Zero Realized Loss: A Key Indicator of a Successful Investment Company

By Quinn Brewer, Communications Manager

There are numerous ways to measure the success of an investment. How much did you make? How fast did it grow? How did its performance compare to others in the same market or exchange? When it comes to investments in commercial real estate, success indicators are even more complex. Did your investment stay on cost and budget? How long will it take for the investment to stabilize and—hopefully—begin to show profit? All of these are important. Today, however, we’d like to focus on two key investing metrics: recognized loss and realized loss. Although they work the same way in every type of investment, they hold key benefits when utilized in commercial real estate specifically.

In any investment, “recognized loss” occurs when the market value of an asset drops lower than its total cost. This loss is only “realized” once the investment has been exited and the asset is sold for less than its total cost.

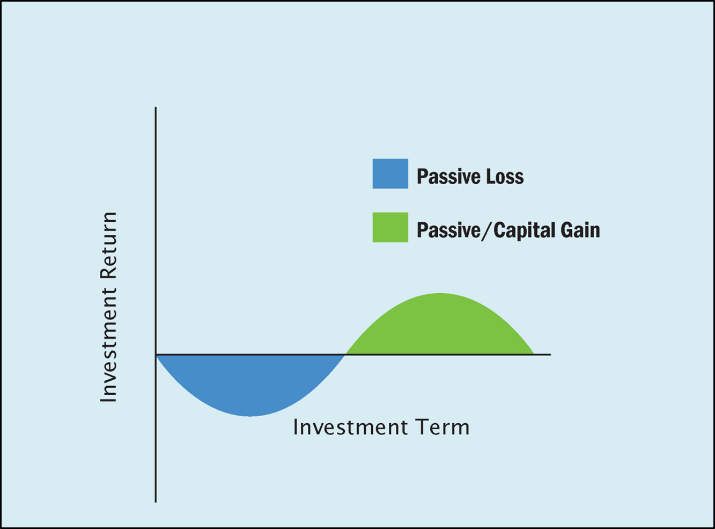

Unlike recognized losses in the stock market, which are often unexpected and may not be recovered, recognized losses in commercial real estate are often anticipated and ultimately recovered when the investment exit occurs. For instance, at Senior Living Fund (SLF), we incorporate periods of projected recognized losses and recovery/profit within our fund timelines. Losses typically occur when expenditures are high, and profits are inadequate to cover the expenses. Some examples of these high expenditure periods are during construction, renovation, staffing, lease-up, etc.

One of the key benefits of investing in commercial real estate, such as senior housing, is that you may experience the tax benefits of recognized loss without those losses ever being realized. In fact, SLF has not incurred any realized losses on its investment projects since inception. At the same time, our investors have been able to benefit from recognized passive losses on their taxes. Savvy investors can use these periods of passive, recognized losses to offset passive income generated in other areas of their portfolio.

The following chart illustrates the concept of recognized passive loss, followed by a period of recognized passive gain in our equity funds.

It is rare to avoid realized loss. Any investment generating a higher return generally carries higher risk, even in sectors such as senior housing. However, at SLF, we have been able to avoid realized losses with a thorough underwriting and investment management process. We focus on creating diversification (size, geographic location, and community type) within each of our funds to mitigate the impact of any particular realized investment loss on the overall fund.

This article originally appeared on BiggerPockets.com.