountrySide Lakes Senior Living is a 145 unit independent and assisted living community located in Port Orange, Florida. CountrySide Lakes experienced over 90% occupancy for the entire year of 2024. This asset exemplifies the demand that can be created when a strong reputation is supported by quality care, diverse activities, positive culinary experiences and strong programming.

CountrySide Lakes reported revenues in Q4 2024 over $1.92 million for the first time in the history of this 30-year-old + asset. Our 3rd party operator was able to generate record revenues thru high occupancy and the ability to raise market rental rates and capture appropriate levels of care with our assisted living residents.

Successful IL/AL communities are not an accident and occur when ownership and operator interests are aligned and in sync with the needs of market area. Want to see what life is like inside of an SLF Investments community? Check out the video below!

Our Team.

The Senior Living Fund investment team is comprised of industry, securities, financial, and investment experts, as well as support personnel, based primarily in the Kansas City metropolitan area.

SLF Executive Team.

Dan Brewer, Founder & Chief Fund Manager

Dan has 30+ years of business experience, including 25+ years as an executive and principal in real estate, capital placement, business development and management. Dan has 10+ years of experience in a business consulting and management role for Accenture. Dan also has 10+ years of experience in the senior housing sector.

Mark Shader, Chief Operating Officer

Mark brings strong operations management skills to the SLF team through his 30+ years of experience in business consulting, real estate investment and development, financial analysis and management. Mark currently serves as Chief Operations Officer for Senior Living Fund, LLC and its affiliated entities.

Rick Maner, Chief Financial Officer

Rick brings over 30 years of financial management experience, mostly focused on financial services industry. Rick oversees all of the accounting operations including financial reporting, cash planning, and managing external audit relationships and the Funds tax reporting.

How to Participate.

Senior Living Fund has five (5) investment offerings for accredited investors:

SLF Value-Add Fund 1 - (SLF VAF 1)

- Anticipated 4.5-5 Year Term

- Annual Accrual + Profit Participation

- 12.00% to 21.00% Projected Fund IRR

SLF Value-Add Fund 2 - (SLF VAF 2)

- Anticipated 4.5-5 year term

- Monthly Distributions + Profit Participation

- 10.50% to 20.00% Projected Fund IRR

F4 Fixed Note Offering

- Anticipated 3 Year Term

- Monthly Distributions

- Fixed Interest Rate Equal to 15% Per Annum

F5 Fixed Note Offering

- Anticipated 3 Year Term

- Monthly Distributions

- Fixed Interest Rate Equal to 15% Per Annum

F6 Fixed Note Offering

- Anticipated 3 year term

- Monthly Distributions

- Fixed Interest Rate Equal to 15% Per Annum

Interested in investing? Contact our Investor Relations Team today!

Team@seniorlivingfund.com | 913.283.7804